Helius Medical Technologies announced Monday that it secured $500 million through an oversubscribed private investment in public equity (PIPE) offering led by Pantera Capital to build a Solana treasury focused on acquiring SOL.

The offering includes an additional $750 million in stapled warrants, potentially bringing the total Solana treasury capital to $1.25 billion, according to the company’s press release.

Beyond Pantera Capital, Summer Capital joined the round as one of Asia’s earliest licensed fund managers to invest in crypto.

The investor lineup featured a robust group including Big Brain Holdings, Avenir, SinoHope, FalconX, Arrington Capital, Animoca Brands, Aspen Digital, Borderless, Laser Digital, HashKey Capital, and Republic Digital.

Helius Medical Targets 7% SOL Yields Over Bitcoin’s Zero Returns

The SOL treasury strategy will be guided by Director and Executive Chairman Joseph Chee (founder and chairman of Summer Capital and former head of investment banking, Asia at UBS).

The strategy will also be guided by Board Observer Cosmo Jiang (general partner at Pantera Capital) and adviser Dan Morehead (founder and managing partner of Pantera Capital).

Helius executives noted Solana’s position as the fastest-growing blockchain historically, leading the industry in transaction revenue while processing over 3,500 transactions per second.

The executives also emphasized SOL’s financial productivity through design, offering a roughly 7% native staking yield, which contrasts with non-yield-bearing assets like Bitcoin.

The company plans to capitalize on Solana’s native yield-generating architecture and capture opportunities in DeFi and broader on-chain activity.

“We believe that Solana is a category-defining blockchain and the foundation on which a new financial system will be built,” said Dan Morehead, founder and managing partner of Pantera Capital.

Following the announcement, Helius stock (HSDT) surged over 159%, jumping from Friday’s close of $7.91 to $45.51 before settling at $19.63 at press time, based on Yahoo Finance data.

This pattern has become familiar among Nasdaq-listed companies announcing digital asset treasury initiatives.

BitMine’s stock price jumped from $4.26 to $26.06, a 511.02% intraday increase, when the company announced its crypto-focused treasury strategy in June.

The Solana Treasury Trend

The market appears to be entering “Solana season,” similar to when Ethereum attracted companies like Sharplink Gaming and BitMine to launch ETH treasuries that later accumulated billions of dollars in Ether.

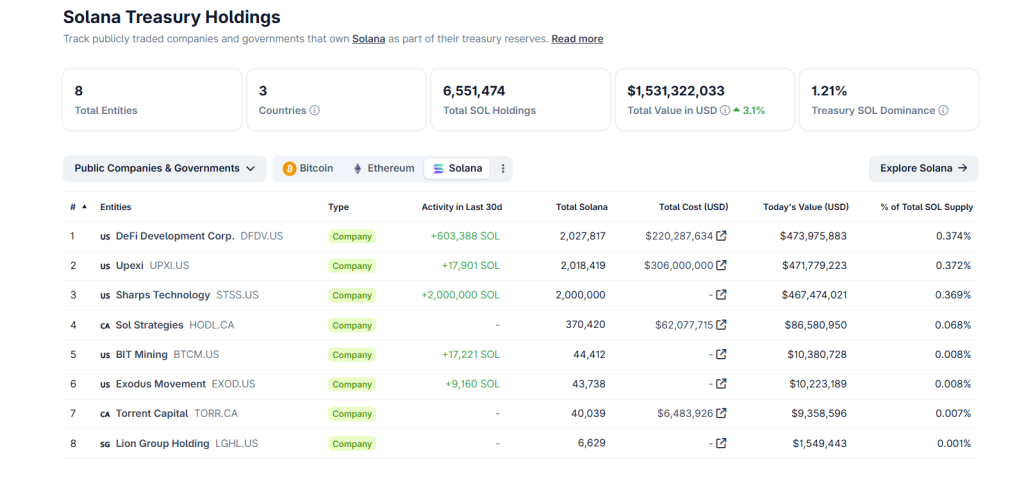

Current Solana treasury companies, including DeFi Development Corp., Upexi, and Sol Strategies, are already deploying hundreds of millions of dollars to accumulate SOL.

Upexi Inc., a consumer products firm turned Solana treasury powerhouse, now holds over 2 million SOL valued at $447 million, with $142 million in unrealized gains and daily staking rewards of approximately $105,000.

The firm also recently appointed former BitMEX CEO Arthur Hayes to its advisory board.

CoinGecko data reveals that approximately eight Solana treasury companies have been established, collectively accumulating more than $1.5 billion worth of Solana, equivalent to over 1% of the entire SOL supply.

Recently, Forward Industries, a newly established Solana treasury company, announced a purchase of 6.82 million SOL at an average price of $232, totaling approximately $1.58 billion.

Mert Mumtaz, CEO of Solana-based infrastructure provider Helius, recently shared that Solana-focused treasury companies have raised between $3 billion and $4 billion to date, with more expected to follow.

Unlike Bitcoin and Michael Saylor’s treasury company MicroStrategy (MSTR), a large percentage of capital raised by Solana treasury companies will be deployed into SOL DeFi, potentially increasing the SOL token’s value and overall ecosystem growth.

Solana currently trades at $233.82, boasting over $13 billion in total value locked (TVL) across its DeFi ecosystem, second only to Ethereum.

Global investment firm VanEck maintains a bullish outlook on Solana, predicting SOL could reach $520 before year-end.

China’s DeepSeek AI recently projected that SOL could eventually target $1,000 by late 2026, well above its previous $295 all-time high.

This article first appeared at News