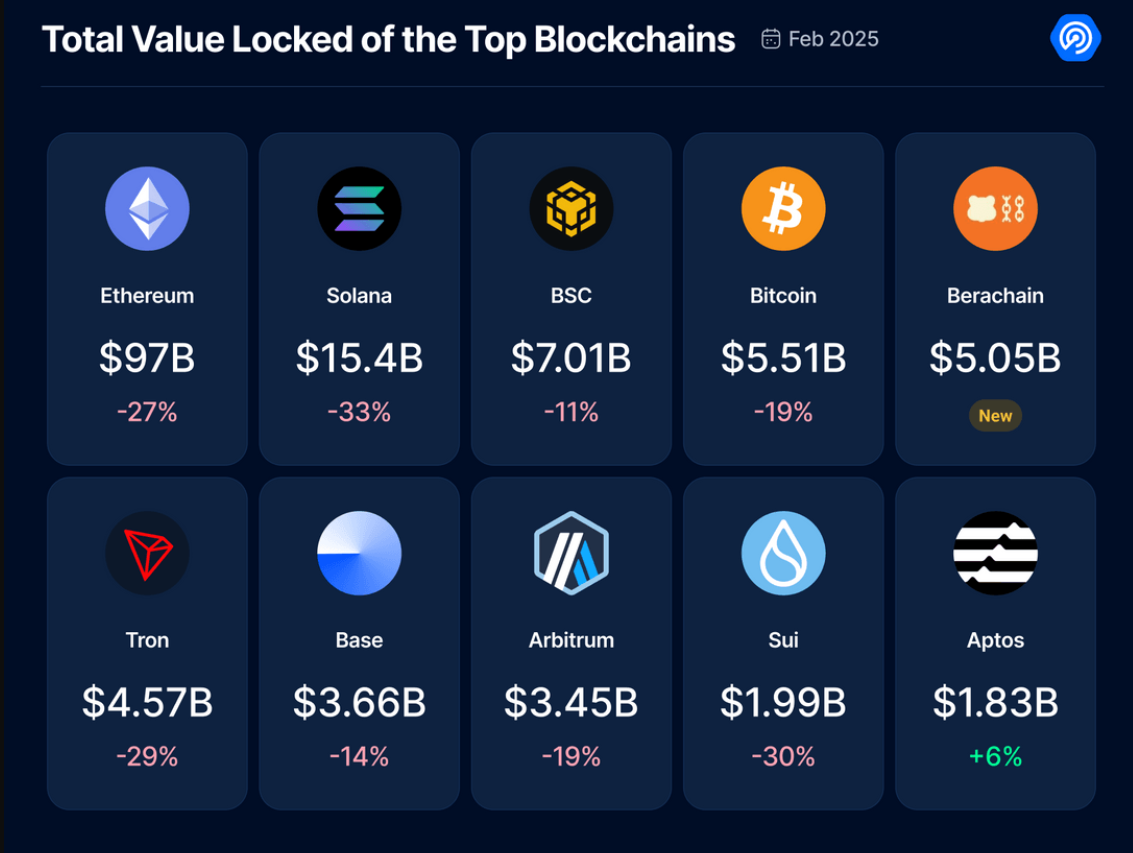

Ethereum’s total value locked dropped 27% to $97 billion in February, as the broader decentralized finance sector fell from $217 billion to $168 billion amid liquidity outflows.

Decentralized finance‘s total value locked fell by nearly 23% in February, dropping from $217 billion to $168 billion as market volatility, liquidity shifts, and capital outflows pressured key protocols, says DappRadar’s analyst Sara Gherghelas.

In a recent research report, Gherghelas pointed out that Ethereum (ETH), which holds nearly 60% of DeFi’s liquidity, saw its TVL fall 27% to $97 billion in February. The decline was mainly due to lower liquidity in liquid staking protocols, the analyst notes. However, despite the decline, Ethereum’s dominance in this area “remains unchallenged,” per Gherghelas.

Solana (SOL) suffered the largest losses in February as its TVL dropped by more than 30% to $15.4 billion. The decline came after a strong January and was likely driven by “profit-taking and liquidity migration toward more stable DeFi environments,” says the DappRadar analyst. On top of that, activity also slowed on key Solana-based platforms like crypto exchange Jupiter and Raydium.

While most major chains faced challenges, Berachain (BERA) turned out to be one of the few winners, reaching a TVL of $5.05 billion, according to data.

“The chain’s rise is fueled by its proof-of-liquidity model, which has attracted users through lucrative liquid staking and yield farming incentives. As users seek high returns despite broader market declines, Berachain is positioning itself as a key player in the evolving DeFi landscape.”

Sara Gherghelas

BNB Chain (BNB) saw a smaller drop of 11%, helped by stablecoin trading. Meanwhile, TRON’s (TRX) TVL fell 29%, likely due to weaker demand for Tether’s (USDT) transactions. Aptos (APT) was also one of the rare gainers, increasing its TVL by 6% to $1.83 billion.

Ethereum’s drop in TVL comes as futures open interest in key cryptocurrencies also fell sharply. As crypto.news reported, traders have started reducing long positions, with futures open interest falling amid concerns over the trade war and the Fed’s tough stance. Matrixport analysts believe many traders are waiting for clearer signals before re-entering the market.

While the upcoming Pectra upgrade, which aims to improve network functionality and fee efficiency, could provide a short-term boost, it’s unclear whether these upgrades will be enough to reverse the decline in DeFi activity.

This article first appeared at crypto.news