Mantle (MNT) reaches a new all-time high as investors show an accumulation pattern amid bullish market conditions.

Mantle’s price has registered a slight decline after reaching a new all-time high of $1.29 at around 05:30 UTC on March 27. MNT is still up by 28% in the past 24 hours and is trading at $1.18 at the time of writing. The asset’s market cap grew to $3.8 billion, making it the 33rd-largest digital currency.

Moreover, Mantle’s daily trading volume increased by 65%, reaching $410 million. Data shows that the majority of the token’s trading activity comes from the Bybit crypto exchange — roughly $312 million.

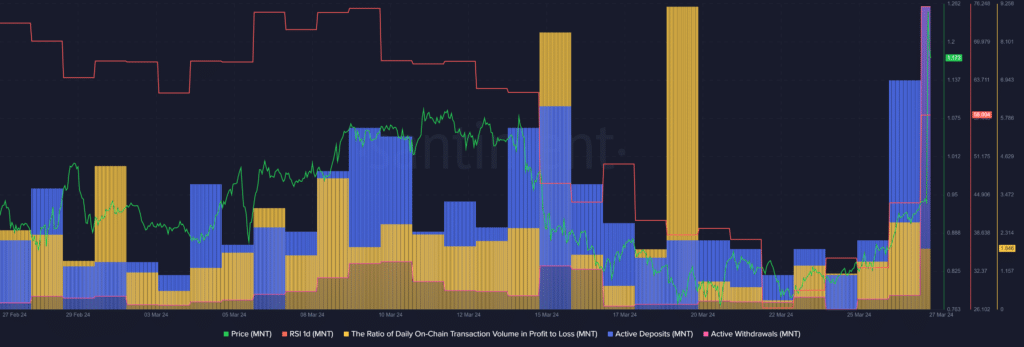

According to data provided by Santiment, the ratio of daily on-chain MNT transactions in profit to loss has been consistently increasing over the past three days as the asset gained bullish momentum — currently sitting at 1.85.

At this point, a wave of profit-taking movements would most likely be expected even though MNT doesn’t show any signs of overheating.

Per Santiment, Mantle’s Relative Strength Index (RSI) surged from 43 to 58 over the past 24 hours. The indicator shows a slightly increased price volatility as the cryptocurrency might witness high on-chain activity.

Data from the market intelligence platform shows that the number of active MNT deposits surged by 32% over the past day and is currently hovering at 70 unique deposits.

However, the number of active Mantle withdrawals rallied by 1,415% in the past 24 hours — rising from 43 to 651 unique withdrawal transactions from all exchanges.

The trend typically shows a short-term accumulation pattern while large whale movements should still be expected.

This article first appeared at crypto.news