Meme coin prices crashed on Thursday, erasing most of the gains made during the Santa Claus rally on Christmas Eve.

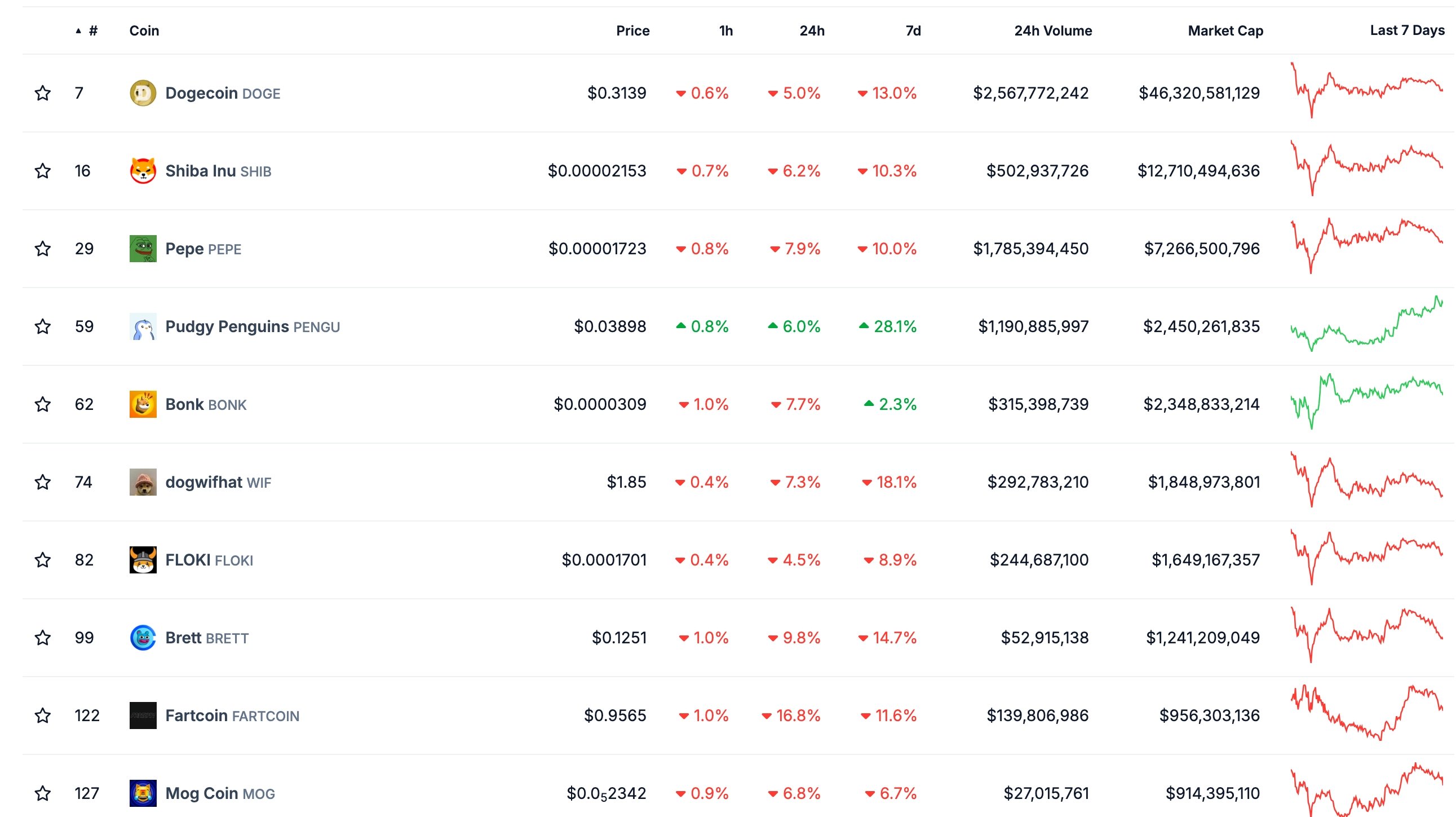

Fartcoin (FARTCOIN), one of the top meme coins in the Solana ecosystem, dropped by 16.8%, making it one of the biggest laggards.

Floki (FLOKI) retreated by 4.5%, while Shiba Inu (SHIB) plummeted by 6.5%. Other top laggards in the meme coin industry were Brett, Mog Coin, and Popcat (POPCAT).

PENGU was the only major meme coin in the green, rising by 6% as total sales jumped by 127% in the last 24 hours to $6.1 million.

Meme coins retreated because of the risk-off sentiment in the crypto industry, as most coins dropped. Bitcoin fell to $95,000, while the market cap of all coins fell to $3.32 trillion. Altcoins, especially the highly volatile meme coins, often drop sharply when Bitcoin is not doing well.

Meme coins and other altcoins also dropped as liquidity in the crypto industry fell because of the Christmas holiday. Data shows that most cryptocurrencies are seeing low volume as most investors and traders remain on holiday. Bitcoin had a 24-hour volume of $33.96 million on Thursday, the lowest level since November 3rd.

Other meme coins had lower volume, too. Floki’s 24-hour volume was $238 million, its lowest level in over a month. Similarly, Fartcoin’s volume was $187 million, while Shiba Inu had a $576 million volume. Cryptocurrency prices often experience major swings in either direction when there is limited volume.

Meme coin prices are also falling as investors continue to book profits after most of them rose sharply during the year. Floki peaked at $0.0002885 in November, 200% higher than its lowest level in August, while Shiba Inu reached $0.000033.

Additionally, there are still concerns about the Federal Reserve, which hinted that it will deliver just two interest rate cuts in 2025. That hawkish tilt has pushed bond yields higher, with the 10-year moving to 4.63% and the 30-year and 5-year rising to 4.8% and 4.50%, respectively. Cryptocurrency prices and stocks often drop when bond yields are rising.

This article first appeared at crypto.news