According to data from DappRadar, OKX NFT marketplace secured 32% dominance in the NFT sector, surpassing OpenSea in trading volume.

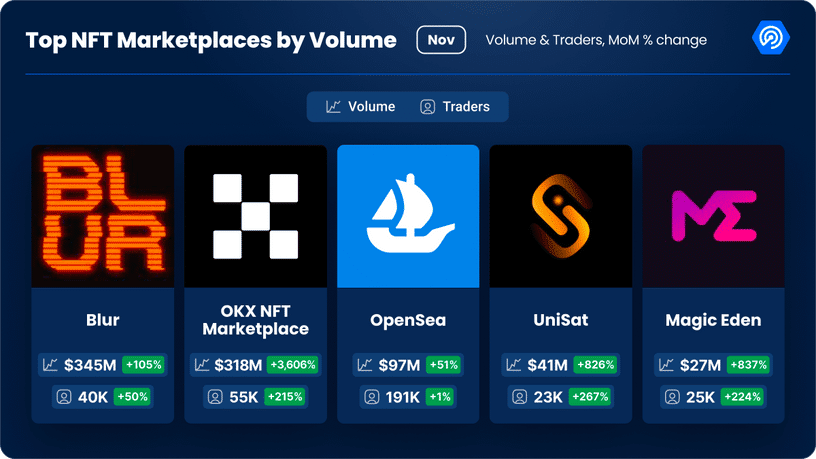

In a blog post on Dec. 7, 202, DappRadar gathered top marketplaces for trading digital collectibles, which allocated the most liquidity in November 2023. According to the data, the Blur marketplace was ranked the top platform, controlling a 35% share of the NFT trading volume and generating $345 million in trades in November 2023.

OKX NFT, a digital marketplace powered by the OKX crypto exchange, appeared to be the second-largest NFT platform over the past month, surpassing OpenSea in trading volume. As per DappRadar, OKX NFT secured a “substantial 32% dominance in the NFT sector,” overtaking OpenSea, which is currently holding a 10% market share in terms of trading volume.

Yet, DappRadar Blockchain Analyst Sara Gherghelas notes that OpenSea remains the top platform in terms of user base with over 190,000 registered accounts as of November 2023. She also suggested OKX succeeded in its efforts thanks to its bet on unique offerings of Bitcoin Ordinals art pieces.

However, it is yet to be seen if OKX could retain its title given that Bitcoin Core developers are planning to get rid of Inscriptions, essentially putting an end to Bitcoin Ordinals and BRC-20 tokens.

As crypto.news reported, Bitcoin Core developer Luke Dashjr hopes to put an end to BRC-20 tokens and Bitcoin-based NFTs with a set of upgrades as these products appear to be spamming the network, leading to an excessive amount of data being stored on the blockchain.

Bitcoin Ordinals are non-fungible tokens that enable the inscribing of data onto a satoshi, the smallest division of a Bitcoin. Since its launch in January 2023, the protocol has seen the inscription trend take off, leading to thousands being minted on the Bitcoin network. This has caused congestion and spikes in transaction fees, reaching a peak in April and May 2023.

This article first appeared at crypto.news