Discover how Ethereum’s shift to PoS and liquid staking protocols transform blockchain technology and address the 32 ETH staking challenge.

Ethereum staking has revolutionized the way we use and interact with blockchain technology. With its security now relying on capital rather than computing power, Ethereum’s (ETH) shift to proof-of-stake (PoS) offers numerous benefits, including a reported 99% reduction in the network’s carbon footprint.

However, it still presents several drawbacks, chief among them being the 32 ETH economic requirement for participants to run a dedicated node on the network.

Liquid staking protocols: what to look out for

As of January, 32 ETH is about $84,724. Not many would-be validators can easily afford that amount, especially in regions with lower incomes.

Additionally, staking funds become locked and lack liquidity, pushing stakers to join staking pools instead. These pools often prove more profitable than individual validators due to the advantages of smoothing effects, safety mechanisms, and insurance they offer.

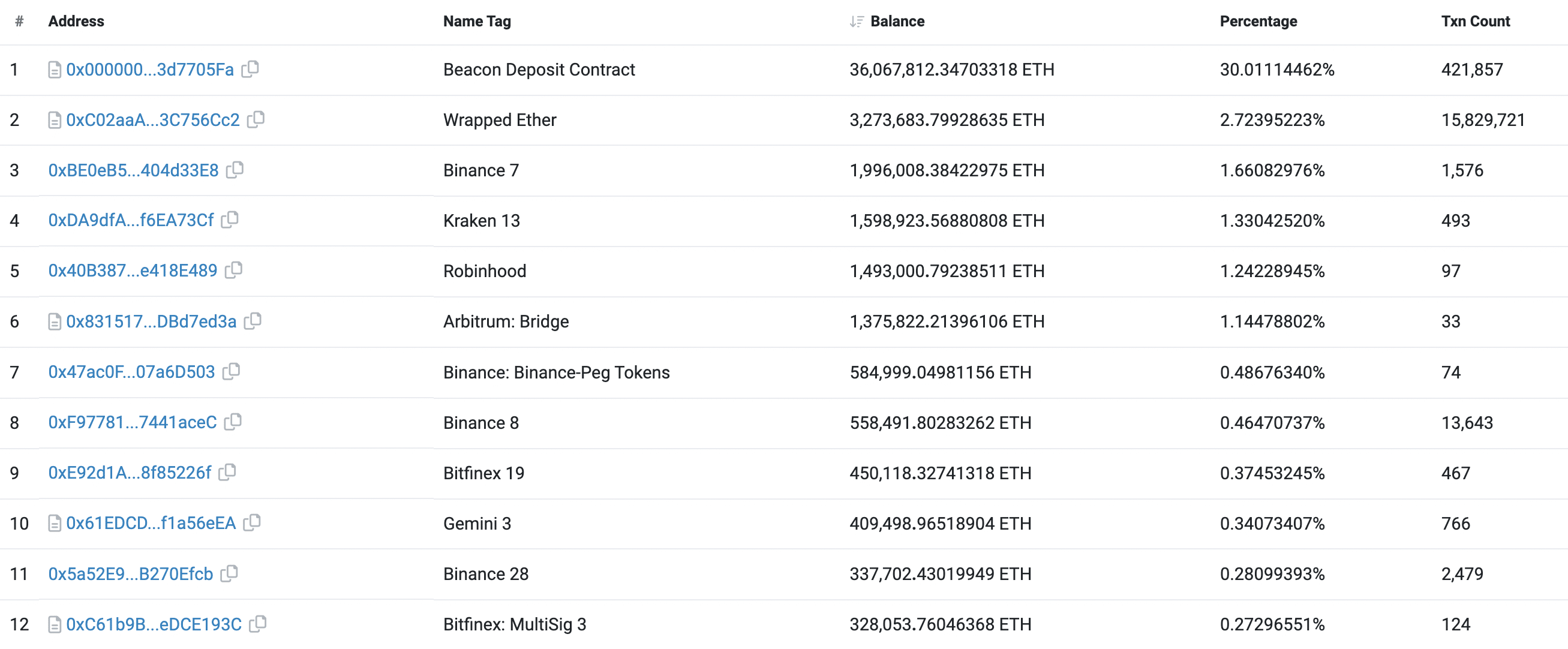

The situation has led to a concentration of power on the Ethereum network, with a small number of stakers controlling a significant share of the blockchain. Since these entities hold most of Ethereum’s validator keys, it gives them full control over crucial aspects like block production, transaction censorship, and MEV (maximal extractable value) choices.

And as these pools grow larger, they gain more strength, eroding the core decentralization principles of Ethereum. As a result, there have been calls for more decentralized and pocket-friendly solutions to address this concern.

This is where community-driven liquid staking protocols come in. These platforms offer a new way to stake ETH and enjoy the benefits of staking while maintaining liquidity and flexibility. To shed light on this groundbreaking trend, we sat down with the teams behind three emerging liquid staking protocols: ether.fi, Diva, and Tenderize.

ether.fi: unlocking liquid staking

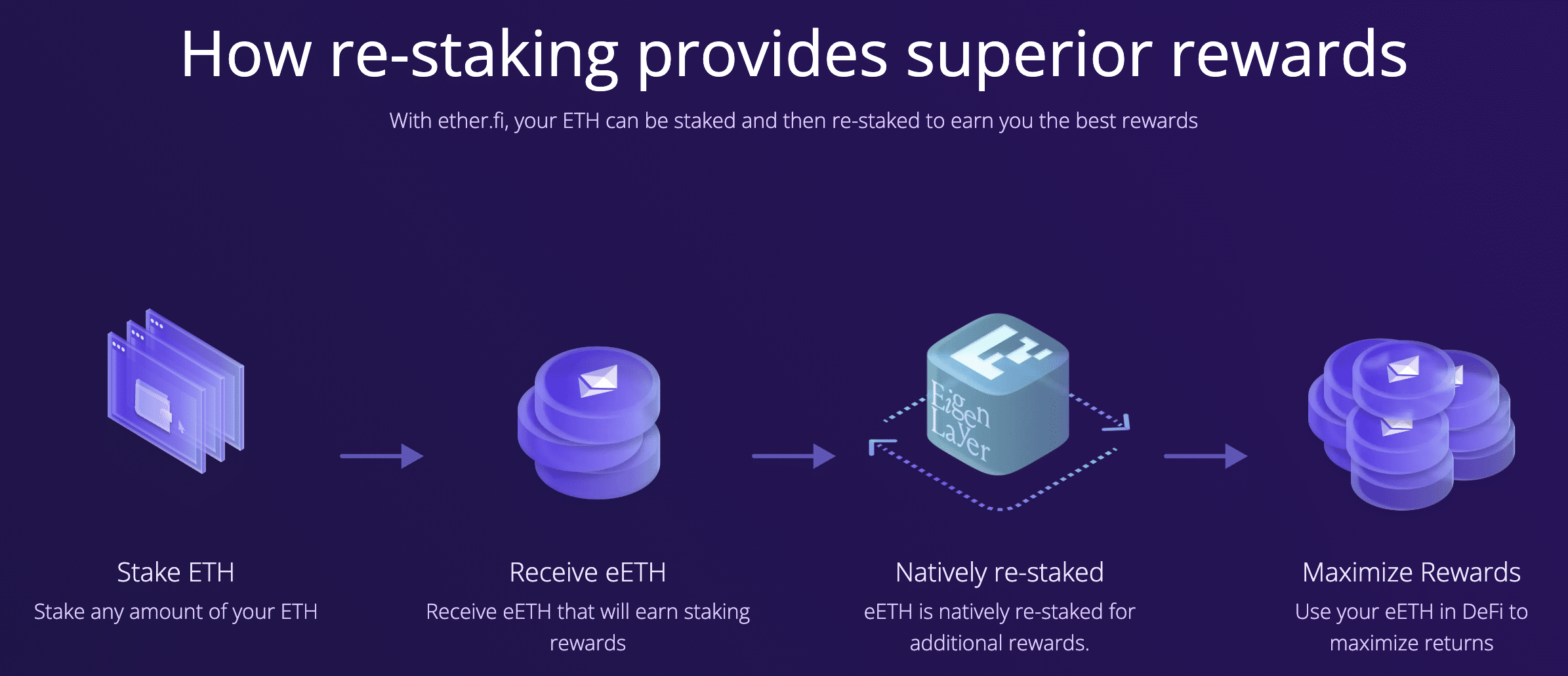

Ether.fi team has pioneered a non-custodial protocol that enables users to stake their ETH holdings while keeping their private keys securely in their possession.

Among the people associated with this project is Arthur Hayes, an investor who actively contributes to ether.fi through his family office, Maelstrom.

When we asked the ether.fi team about their target audience, they responded,

“We cater to individuals who have a keen interest in staking Ethereum.”

However, they also highlighted the regulatory uncertainties surrounding ETH staking in the United States. Consequently, ether.fi has temporarily geofenced U.S. users until the Securities and Exchange Commission (SEC) provides more precise guidance.

The ether.fi team prioritized security for their protocol, employing auditors like Nethermind, Omniscia, Zellic, and Solidified to enhance safety measures.

Ether.fi offers loyalty points and membership programs, providing rewards for users. The platform adopts a non-custodial approach, allowing users to maintain control over their keys, aligning with the principle of “Not your keys, not your coins.”

To tackle liquidity and volatility issues in staked tokens, ether.fi has made provisions for users to withdraw or trade their assets through the eETH liquidity pool.

As of Jan. 12, ether.fi was one of the major liquid staking protocols per the amount of ETH staked in the last six months.

Diva: another approach to liquid staking

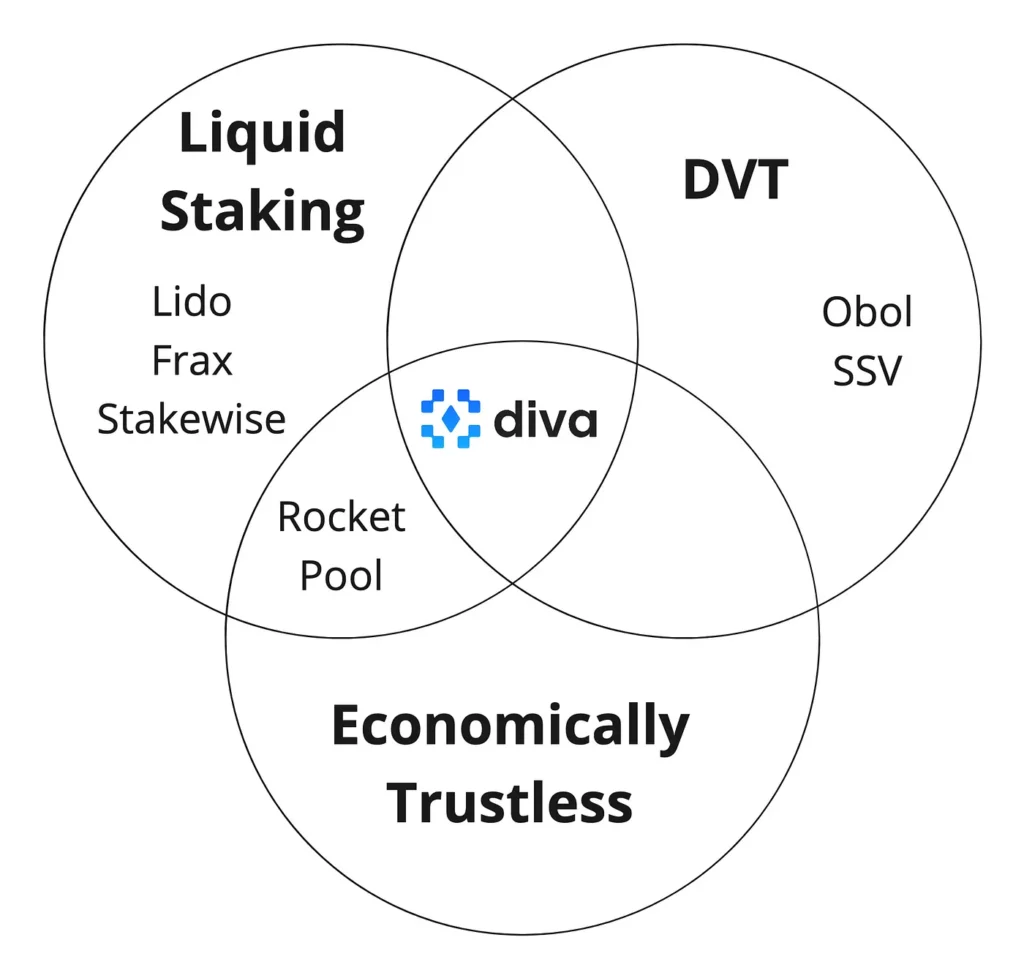

Diva, a liquid staking protocol that will be launched in 2024. Diva’s distributed validator technology (DVT) allows the entire network to perform validation, reducing the risks associated with centralization. Per developers, Diva’s security model, based on DVT, offers improved uptime and a diverse range of operators without requiring permission.

It provides an alternative to solo staking, which demands 32 ETH per validator and requires considerable technical expertise. Diva’s operator union model makes staking more accessible by allowing users to lock as little as 1 ETH while providing better rewards and flexibility, according to the protocol’s developers.

The platform engages its community through Discord channels, encouraging users to contribute to early testing and provide feedback. According to the team, the community plays a significant role in governance decisions, ensuring the protocol evolves in response to the needs and concerns of its users.

The Ethereum Shanghai upgrade has played a crucial role in accelerating the growth of liquid staking for ETH. This upgrade completed the circle for Diva, particularly by making liquid staking tokens (LSTs) fully functional. This functionality allows LSTs to trade closely to their fair value, significantly reducing the cost of providing liquidity in defi.

With deep liquidity pools now more accessible, protocols like Diva may gain a competitive advantage over established players like Lido Finance.

To ensure the stability and liquidity of the stETH derivative token, Diva employs divETH tokens, which closely track ETH at a 1:1 ratio. This approach, combined with DVT-based security, is how Diva mitigates significant price deviations from ETH.

The protocol has also adopted a special approach to navigate legal challenges and ensure regulatory compliance globally. Instead of operating as a traditional company or platform, Diva positions itself as a pure software extension of Ethereum. Its immutable code, similar to contracts such as Wrapped ETH or Liquity, ensures that no central entity offers services or charges fees. Diva aims to establish regulatory equivalences by staking on Ethereum itself, simplifying compliance efforts.

At the time of writing, Diva has not yet launched. However, by offering an Operator Testnet Alpha and proposing a Pre-Launch Vault, Diva aims to encourage early commitments of total value locked (TVL) in ETH or stETH.

Tenderize: empowering validators

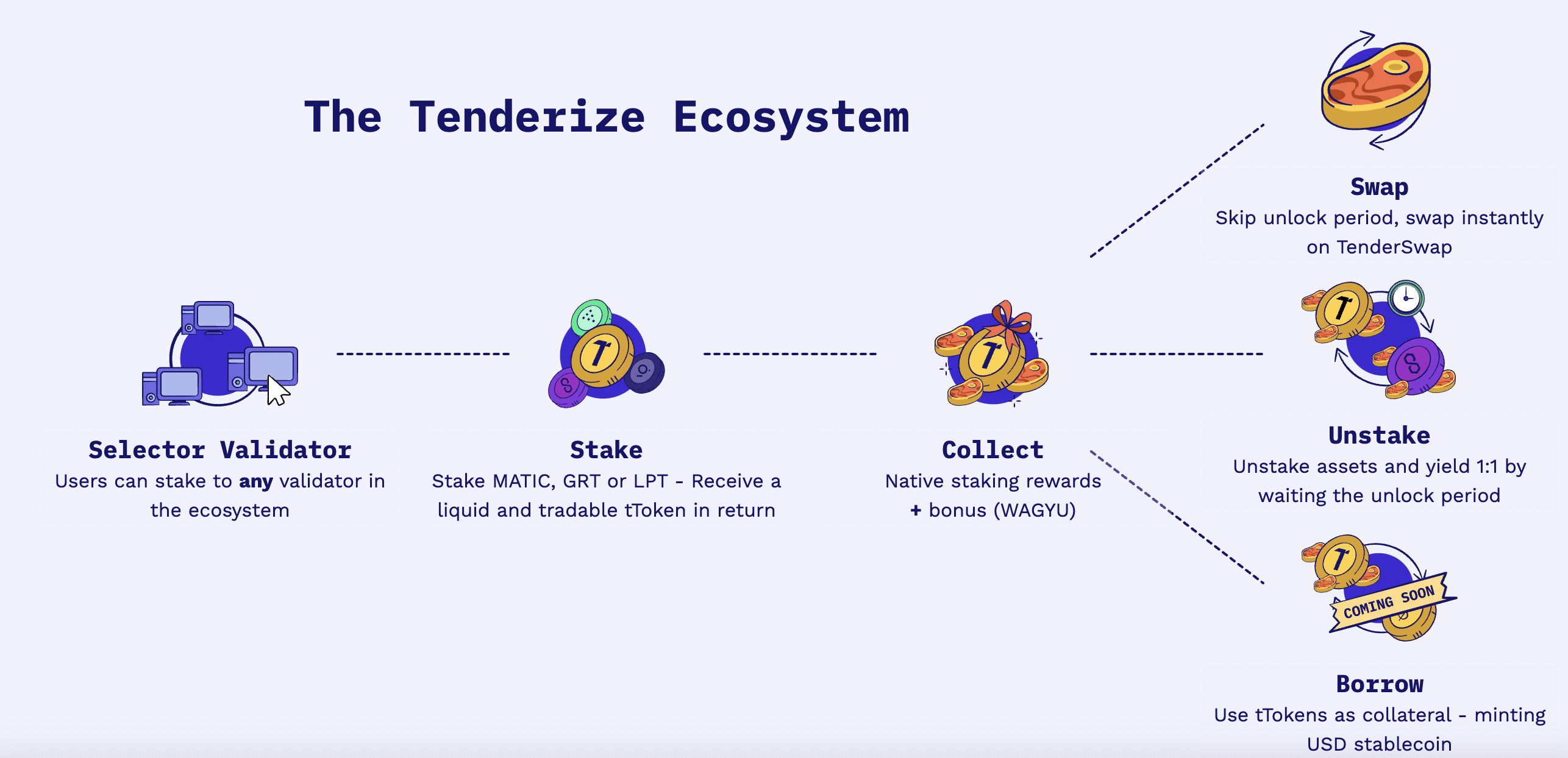

Tenderize is a liquid staking solution that allows any validator on the network to participate, potentially unlocking as much as $30 billion worth of crypto previously neglected in liquid staking.

According to the Tenderize team, the platform has attempted to tackle issues of neglected assets by providing each validator with highly-liquid staked tokens, promoting decentralization in the ecosystem.

The platform has a new upgrade dubbed Tenderize v2, and what sets it apart, in the words of its creators, is its self-custodial nature, which eliminates the need for intermediaries. It means users can swiftly exit staking through a native decentralized exchange (DEX), with the shared liquidity approach ensuring greater flexibility and liquidity access without centralizing stake on whitelisted nodes.

Much like Diva, the Ethereum Shanghai upgrade played a vital role in accelerating the growth of liquid staking for Tenderize, with the platform reportedly experiencing its fair share of positive impact.

Prior to the upgrade, TenderSwap, a crucial component of the Tenderize protocol, faced limitations in facilitating unstaking. However, with the upgrade, users could unstake ETH, which paved the way for the launch of tETH through Tenderize v2.

The protocol emphasizes community involvement in its development, with Tenderize offering grants to validators and liquidity providers for their input and testing. The platform also involves token holders in governance decisions, such as fee and reward determination.

In liquid staking, addressing stability and liquidity concerns is crucial. Tenderize offers two methods for converting tTokens back to their original form.

One method is through TenderSwap v2, where users can exchange their tTokens (like tMATIC, tLPT, or tGRT) for the corresponding asset (MATIC, LPT, or GRT) at a 1:1 ratio, subject to a service fee. The alternative method requires waiting for the unstaking period to end, which varies by blockchain. Tenderize aims to maintain a 1:1 swap ratio on TenderSwap to manage price deviation risks and support user stability and liquidity.

The mainnet launch is scheduled at Jan. 29, according to Tenderize X account.

Liquid staking protocols: the future of staking?

Ethereum staking represents a notable development in the cryptocurrency space, with various projects contributing to this trend. These projects enable users to stake amounts less than 32 ETH, supporting Ethereum’s transition to proof-of-stake.

Additionally, these projects offer methods for users to liquidate their staked assets without undergoing a full withdrawal process, enhancing the flexibility of cryptocurrency staking.

Projects supporting ETH staking below the 32 ETH threshold provide an opportunity for users to participate in staking with smaller investments.

This article first appeared at crypto.news