Friday’s crypto market liquidation was largely triggered by heightening fears of conflict between Iran and Israel, according to QCP Capital.

Historically, geopolitical instability tends to drive investors away from riskier assets like cryptocurrencies, seeking safety in more stable investments.

This shift often results in sell-offs across risk asset classes, as observed in the recent downturn.

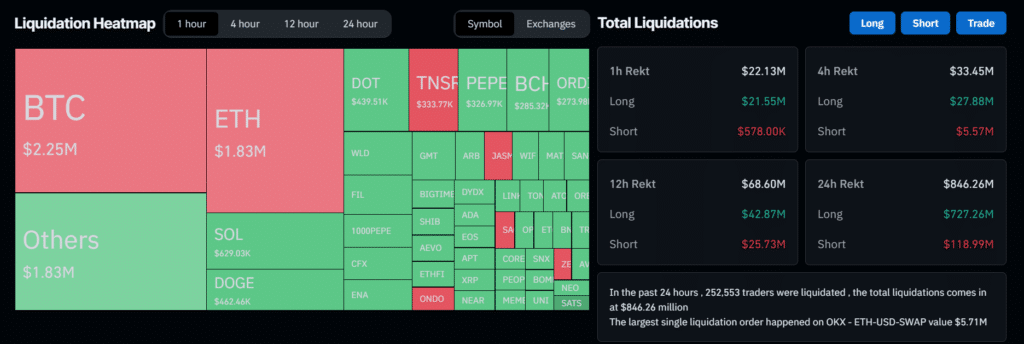

In the last 24 hours, 261,054 traders were affected, and $860.82 million in assets were liquidated as the overall crypto market cap plummeted nearly 5%.

QCP Capital also observed the ETH risk reversal indicator played a significant role in the liquidation. The firm noted on Friday that there was a notable downside skew in the Ethereum risk reversal, which signaled a potential drop.

The risk reversal’s bearish skew indicates that traders were betting on ETH’s price dropping, a sentiment that likely stemmed from its use as a hedge.

This technical indicator proved accurate, as ETH’s value dropped over 5% to $3100. Typically, speculators holding long positions in altcoins use ETH puts to protect against downturns, making ETH prices particularly sensitive to shifts in market sentiment.

The fear permeating the crypto markets was palpable, further reflected in the negative swing of perpetual swap funding rates.

These rates plunged to over -40%, marking the deepest negative funding this year and signaling a strong bearish sentiment.

Additionally, this anxiety crushed the forward curve, with the front end falling below 10%, highlighting a bleak short-term outlook for cryptocurrency prices.

This article first appeared at crypto.news