KAS, the native token of proof-of-work cryptocurrency Kaspa, surged 13% as major Bitcoin miner Marathon Digital revealed it has mined over $16 million worth of the token to diversify from Bitcoin.

Marathon Digital announced on June 26 that the move enables the firm to “capitalize on the higher margins” achievable with Kaspa mining machines, which can reach up to 95% in some cases.

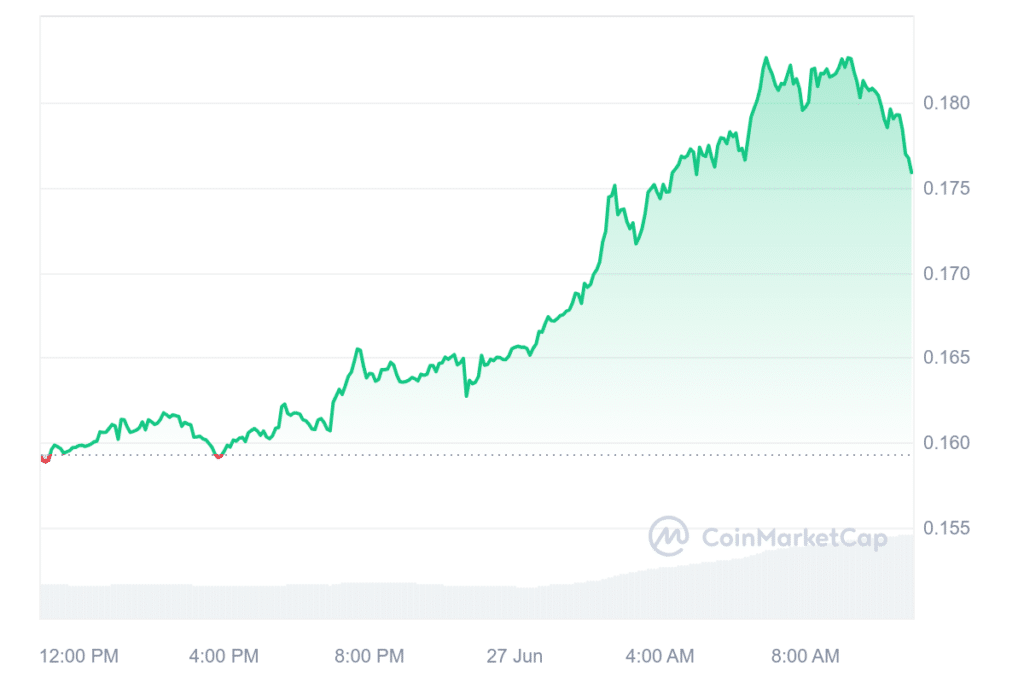

At the time of writing, KAS has experienced a 145% surge in trading volume and a 10% rise in price during the last 24 hours. The crypto asset has risen 20% over the last 7 days and 26% in the last 30 days, indicating an optimistic outlook for the altcoin this month.

According to data from CoinMarketCap, Kaspa now ranks 24th in the global cryptocurrency list, with a trade price of $0.1759, a circulating supply of around 24.035 billion KAS tokens, and a market capitalization of $4.2 billion.

Kaspa is a cryptocurrency that aims to deliver a high-performing, scalable, and secure blockchain platform.

The Layer-1 protocol’s distinguishing feature is the use of the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that allows for faster block times and higher transaction throughput than typical blockchains.

Unlike Bitcoin, GhostDAG allows for the production of multiple blocks at the same time. This approach speeds up transactions and boosts block rewards for miners, according to Marathon.

Adam Swick, Marathon’s chief growth officer, mentioned that mining Kaspa allows the company to create a diversified revenue stream from Bitcoin, emphasizing it is “directly tied to [their] core competencies in digital asset compute.”

Marathon began mining Kaspa in September last year after bringing the first mining computer online.

The Bitcoin mining giant has purchased approximately 60 petahashes of KS3, KS5, and KS5 Pro ASICs to mine Kaspa tokens. Half of that is now operating, with the remainder set to be deployed sometime in the third quarter.

The company has mined 93 million KAS, which is estimated to be worth approximately $16 million.

The Kaspa token’s price has surged about 50% this year, while Bitcoin’s price has risen by 44%.

Bitcoin miners have been seeking ways to diversify their revenue during the crypto winter, and the latest halving has increased competition. Many miners have switched to utilizing their existing infrastructure to support artificial intelligence (AI) and other computational demands.

Meanwhile, some miners, such as Marathon, have chosen to capitalize on additional layers of Bitcoin to boost their earnings.

This article first appeared at crypto.news