Key Takeaways:

- Michigan joins 19 other states in proposing legislation for a strategic cryptocurrency reserve.

- Under the proposed bill, the state treasurer is authorized to trade and/or loan up to 10% of some state funds for cryptocurrencies.

- A Michigan representative floated the idea of “MichCoin,” a stablecoin backed by Michigan’s gold and silver reserves.

Michigan Eyes a Future in Crypto: A Deep Dive into the Proposed Bitcoin Reserve

The world of cryptocurrencies is changing at an ever-increasing pace, and it is no wonder that local governments in the United States are playing catch-up. The latest state lining up to get in on this phenomenon is Michigan. Michigan’s plan includes a bill that would set up a reserve fund with Bitcoin as the currency. This move could signal a growing trend of virtual currencies as a major investment avenue and economic growth driver, shaping both Michigan’s financial future and the global crypto market.

HB 4087: The Foundation for Michigan’s Crypto Strategy

Bryan Posthumus and Ron Robinson are the two representatives who introduced House Bill 4087 (HB 4087) on February 13th. Their hope is that the new law, if enacted, will amend Michigan’s Management and Budget Act, the purpose of which in turn shall result in the establishment of a strategic Bitcoin reserve for the state. The announcement sparked discussions, with some supporters suggesting that Michigan could gain a competitive edge as an early adopter of this investment category.

“Michigan can and should join Texas in leading on crypto policy by signing into law my bill creating the Michigan Crypto Strategic Reserve,” Posthumus stated on X. His statement mirrors the view of many bureaucrats who consider the cryptocurrencies as a golden opportunity.

Michigan can and should join Texas in leading on crypto policy by signing into law my bill creating the Michigan Crypto Strategic Reserve. https://t.co/x2Yke3uWTn

— Rep. Bryan Posthumus (@posthumus_bryan) February 13, 2025

What Does the Bill Entail?

The proposed legislation grants the state treasurer the authority to invest up to 10% of the general fund and the economic stabilization fund in cryptocurrencies. Unsurprisingly, the bill does not contain any specific criteria for the types of cryptocurrencies that can be bought. In particular, the state’s position on Bitcoin is crystal clear as the name of this digital asset is explicitly mentioned in the bill.

Earning Through Lending: A Risky Proposition?

The bill includes an innovative and, perhaps, controversial provision that allows the lending of cryptocurrency. One key provision in the bill states: “If cryptocurrency can be loaned without increasing financial risk to this state, the state treasurer is permitted to loan the cryptocurrency to yield further return to this state.” Nevertheless, this idea has yet to go through its testing period and may still be faced with heavy fluctuations and the missing regulatory framework. A few concerns linger regarding the actual extent of risk taking during these activities.

Custody and Security: A Priority

The bill specifies that the state must store its crypto assets either through secure custody solutions or exchange-traded products (ETPs) from registered investment companies. This analog even implies some understanding of security risks supposed by such assets and the need to let the risks through established control gates.

The “MichCoin” Concept: A State-Backed Stablecoin?

Following the Bitcoin reserve proposal, Representative Posthumus introduced the idea of “MichCoin.” In his newly composed post titled x, he proposed the “MichCoin” as “a stablecoin, which I believe the state of Michigan should create” and also wrote it would “link to our gold and silver reserves.” This thought is still in its embryonic state; it’s more like the case when Michigan is expressing its desire to engage in blockchain technology to use it to solve state-supported digital money challenges.

The concept of a state-supported stablecoin is fraught with many questions. Will its regulation be like the regulation of fiat money? Will a central bank guarantee its stablecoin value? Will there be a secure and reliable infrastructure to support it? All these are questions that must be resolved before any such scheme can ever become a real project.

Crypto Adoption in Michigan

It is worth noting that Michigan is not a completely new player in the crypto industry. The state’s pension funds already have certain Bitcoin and Ether exposures made through exchange-traded funds (ETFs). Thus, such previous experiences serve as a vehicle for the future creation of a broader crypto investment strategy in case the bill becomes law.

The Bigger Picture: A Trend of States Embracing Crypto

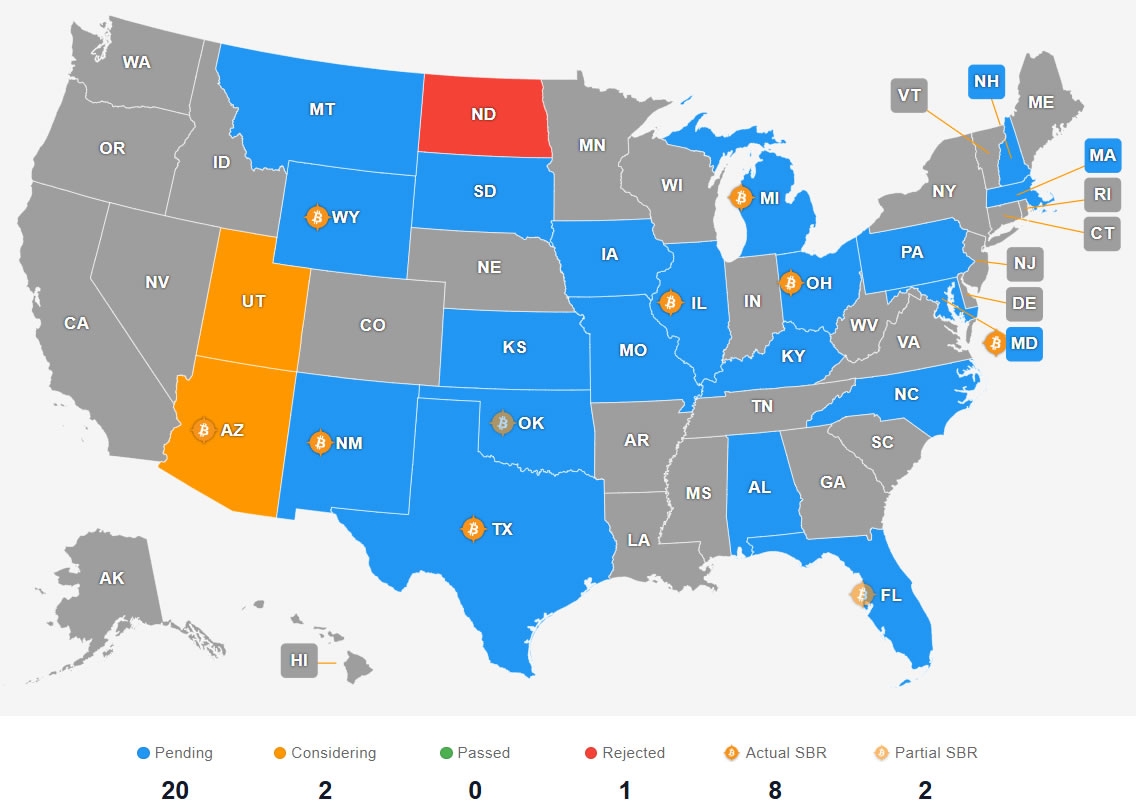

Michigan’s proposal constitutes a part of a larger pattern across the United States. As many as 20 states have introduced legislation regarding state investment in crypto. For example, Texas is the latest state to introduce similar legislation. But North Dakota is the only state thus far to have voted down the bill.

More News: Texas Considers Establishing a Bitcoin Reserve in 2025 Under Lt. Governor Dan Patrick

The bills’ status. Source: Bitcoin Reserve Monitor

Matthew Sigel, head of digital assets at VanEck, estimated that up to $23 billion in state funds could potentially enter the crypto market, driving significant upward pressure on Bitcoin and other digital assets.

The trend is not limited to states; corporations are also jumping on the crypto bandwagon. Metaplanet, for example, has recently declared that it has raised about $26.1 million to buy more Bitcoins using zero-interest, unsecured bonds. This action is a direct consequence of institutional capital flows as a cryptocurrency that is becoming an asset.

Factors Behind the Push for Crypto Reserves

One key factor is the growing acceptance of crypto reserves by various institutions. A few contributing factors are things like a spike in the use of digital currencies, diversification incentives, and competitive pressure in a rapidly evolving financial scene.

- Diversification: The crypto assets market, with Bitcoin being the most prominent one, is perceived by some as a distinct unalloyed asset class, so their prices move in a manner that is not directly connected to the traditional markets. Allocating a portion of state funds to crypto may reduce overall portfolio risk by providing diversification benefits.

- Innovation: States could be compelled to demonstrate that they are competitive to their peers and able to attract tech-savvy businesses and residents by integrating new technologies, such as blockchain and digital currencies, into their organizational structures.

- Yield Generation: Lending acquired crypto to generate additional income presents an attractive opportunity for states to improve their financial performance.

Challenges and Considerations

The possibility of problems and opposing factors have to be very much in the forefront when we want to talk about potential benefits.

- Volatility: The cryptocurrency market is in general characterized by its high volatility. States need to have resilience in case of substantial market fluctuations.

- Security: Crypto assets are prone to theft, be it physical or virtual, due to poor security and hacking. The solution is robust security systems and secure custody solutions that have to be implemented.

- Regulation: The world of cryptocurrencies is still underregulated and it will take time for the development of proper legal frameworks. States should be efficient in employing good legal strategies in a tricky and ambiguous world.

Integrating cryptocurrency into state financial strategies, as Michigan proposes, requires careful and informed decision-making. The expected return on investment is outstanding, but the thorough understanding of the risks is the key for the protection of the taxpayer’s money.

This article first appeared at CryptoNinjas