MiCA will finally give crypto firms in Europe clear rules of the road to follow — but it could potentially threaten the dominance of the world’s biggest stablecoin issuer.

December 30 is shaping up to be a big day in the crypto calendar.

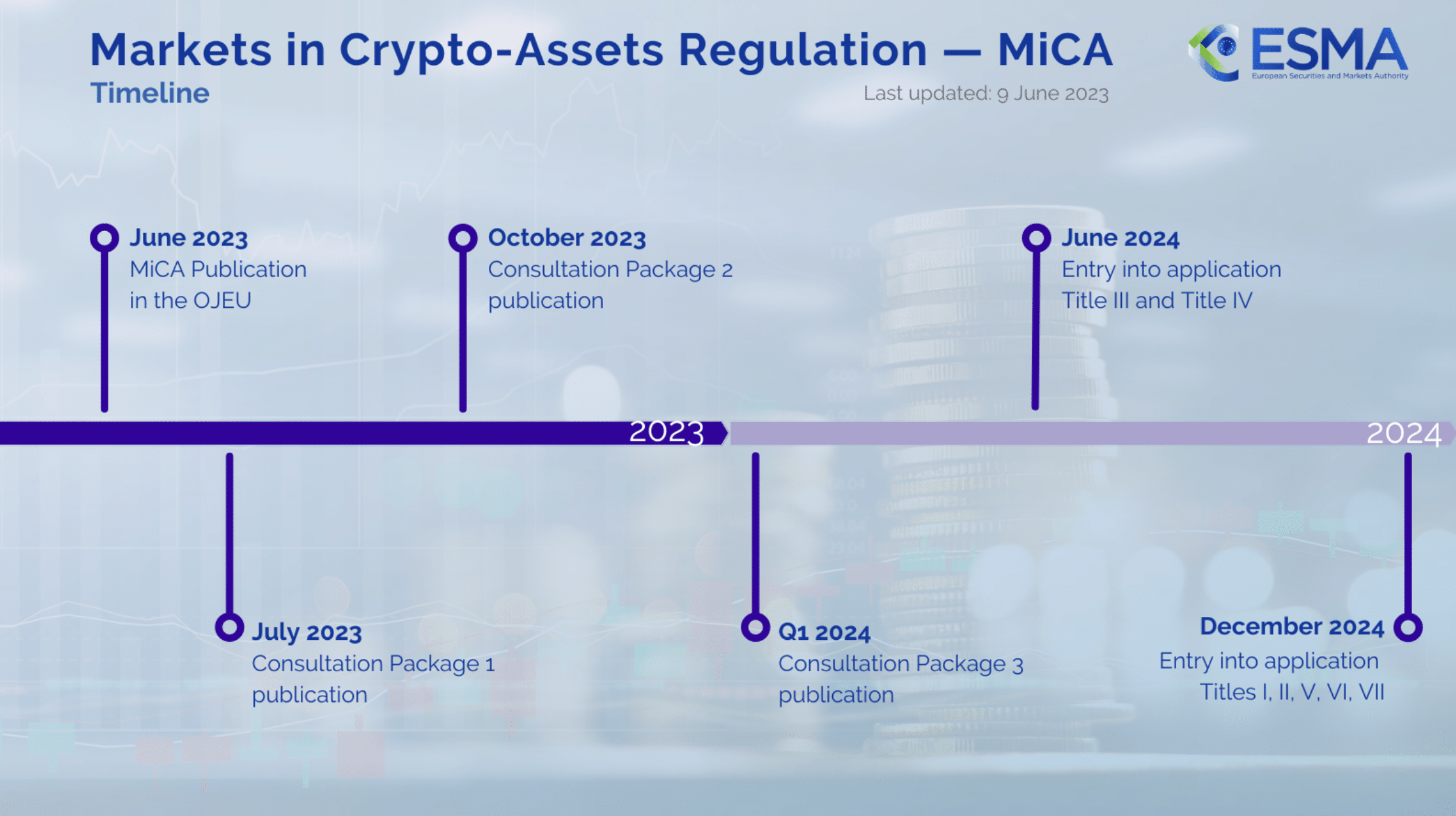

That’s when the EU’s long-awaited Markets in Crypto-Assets Regulation, otherwise known as MiCA for short, will come into force.

The goal is to create consistent rules for the industry across the trading bloc, all while offering greater protections for consumers.

Politicians have raised hopes that it will make the “Wild West” of crypto a distant memory — and it’s been welcomed by firms in the space that have long craved clear rules of the road to follow.

In the past, crypto has often been regulated through the prism of existing securities laws, some of which were written many decades ago.

By contrast, MiCA adapts this legislation and introduces measures specific to up-and-coming digital assets, such as stablecoins pegged to the value of fiat currencies.

It’s these rules in particular that are going to send shockwaves through the industry, and potentially threaten the dominance of the world’s biggest stablecoin issuer.

Tether (USDT) is streets ahead of the competition right now with a $119.7 million market capitalization, and that’s almost four times larger than its nearest competitor USD Coin (USDC).

But there’s a problem: Tether currently lacks the e-money license that’s necessary to operate in the EU, and it’s unclear whether its digital assets are compliant with MiCA.

Meanwhile Circle — which issues USDC as well as its euro-focused counterpart EURC — managed to achieve compliance after securing a license in France.

What complicates matters for Tether relates to how achieving compliance would mean a far greater chunk of reserves would need to be held in traditional bank accounts rather than Treasuries, potentially eating into the company’s profit margins.

Back in July, the company had revealed that its direct and indirect exposure to Treasuries stood at $97.6 billion — far greater than major economies including Germany and Australia. That had led to jaw-dropping net profits of $5.2 billion between January and June.

Coinbase has previously confirmed that it will be delisting non-compliant stablecoins across Europe before this December 30 deadline, in what could be a huge blow for Tether unless it gets its paperwork in order.

But this is just one facet of how Europe’s crypto industry is evolving as MiCA looms.

The winners and losers of MiCA

Marina Markezic is the co-founder and executive director of the European Crypto Initiative, which aims to help industry players get their voices heard in Brussels. She told crypto.news that MiCA is a vital step forward that positions the trading bloc favorably when compared with other markets, and said:

“There is a vibrant crypto industry in the EU, with stable, growing companies serving EU citizens for years now. Compared to other markets, the crypto industry in the EU isn’t a homogenous concept because of the fragmented regulation coming from member states. Prior to MiCA, there wasn’t a unified understanding of what a cryptoasset is, let alone what a cryptoasset service is and how it should be regulated.”

Markezic explained that there’s “a trend of consolidation” across the crypto sector because of these new regulations. Not only have we seen some high-profile acquisitions, with Robinhood acquiring Bitstamp, but “extensive legal obligations and formal requirements” means that many businesses operating in the region are now alike.

“As we expected ever since we saw the first draft of MiCA back in 2020, the incumbents and the big players will benefit the most from MiCA, with the burden being too great for smaller entities, effectively crippling their operations and forcing them to fundamentally rethink their services and overall existence.”

The European Crypto Initiative believes that greater levels of clarity are needed concerning some of MiCA’s requirements — and question marks remain for stablecoin issuers and exchanges.

“There is also a lot of uncertainty around the basics, such as which activities are regulated and thus in the scope of MiCA. One such example is projects that offer services in a decentralized manner without any intermediaries.”

But despite all of this, Markezic maintains the EU is blazing a new trail for crypto — and isn’t suffering from the paralysis seen across the Atlantic, with the Securities and Exchange Commission accused of adopting a “regulation through enforcement” approach.

“Currently, the EU provides much more clarity in terms of its regulatory approach towards crypto compared to many other jurisdictions, and particularly compared to the US. The ongoing uncertainty around whether or not assets such as Ethereum and Bitcoin will be considered securities is a brilliant example of this — in the EU, those questions are answered thanks to MiCA.”

Markezic says applications surrounding the tokenization of real-world assets are a particular hot-button topic in the EU right now — and this up-and-coming technology, when coupled with stablecoins, amount to the most compelling use cases for crypto across the region.

Of course though, the likes of Tether and Circle could soon have competition in the form of an EU-wide central bank digital currency. Brussels is still weighing up whether to launch one, and as in other jurisdictions, concerns have been raised that such a CBDC could impinge on the privacy of consumers and be used as an instrument for surveillance.

“The digital euro topic is incredibly politically charged, so it likely won’t get resolved soon. What is apparent, however, is that blockchain will not be used in the development and execution of the project, significantly reducing the broader interest towards it, coming from the crypto industry.”

The next two-and-a-half months are shaping up to be fast and furious as crypto firms get ready for MiCA — and given the EU is home to 450 million people, the regulation will have an indelible impact on investors from Croatia to Cyprus, Spain to Sweden, and Germany to Greece.

This article first appeared at crypto.news