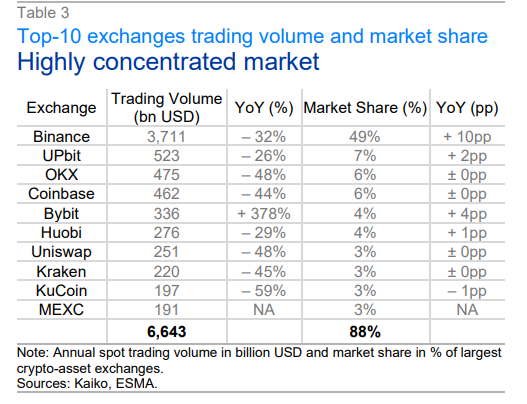

The crypto market appears to be highly concentrated, as only 10 exchanges process around 90% of all trades, according to a recent study done by the European securities regulator.

A recent study conducted by the European Securities and Markets Authority (ESMA) has unveiled a significant concentration within the crypto trading landscape, raising concerns about its potential implications for market stability. According to the study titled “Crypto assets: Market structures and EU relevance,” only 10 crypto exchanges handle approximately 90% of all trades, with Binance accounting “for almost half of global trading volumes.”

Collectively, Binance, UPbit, and OKX control over 60% of the market share, with Bybit experiencing a 380% increase in trading volume year-over-year, while Coinbase saw a 44% decline for the same period, the study shows. ESMA warns that such concentration carries potential risks, expressing significant concerns about the potential fallout of a major asset or exchange failure on the broader crypto ecosystem.

“Moreover, we find that market liquidity can vary widely and tends to be higher in the largest exchanges.” ESMA

The European securities regulator also pointed out that contrary to popular belief, cryptocurrencies do not consistently serve as a safe haven during periods of market stress, saying cryptocurrencies “are strongly interconnected” with equities and “no stable relationship with gold” has been found.

Despite regulatory efforts such as the EU Virtual Asset Service Provider (VASP) license, the study suggests that a substantial portion of transactions executed on EU-licensed exchanges likely occur outside the EU, underscoring the need for continued monitoring and regulation of the crypto market.

This article first appeared at crypto.news