FTX is selling two-thirds of its shares in Anthropic at $884 million, most of which are being acquired by Abu Dhabi-based investors.

ATIC Third International Investment Company LLC, linked to the United Arab Emirates sovereign wealth fund Mubadala, plans to secure nearly $500 million worth of FTX’s interest in Anthropic. This move came to light through a recent court document filed at the U.S. Bankruptcy Court for the District of Delaware.

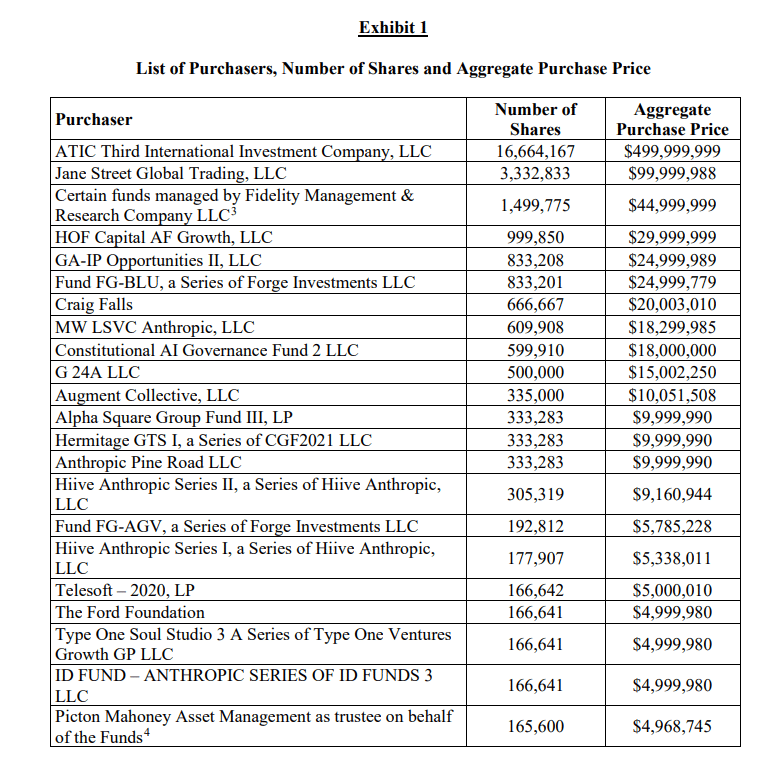

Additionally, Jane Street, various Fidelity Management and Research-managed funds, and the venture capital entity HOF Capital, among 20 other entities, have agreed to acquire stakes.

In 2021, FTX made a significant investment of $500 million in AI startup Anthropic, only to face bankruptcy the following year due to fraud charges. Since last year, Anthropic’s value has rapidly increased with the developments surrounding generative AI and the prospect of the firm rivaling OpenAI.

Given that FTX’s holding in Anthropic ranks among the most lucrative assets within its portfolio, and with the estate’s cash reserves reported at roughly $6.4 billion previously, FTX officials are optimistic that creditors will fully recover their dues.

Previously, there were reports of interest from Saudi Arabia-based buyers. However, Anthropic executives revealed that Saudi investments were disregarded due to national security matters.

This article first appeared at crypto.news