After a prolonged consolidation, XRP’s price action appears to be turning bullish, with technical patterns pointing to more upside.

A report from Singapore-based blockchain firm Matrixport shows that the Relative Strength Index is hovering near 40%, leaving room for a potential surge. The firm noted that in the past, XRP (XRP) has often rallied when RSI is around this level, typically facing resistance closer to 70%.

#Matrixport Today 📈 – Feb 18 2025⬇️#XRP’s Breakout: RSI Signals a Potential Rally Amid #SEC Uncertainty#Crypto #Ripple #CryptoFinance #CryptoMarket #RIS pic.twitter.com/rgGHz2XqeE

— Matrixport Official (@Matrixport_EN) February 18, 2025

Matrixport also notes that further gains could depend on regulatory developments. If the SEC takes another look at its case against Ripple Labs under the new administration, XRP could have even more room to run, the firm says.

“The recent rebound could have further upside, particularly if the SEC revisits its legal case against Ripple Labs under the new U.S. administration. With the RSI currently near 40%, the technical setup appears favorable for a potential rally.”

Matrixport

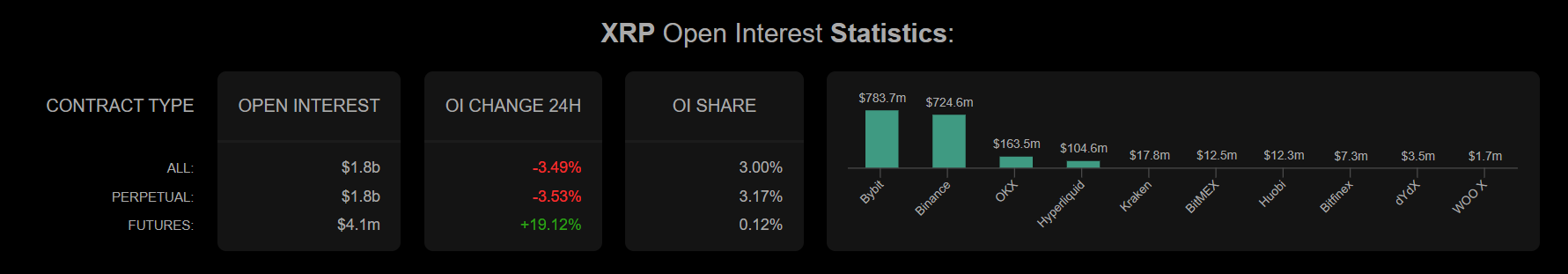

Market data from Coinalyze shows XRP’s open interest in perpetual and futures contracts dropped over 3.5% in the past 24 hours to $1.8 billion.

This suggests some traders are scaling back leveraged positions, either to lock in profits or manage risk. It could also mean speculative trading is cooling off after the recent price jump. But if open interest starts climbing again alongside price gains, it might be a sign that bullish momentum is picking up.

As of press time, Bybit holds the largest share of XRP open interest at $783 million, followed by Binance at $724 million.

In the meantime, the SEC has officially acknowledged Grayscale’s filing for a spot XRP ETF, starting the review process that could bring the fund to market later this year. Next up, the agency is expected to review applications from other firms that jumped in after Grayscale. So far, Bitwise, 21Shares, Canary Capital, and WisdomTree have all filed their own proposals and are waiting for the SEC to take the next step.

At the time of writing, XRP is trading down 2.76% at $2.59.

This article first appeared at crypto.news