Days after hitting a month-high of $3,943, the price of Ethereum (ETH) has begun to correct.

The initial rise followed the U.S. Securities and Exchange Commission (SEC) approving applications from NASDAQ and the NYSE to list Ethereum exchange-traded funds.

Although ETF issuers still need final approval before their products can launch, the SEC’s May 23 decision marked a significant and unexpected victory for firms that had made applications and the broader crypto industry.

Until Monday, many had anticipated regulators would reject the filings. Nine issuers, including VanEck, ARK Investments/21Shares, and BlackRock, hope to launch ETFs linked to Ethereum, following the SEC’s January approval of Bitcoin ETFs, which was another landmark moment for the sector.

However, after the initial jump following the ETF approval, the price of the second-largest cryptocurrency by market capitalization has since dropped more than 4% from that level and is now trading at $3,760.

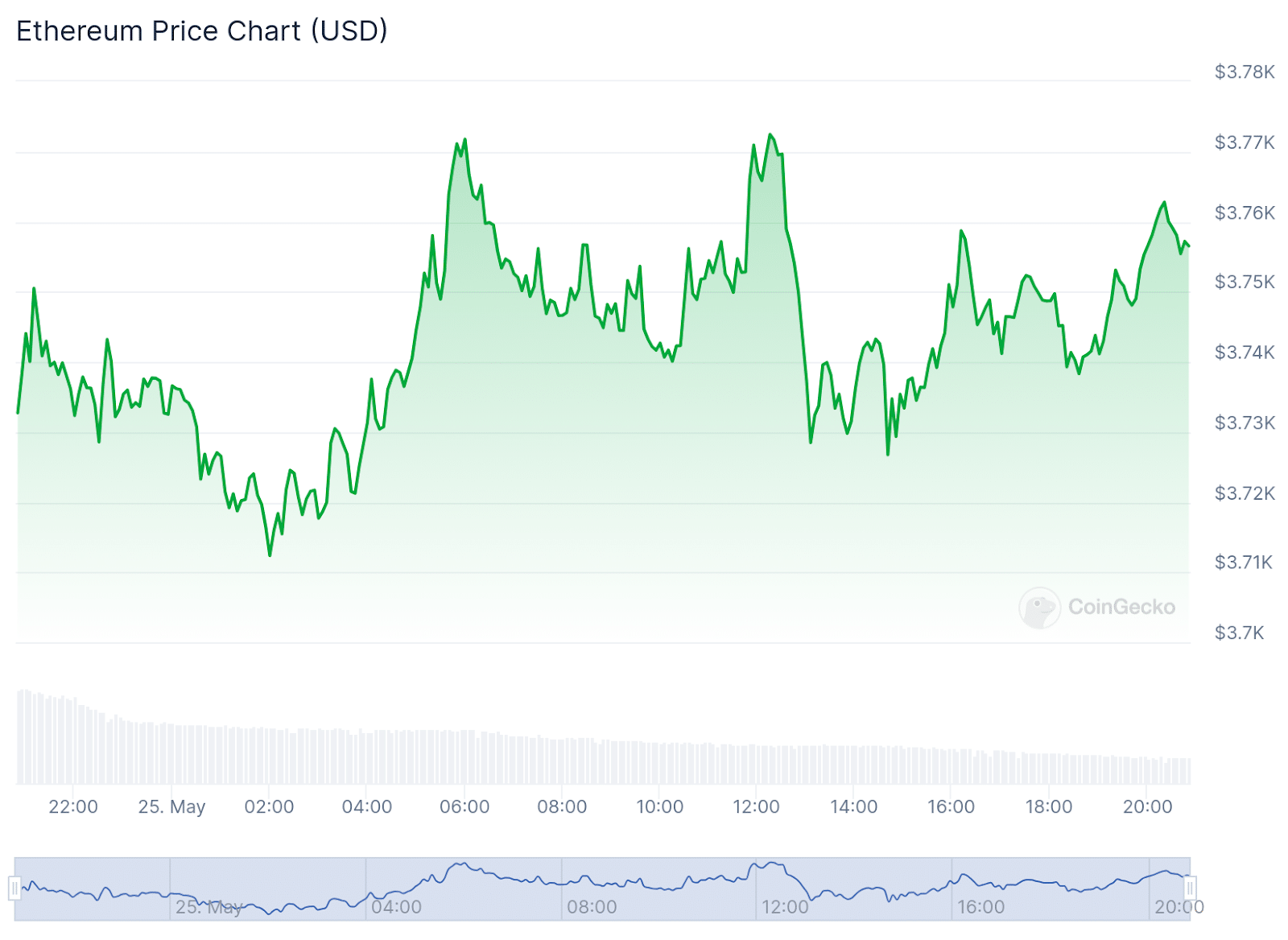

Still, the new price reflects a very modest 0.9% uptick in the last 24 hours and a more significant 20.7% increase over seven days. Likewise, the current price is a 28.5% improvement from where ETH was trading a fortnight ago and a 19% jump over 30 days, according to data from CoinGecko.

In the past 24 hours, Ethereum’s price has been consolidating, fluctuating between $3,776 and $3,710. Such price behavior typically indicates a buildup of momentum that could lead to a breakout, either above or below the current consolidation range.

At this juncture, the next direction for ETH remains uncertain.

However, analysts at trading firm QCP Capital suggest that the SEC’s approval of spot Ethereum ETFs could drive ETH prices to $5,000 by the end of the year.

This article first appeared at crypto.news