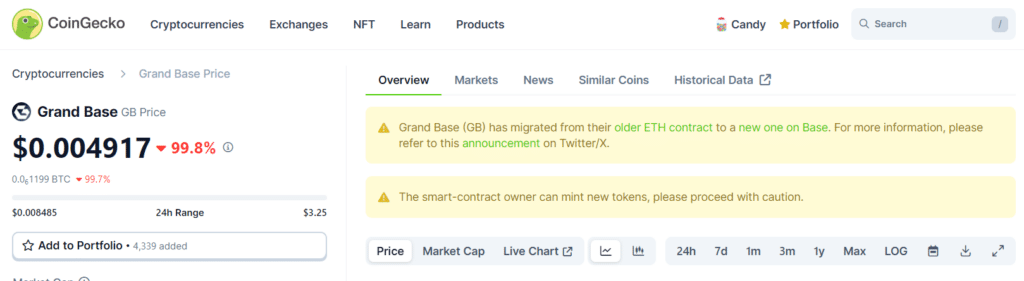

Grand Base’s token sees a nearly 100% drop in value following reports that the protocol’s deployer minted millions of new tokens, raising concerns of a potential rug pull.

Decentralized finance protocol on the Base network, Grand Base, is suspected of conducting a rug pull after the crypto community noticed a multi-million mint via the deployer’s address. As noted by a user @0xkinnif, Grand Base’s deployer minted on Apr. 15 an additional 22.5 million GB tokens (worth around $47 million), sending the token’s value plummeting by nearly 100% to $0.0049.

In response to the incident, a spokesperson for the project addressed concerns in a Telegram channel, attributing the minting to an exploit of the project’s deployer wallet. The spokesperson reassured users that the team is actively collaborating with the MEXC crypto exchange to halt trading activities associated with the exploited tokens.

Launched in early 2024, Grand Base aimed to provide a decentralized marketplace for spot synthetic real-world assets (RWAs), offering exposure to RWAs without the need to hold the underlying assets. The project gained significant traction, with its GB token generating millions of dollars in daily trading volumes, according to data from CoinGecko.

However, despite its initial success, the project also faced scrutiny due to a feature in its smart contract that allowed developers to mint new tokens without any limitations, as highlighted by CoinGecko on GB’s price page. As of press time, MEXC hasn’t issued any public statements regarding the matter, and the method through which the exploiter gained access to the deployer wallet remains unclear as well.

This article first appeared at crypto.news