Helium, touted as Solana’s biggest Decentralized Public Infrastructure Network, outperformed the broader altcoin market throughout August.

Helium (HNT) jumped by over 51% in the last 30 days, outperforming the top 100 altcoins in the market. The crypto asset has reached an intraday high of $7.33, a rise of over 2.4% in the past day.

Helium has almost doubled from its lowest point of $3.65, seen on Aug. 5, when the crypto and stock markets crashed, causing over $1 billion in liquidations across the global crypto market.

The monthly hike in Helium’s price comes as its community strongly supported the HIP130 and HIP131 proposals. This decision enables all compatible Wi-Fi access points to be set up to support operators such as Helium Mobile.

On the other hand, proposal HIP131 permits service providers to start enhancing Hex areas, focusing only on the top-earning regions. These proposals will be implemented seven days following their announcement.

Furthermore, recent discussions in the crypto space have centered on Helium’s potential to reshape wireless infrastructure. Traditionally, expanding coverage requires large carriers to invest heavily in building additional cell towers. Helium provides a novel technique for increasing wireless coverage through a decentralized network of mobile nodes.

HNT also gained traction after announcing trials with two major US telecom companies to test offloading network traffic onto the Helium MOBILE network. The carrier offload test involves over 500,000 users participating in these trials.

The strategy could allow these carriers to cut costs and improve coverage by offloading some users to the Helium Network. At the same time, Helium would benefit from increased traffic, revenue directed toward its hotspot providers, and enhanced value for investors through increased HNT token burns.

According to Helium’s statistics, the MOBILE network currently operates around 20,680 active hotspots, and its IoT solution is deployed across 357,359 locations, with both figures steadily increasing.

Meanwhile, the ongoing price rally for HNT is supported by a 65% surge in total open interest, indicating a rise in trader interest. According to Coinglass data, open interest in the futures market has climbed to $7.43 million, the highest since April and significantly above the low of $2.35 million earlier this month.

The community sentiment on the HNT token was also bullish on CoinGecko and CoinMarketCap.

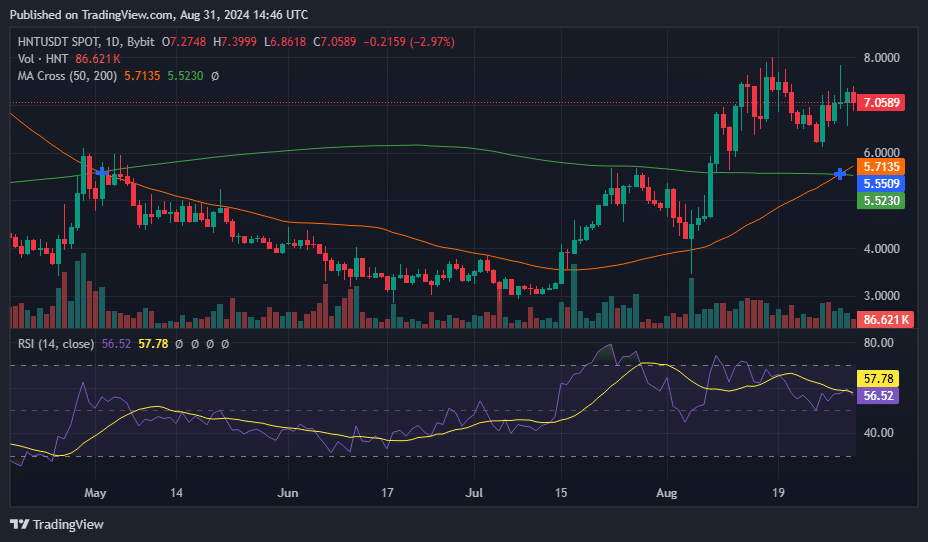

HNT’s technical analysis reveals strong bullish momentum, highlighted by the golden cross pattern where the 50-day and 200-day Moving Averages intersect. This key bullish signal, coupled with a mid-range Relative Strength Index around the mid-50s, indicates balanced market conditions with potential for further gains.

Helium has also developed a cup and handle pattern, where the latest consolidation phase corresponds to the handle part of the pattern.

Combined with high trading volumes and a spike in open interest in the futures market, these indicators reveal robust market participation and optimism about Helium’s strategic initiatives to expand its decentralized network, potentially driving further price hikes in HNT’s value.

This article first appeared at crypto.news