Loaded Lions token crashed 48% since its all-time high as airdrop participants took profits.

On Feb. 27, Loaded Lions, the flagship NFT project of Crypto.com, has officially launched its long-awaited token LION with an airdrop to Loaded Lions NFT holders.

Upon launch, the token debuted on Crypto.com App, VVS Finance, and Crypto.com cxchange. CoinGecko listed the token on Feb. 3. Upon listing, LION hit an ATH of $0.004339. However, it has since crashed by 48%, trading at $0.002225 at the time of writing, according to CoinGecko.

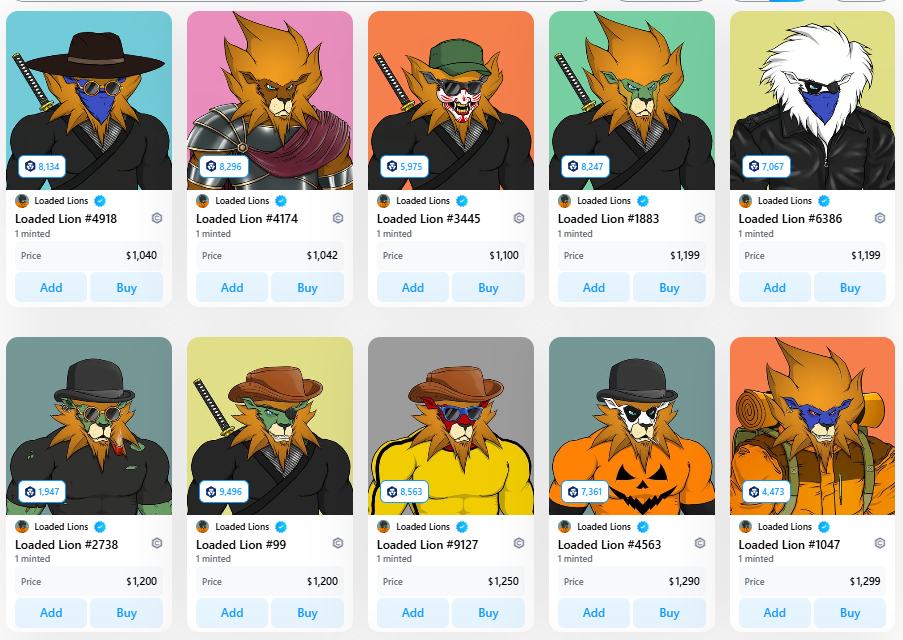

The LION token serves as the main utility token for the Loaded Lions NFT project, which is the first-ever platform-owned NFT profile picture project by Crypto.com. The collection includes 10,000 unique, algorithmically generated PFPs with different levels of rarity. The Loaded Lions NFT holders have the privilege to access Mane Net, a private community offering VIP experiences, giveaways, and priority access to Crypto.com NFT drops.

Currently, LION is available only on the Cronos EVM chain, with plans to expand to Ethereum (ETH), Solana (SOL), and other blockchain ecosystems. Token holders will have opportunities to stake LION in on-chain vaults and other Crypto.com app programs. Staking will provide token rewards, app perks, and benefits in Loaded Lions: Mane City. In the future, LION holders will gain governance rights to participate in ecosystem decision-making.

With a total supply of 100 billion tokens, the LION tokenomics is structured to support community growth, strategic initiatives, and ecosystem sustainability. Half of the supply is dedicated to community & strategic partnerships, with 20% allocated directly to the community, 15% for incentives, and 15% for strategic collaborations. Then, 10% is set aside for operations and marketing, and a further 15% is reserved for the ecosystem, while 25% is allocated to liquidity.

This article first appeared at crypto.news