Michael Saylor announced a significant Bitcoin purchase by MicroStrategy shortly after pitching the cryptocurrency to Microsoft.

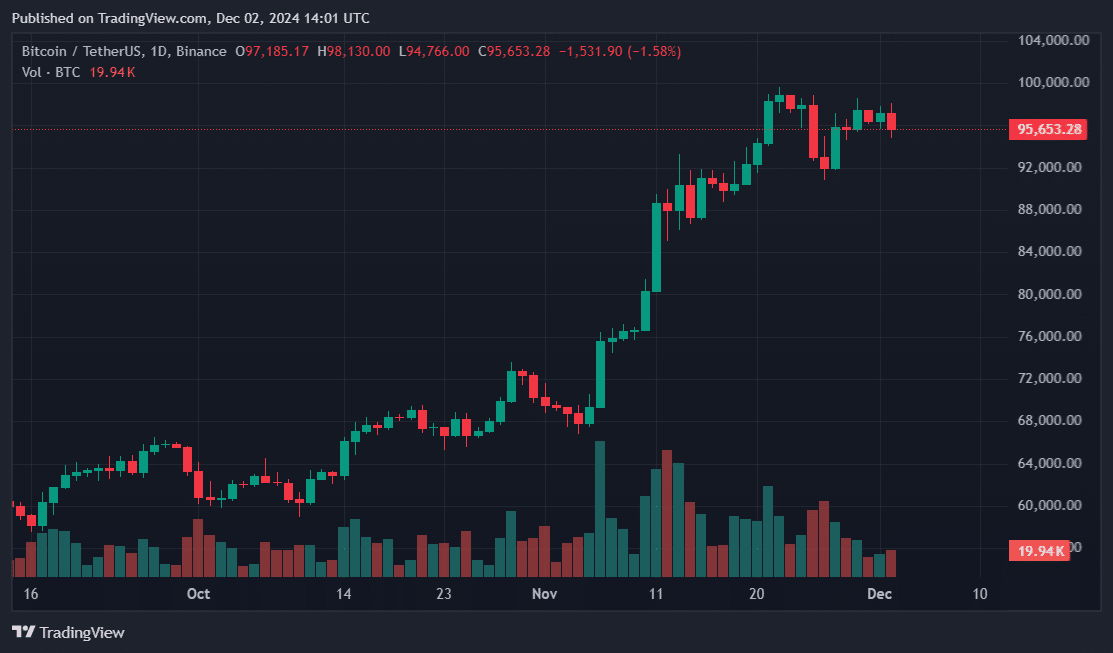

On Dec. 2, Saylor revealed that MicroStrategy had acquired15,400 Bitcoin (BTC) for $1.5 billion, with an average purchase price of $95,976 per coin. The acquisition increased MicroStrategy’s Bitcoin holdings to approximately 402,100 BTC, valued at over $38 billion as of press time, with Bitcoin trading around $95,194.

MicroStrategy has spent $23.4 billion on Bitcoin acquisitions at an average cost of $58,263 per coin. The firm’s holdings have generated over $15 billion in unrealized gains since it began accumulating Bitcoin in 2020.

MicroStrategy’s Bitcoin playbook

MicroStrategy has raised funds for its Bitcoin purchases through share sales and securities issuance, introducing the “BTC Yield” metric to measure Bitcoin holdings growth relative to share dilution. According to Saylor, MicroStrategy’s BTC Yield stands at 38.7% quarter-to-date and 63.3% year-to-date.

The company’s strategy has inspired others, including Tokyo-based Metaplanet and Bitcoin miner Marathon Digital. Both companies have adopted similar approaches to finance Bitcoin acquisitions. Metaplanet has even announced plans to reward shareholders with Bitcoin for holding its stock.

Shortly before Saylor’s disclosure, Marathon announced a new proposed $700 million private convertible note offering with a $105 million extension option. Marathon said the proceeds would be deployed mainly to buy more Bitcoin and initiate note buybacks, as in previous BTC-focused capital raises.

Saylor, a vocal advocate for Bitcoin, has continued promoting its adoption. Over the weekend, he pitched Bitcoin to Microsoft’s Board of Directors, reinforcing his position as a leading proponent of corporate cryptocurrency investment.

This article first appeared at crypto.news