Key takeaways:

- The bill introduced by North Carolina House Speaker Destin Hall would allow the state treasurer to invest in Bitcoin ETPs.

- The bill aims to diversify North Carolina’s investment portfolio and position the state as a leader in emerging financial technologies.

- HB 92 aligns with a growing trend among U.S. states exploring cryptocurrency investments.

North Carolina is the latest state willing to add digital assets to their investment portfolios. The bill entitled ‘NC Digital Assets Investments Act’ (HB 92), which was introduced by the Speaker of the House of North Carolina Destin Hall, provides for the investment of the state treasurer’s public funds in ‘qualified’ digital assets. However, while the proposal highlights the state’s growing interest in blockchain technology, it also raises concerns about regulatory challenges and financial risks.

The “NC Digital Assets Investments Act” (HB 92): Key Provisions

As stated in the document, HB 92 is primarily aimed at digitalizing the North Carolina investments in order to diversify the state’s portfolio. Nonetheless, the law has clear criteria for the selection of the conforming digital assets.

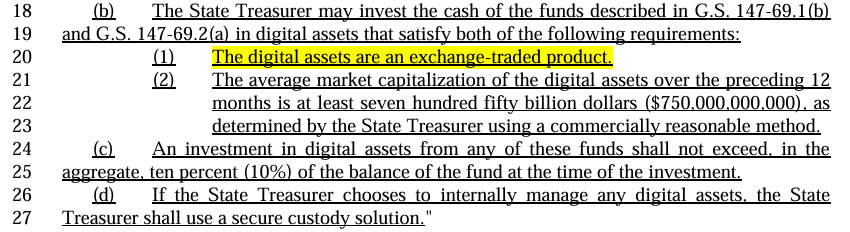

- Exchange-Traded Products (ETPs) Only: HB 92 explicitly restricts investments to exchange-traded products (ETPs), preventing the state from directly holding Bitcoin. Instead, North Carolina would invest in financial instruments that track Bitcoin’s price, ensuring a regulated and indirect exposure to cryptocurrency.

- Market Capitalization Threshold: One of the most important criteria to be met by any digital asset ETP is the average market capitalization of at least $750 billion must be the first requirement of a digital asset ETP. Bitcoin ETPs are the only cryptocurrency that you can possibly invest in when you read this in June 2024, because it is the only cryptocurrency ETP that fits this bill.

- Investment Cap: The bill establishes a requirement that no more than ten percent of the total balance of any state fund at the time of investment can go to digital assets.

HB 92. Source: North Carolina General Assembly

The Idea Behind the Bill

Indeed, those who support HB 92, e.g. Speaker Hall, provide several reasons on why the state may look into Bitcoin investments.

- Potential for Positive Yields: He thinks that investing in ETPs trading Bitcoin could even result in some return!

- Technological Leadership: The intention of the legislation would be the innovation and technological adoption of North Carolina.

- Hedge Against Inflation: Some of the proposals see advantage for Bitcoin in being against the fall and devaluation of the United States dollar.

Hall has made his opinion public that the project is in concert with a “vision for a national Bitcoin stockpile and ensuring North Carolina leads at the state level.”

Which State Funds Will Get Involved?

If approved, the bill will allow along with the teaching team related state funds, others to invest in Bitcoin ETPs. These funds will be run by:

- Teachers who are entitled to pensions for state employees.

- Insurance funds

- Veterans funds

A potential disruption to these funds, particularly pensions, is an issue that needs to be carefully weighed. The fact that cryptocurrency markets are volatile can be seen as providing both opportunities as well as risks for these funds.

A Growing Trend: States and Crypto Investments

In the U.S., the number of states that have included cryptocurrencies in their investment portfolios has recently peaked.

- In Arizona and Utah, the bill had become more than just a House committee bill.

- North Dakota had opted out of identical ideas before.

- Montana contemplated a bill to create a “state special revenue account” for digital assets and precious metals investment.

Weighing the Pros and Cons of Crypto Investments

Bitcoin ETP investment is both a secured investment and a gamble for North Carolina.

Potential Benefits:

- Diversification: Both crypto and traditional assets having such a low correlation factor are capable of diversification.

- Inflation Hedge: It is believed that Bitcoin can serve as a hedge against inflation, so it can help in reserves keeping the same value as before.

- Innovation Hub: It is possible for North Carolina to emerge as a fintech hub if they adopt cryptocurrencies.

Risks:

- Volatility: In most cases, cryptocurrency markets change very rapidly and thus are likely to lead to big problems in managing funds.

- Regulatory Uncertainty: Cryptocurrencies are still not covered by regulations, thus, there are some legal problems and compliance issues that need to be resolved.

- Security Risks: While it is true that ETP is less prone to security risks, the fact is that the underlying assets can also be victims of hacking and stealing.

More News: Florida Considers Investing State Funds in Bitcoin with Sen. Gruters’ Bill Proposal

The Road Ahead for HB 92

The fate of HB 92 will be decided as North Carolina lawmakers debate its potential benefits and risks. If passed, the bill could position the state as a leader in crypto adoption while introducing new financial opportunities.

This article first appeared at CryptoNinjas