April 20 marked Doge Day, and 24 hours later, Dogecoin — the popular dog-themed meme coin — was one of several whose values went up considerably as the crypto market rediscovered its footing.

Dogecoin finds footing

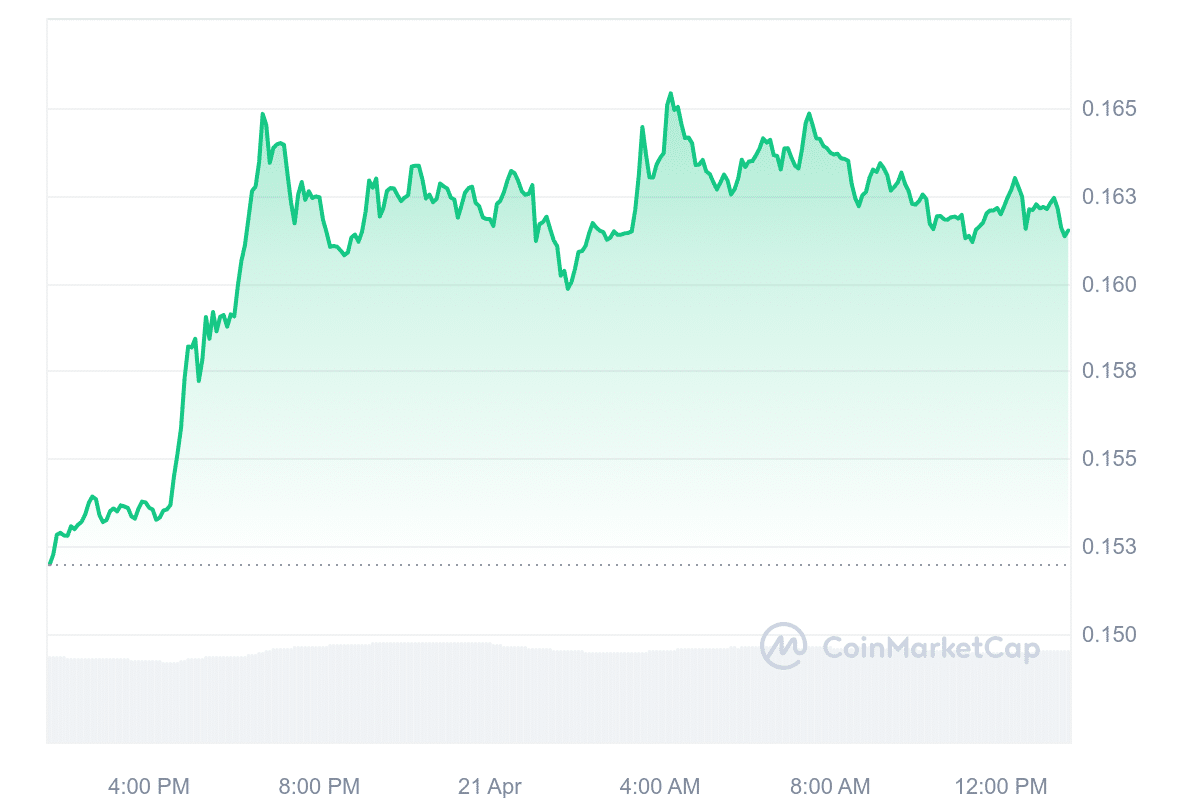

According to crypto data aggregating website CoinMarketCap, Dogecoin (DOGE) is up 6.22% in the last 24 hours, a timeframe that saw more than $1.5 billion worth of DOGE changing hands.

Dogecoin’s current price of $0.1615 per token is also a 6.2% improvement on its value from seven days ago and a 3.6% upswing from where it was a month ago. However, it is still nearly 19% lower than its value from the previous 14 days.

Shiba Inu up by double figures

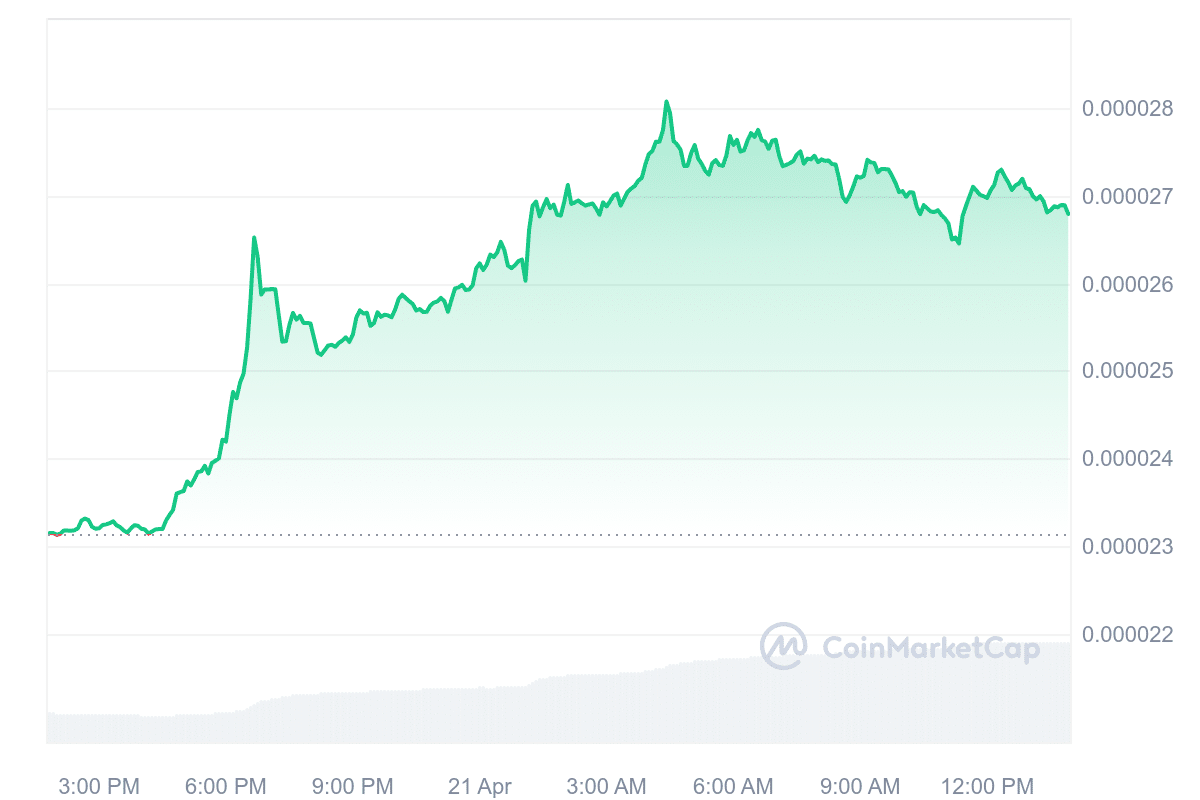

Ranked 11th in market capitalization in the broader crypto market, and the second-largest meme coin in the world, Shiba Inu (SHIB), also had a good 24 hours. Its price went up by more than 16% during that time.

It marks a continuation of Shiba Inu’s upward trend, which started over a week ago, following a period of correction. The price improvement was accompanied by a 24-hour trading volume of $1.4 billion, which made DOGE the eighth most traded cryptocurrency in the market.

Floki: the best performer among 5 biggest meme coins

Among the top five biggest meme coins by market cap, Floki (FLOKI) registered the highest price uptick in the last 24 hours.

According to CoinMarketCap, FLOKI, trading at $0.0001705, is up more than 20%, even though it had a much lower trading volume than DOGE and SHIB, at $360 million.

FLOKI’s current level is also more than 16% higher than where it was a week ago and about 454% better than it was a year ago.

However, the meme coin is still in the red over the 14 and 30-day timeframes, being nearly 17% lower over seven days and more than 23% worse off over 30 days.

Overall, the top meme coin in terms of price performance over the last 24 hours is ERC20, whose value went up an incredible 1,231% in that time.

Solama, Popcat, and Bonk (BONK) also registered top performances, with their prices gaining 96%, 48%, and 41%, respectively.

This article first appeared at crypto.news