Bitcoin’s mining difficulty achieved a record high of 86.4 trillion amid upcoming halving in April.

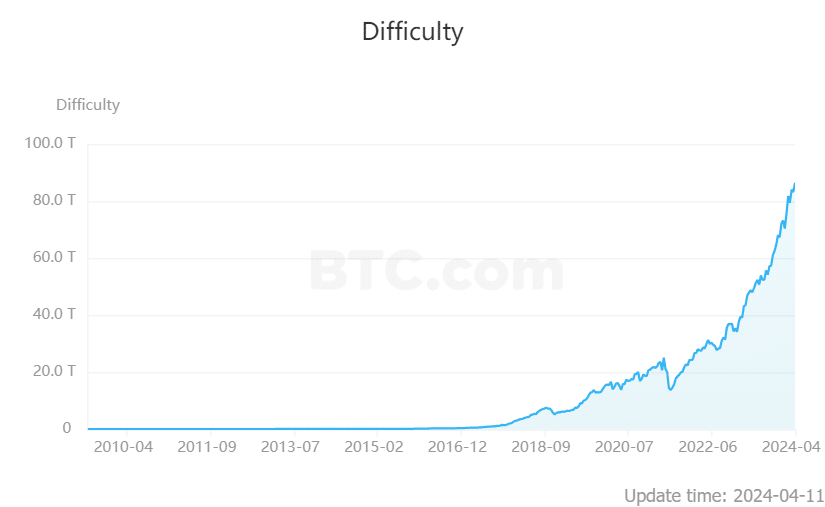

Data gathered by btc.com showed that Bitcoin’s (BTC) mining difficulty achieved a record high of 86.4 trillion as companies generated massive amounts of computing capacity before the much-anticipated halving event later this month.

Mining difficulty refers to the computer-generated power needed to solve complex mathematical equations required for unlocking new Bitcoins. BTC is scheduled to undergo a code change by April 20, and the latest mining difficulty report is the final update before this halving.

According to btc.com, mining difficulty has increased by some 600% since 2020, when the last halving occurred. Also, it has been in a continuous uptrend since May 2021.

BTC miners are churning more computing power than ever as these entities look to stockpile the crypto and bolster cash reserves before block rewards are halved. For miners, block rewards are the main income source, and soon, the reward will be reduced to 3.15 BTC. The drop will also tighten daily Bitcoin issuance from 900 to 450.

Bitcoin halving could trigger short-term market decline

Historically, the asset declines between 15% to 40% pre-halving, per CoinMarketCap, and enters a parabolic increase in the long run following the code change. However, Bakhrom Saydulloev, Mercuryo product lead, told crypto.news that a short-mid term retrace triggered by miners liquidating BTC may happen.

Historical data shows that in the immediate aftermath of the halving, Bitcoin prices typically experience a decrease. At the same time, in the medium to long term, they tend to trigger bull runs. For instance, after a halving, some miners may feel pressured to sell their Bitcoin holdings to cover operational costs due to the 50% reduction in block rewards, affecting their profitability. This could lead to a market “sell-off” as some investors become uncertain about future price trends.

Bakhrom Saydulloev, Mercuryo product lead

Saydulloev further opined that previous halving occurred during better economic and investment climates, citing the current uncertain trajectory around crypto regulations. Conversely, general sentiment posits that the presence of spot Bitcoin ETFs could incentivize cash flow into the cryptocurrency. Spot Bitcoin ETFs have already garnered over $200 billion in trading volume in less than four months.

This article first appeared at crypto.news