Ethereum price surged to $3,663 on March 26, up 20% from the monthly low recorded on March 19: market data shows investors have taken on a more optimistic outlook ahead of the Bitcoin halving.

Ethereum came within whiskers of dipping below $3,000 last week after the post Dencun Upgrade sell-off. But with the Bitcoin (BTC) halving drawing nearer, on-chain data shows a significant change ETH investors’ disposition.

Investors shift 200,000 ETH into long-term storage on 30-day Bitcoin halving countdown

After the wholesale sell-offs that heralded the Dencun upgrade, delays around the widely anticipated Ethereum ETFs, ETH price is now back in recovery phase with 20% gains on the weekly chart.

On-chain data trends suggest that the positive shift in ETH market momentum can be attributed to investors making strategic moves to front-run possible impacts of the Bitcoin halving scheduled for April 20.

Notably, since the Bitcoin halving countdown hit the 30-day mark on March 19, Ethereum investors have switched into a more conservative trading approach.

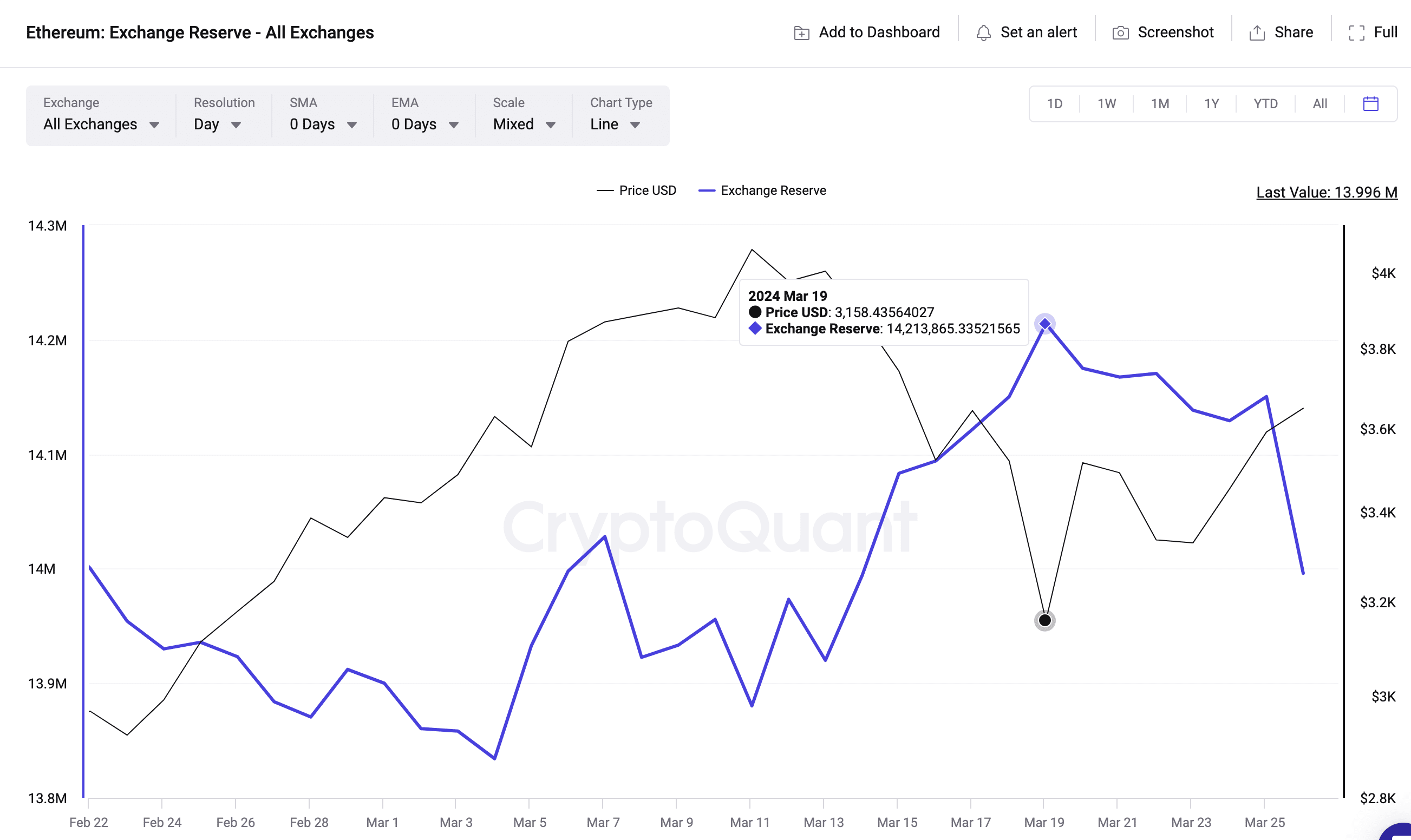

Cryptoquant’s exchange reserves metric tracks the number of coins currently deposited in crypto exchange hosted wallets and trading platforms. It serves as a proxy for tracking investors’ tendency to sell or seek profit-taking opportunities in the short term or otherwise.

As of March 19, investors held a total of 14.2 million ETH coins across various exchanges and trading platforms. But that figure has now declined by 200,000 ETH over the past week.

Persistent declines in exchange reserves can be a prime indicator that traders are looking to hold out and may be reluctant to sell, conditional on timeframe and/or market conditions.

The correlation between this shift in the 30-day Bitcoin halving countdown suggests that the landmark network event could be a key driver behind this shift in Ethereum investors’ disposition.

However, regardless of the catalyst, a decline in exchange reserves often impacts the underlying asset’s price positively.

Firstly, valued at the current prices, it essentially means that within the past week over $740 million worth of ETH coins have been transferred out of the immediate market supply into long-term cold storage options or staking contracts.

If demand remains steady and supply keeps shrinking, it puts upward pressure on prices. And unsurprisingly, ETH price has already surged 20% since the exchange outflows began on March 19.

Hence, if more existing ETH investors keep up the conservative outlook, the Ethereum price recovery phase could further accelerate in the days ahead.

Ethereum price forecast: $3,750 resistance now under pressure

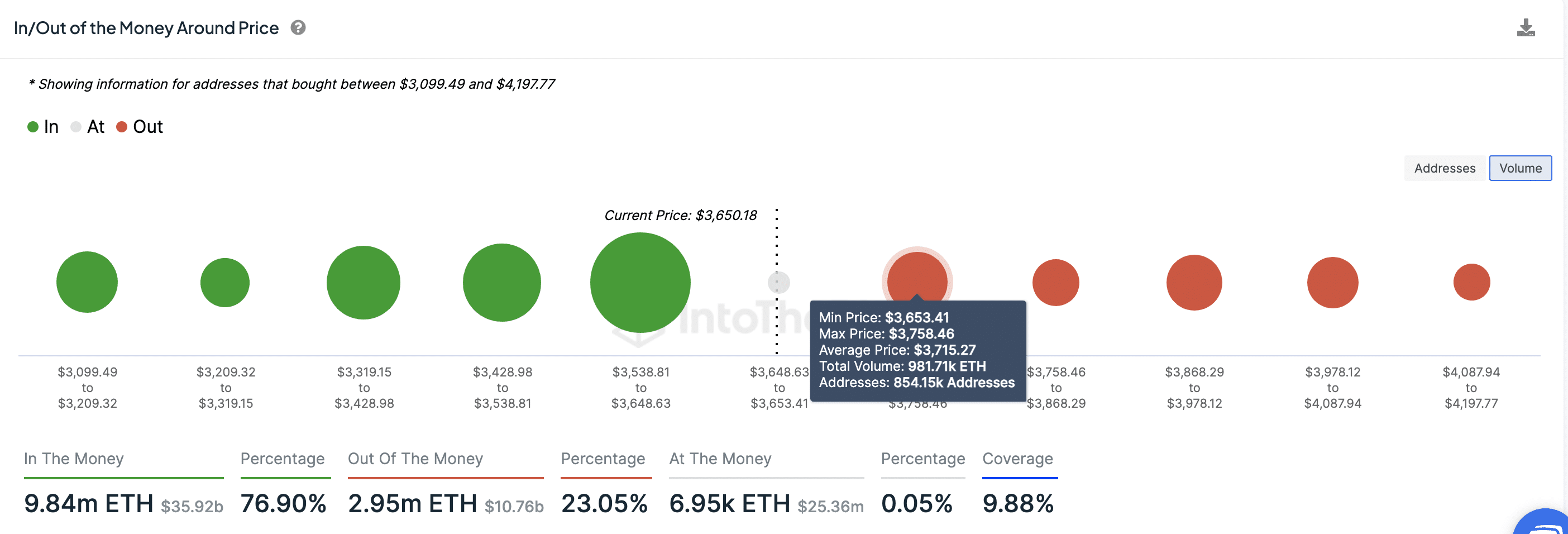

Drawing insights from the $730 million decline in ETH market supply, Ethereum price appears poised for a breakout towards $4,000 ahead of the Bitcoin halving.

IntoTheBlock’s In/Out of the Money chart also affirms this positive stance. ETH currently faces a major resistance cluster from 854,150 addresses that acquired 981,710 ETH at the maximum price of $3,758.

But the IOMAP chart below shows that 76.9% of all investors that bought ETH within the 20% boundaries of the current prices are in profitable positions.

Without any major macro pressures, the majority of them could be reluctant to sell, leaving the door open to a $4,000 rebound as predicted.

However, in the event of another market downturn, the bulls will likely set-up to defend the $3,500 psychological support.

This article first appeared at crypto.news