Grass token continued its strong rally, reaching its highest level since its airdrop on Monday, Oct. 28.

Grass (GRASS) jumped to a high of $1.1418, pushing its fully diluted valuation to over $1 billion. It has become one of the most successful airdrops this year, outperforming the likes of Wormhole (W), ZkSync (ZK), and Hamster Kombat (HMSTR).

A likely reason for the rally is traders’ expectations of additional tier-1 exchange listings. Currently, most trading occurs on exchanges like Gate, HTX, and Bybit. With rising volume, there is potential for platforms like Binance and Coinbase to list the token.

Grass also climbed as futures open interest continued to rise. Data from CoinGlass indicates that interest reached $50 million, primarily on Bybit and OKX.

Futures open interest is an essential metric showing the number of contracts still open or unsettled at the end of the day, often used to gauge market liquidity and activity.

The Grass rally also reflects ongoing market sentiment, with the crypto fear and greed index moving to a greed level of 66. This index may rise further if Bitcoin makes a strong bullish breakout, as analysts expect.

Additionally, data from Dune shows that 77.5% of all Grass tokens, or 61 million tokens, have been claimed by over 1.6 million claimants. Of those who claimed tokens, 30% have staked them, indicating they may not plan to sell, unlike other tokens that are often sold quickly after airdrops.

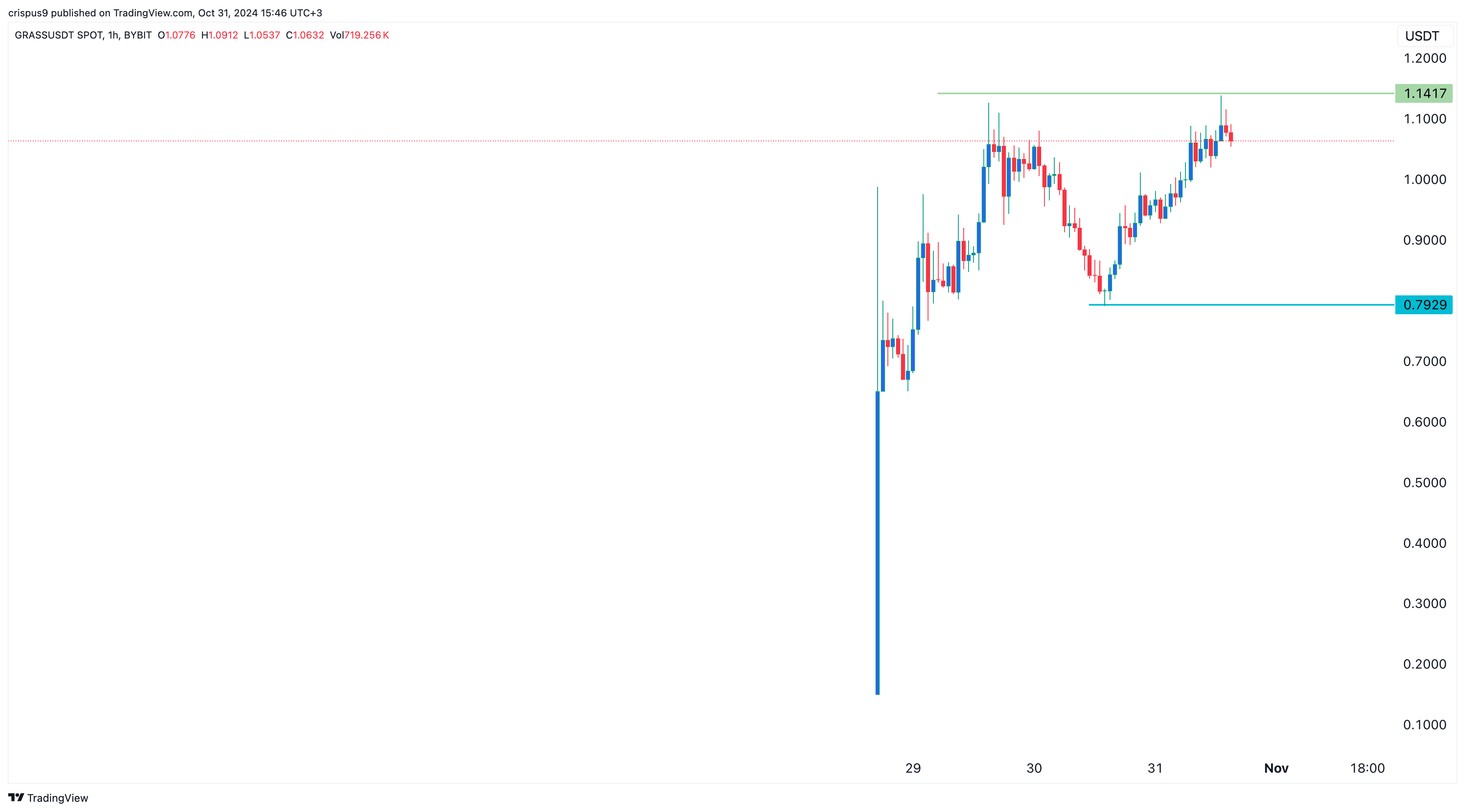

Grass has formed a double-top pattern

However, there is a risk of a sharp reversal for Grass, as post-airdrop rallies often don’t last.

The token has formed a double-top pattern, a common bearish reversal indicator. Consequently, the token may drop and retest key support at $0.80, its lowest point on Oct. 30 and the neckline of this pattern.

This article first appeared at crypto.news