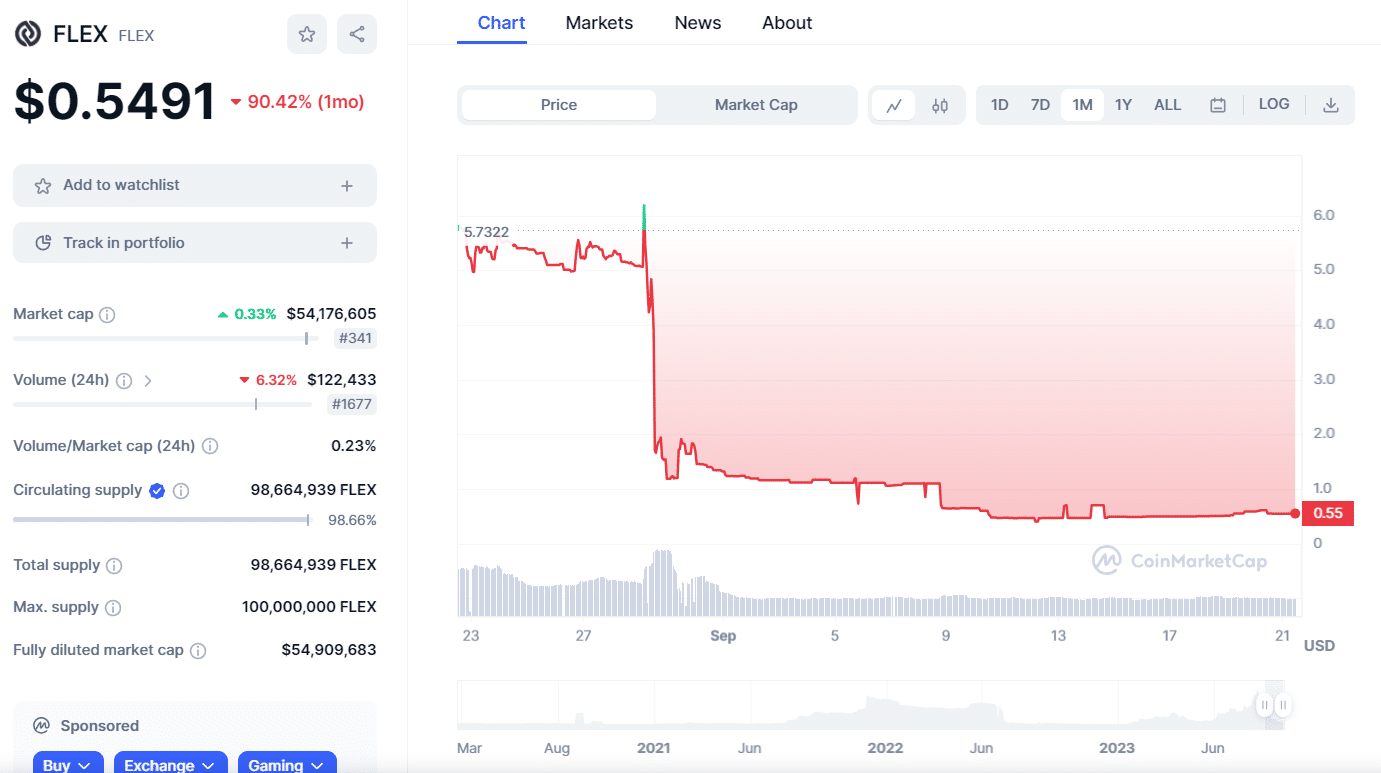

Hodlnaut’s interim judicial managers call FLEX token “illiquid” as its price crashed 90% since August 2023.

Crypto bankruptcy claims exchange OPNX is unlikely to become the new owner of the embattled crypto lending firm Hodlnaut as its interim judicial managers rejected the takeover terms.

According to a report by Bloomberg, Hodlnaut’s managers clarified that the $30 million offer in FLEX tokens will not happen as the exchange’s token is “illiquid” and with “speculative value.” Moreover, court filings show that most of Hodlnaut’s creditors also oppose the OPNX deal.

The interim judicial managers added that OPNX’s offer includes no cash or “assets with similar liquidity” and no timetable for repayment. They say that there are no details on how exactly and when the exchange plans to pay beyond 30% of liabilities.

Amid the news, FLEX price crashed 10% to $0.54, according to data from CoinMarketCap. In August 2023, the token saw a large drop in value, falling 90% from $6.1 to less than a dollar, the data show.

As crypto.news reported, OPNX and its founders were fined $2.8 million by Dubai’s Virtual Assets Regulatory Authority (VARA) for a Market Offense under regulations issued by VARA.

Singaporean crypto lender Hodlnaut fell victim to the crypto winter, filing for bankruptcy in August 2022. According to Bloomberg, FTX made up about 72% of its digital assets.

The firm suspended all withdrawals on Aug. 8, 2022, and has since been widely endorsed in legal battles following its bankruptcy filing. After the court filing and withdrawal suspension, Hodlnaut laid off 80% of its workforce.

This article first appeared at crypto.news