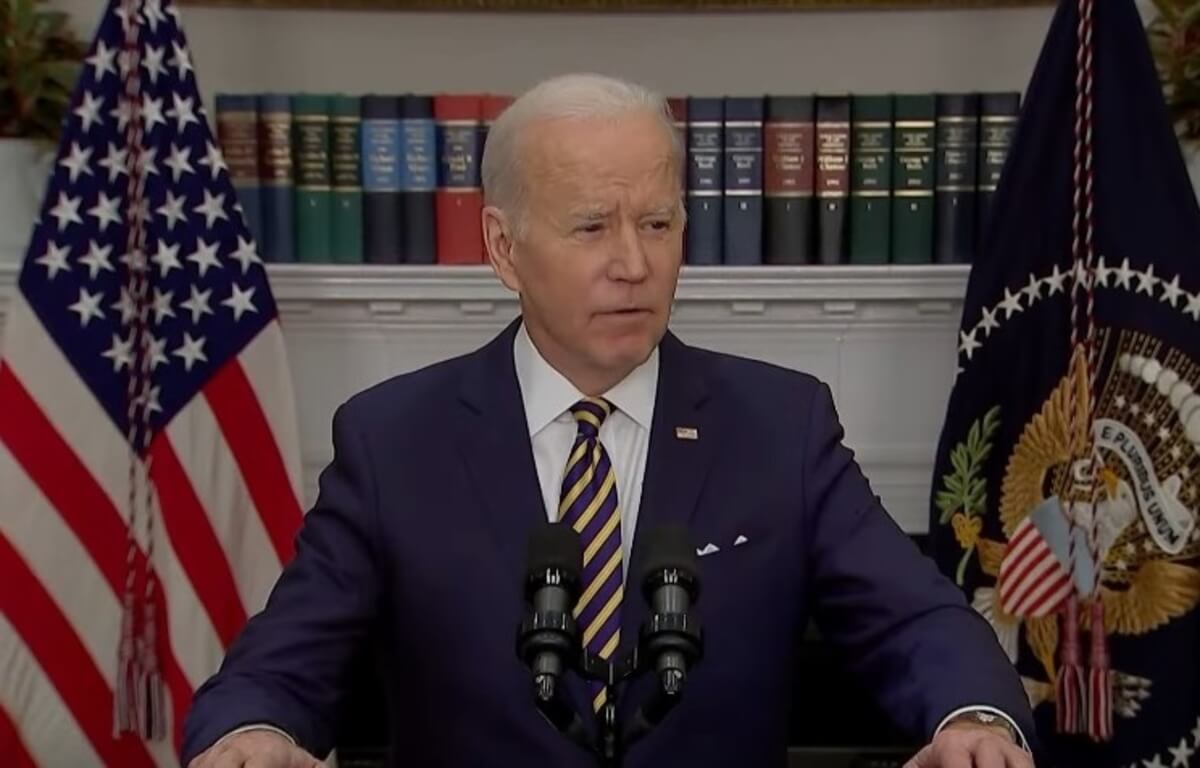

The US White House has confirmed that President Joe Biden will sign an Executive Order on digital assets that will outline recommendations for consumer protection and financial stability in the US, as well as formally consider a US central bank digital currency (CBDC). The order does not contain any new regulations.

According to a statement from the White House issued today:

“The Order lays out a national policy for digital assets across six key priorities: consumer and investor protection; financial stability; illicit finance; U.S. leadership in the global financial system and economic competitiveness; financial inclusion; and responsible innovation.”

It added that the US plans work together with other countries to “guard against risks and guide responsible innovation” in the crypto sector.

The Biden administration will work to develop “aligned international capabilities that respond to national security risks,” as well as work with the private sector to “study and support technological advances in digital assets,” the statement further said.

The administration will also formally consider the development of a US central bank digital currency, backed by the Federal Reserve, the country’s central bank, the statement said.

According to Jeremy Allaire, co-founder and CEO of crypto payments company Circle, the new order marks “a watershed moment for crypto” that can be compared to how the US government’s “wakeup to the commercial internet” in 1996 to 1997.

The Executive Order is “appropriately focused on the here and now of rapid growth in digital assets and stablecoins […] so that these technologies can flourish in a responsible manner,” Allaire said, before adding that he believes the order should be seen as “the single biggest opportunity to engage with policy makers” on crypto issues.

A senior administration official was quoted by The Wall Street Journal as saying:

“This is not a niche issue anymore, and it’s profoundly important that we have the right tools to mitigate the risks to consumers and to investors and frankly to the entire financial system.”

____

Learn more:

– US Treasury Issued Then Deleted Announcement Saying New Crypto Regulatory Measures Are Incoming

– These Are the Latest Crypto Regulatory Moves by US and EU

– US Fed Wants Answers To 22 Questions About Digital Dollar

– US Regulator Launches Probe Into NFT Sales

– US Senators Fail to Find Stable Ground on Stablecoins

– Ukraine War Raises Questions About the ‘End of Monetary Regime’ and Role of Bitcoin

– Regulatory Clarity Would Bring More Crypto Trading to US – FTX’s Boss

– FBI Crypto Unit

This article first appeared at Cryptonews