The Ethereum network’s net profit amounted to $369.11 million in the first quarter of 2024, which is 209.5% more than in the same period last year.

According to Coin98 analytics, Ethereum’s commission income amounted to $1.17 billion, 155% more than in the first quarter of 2023. Total revenue crossed the $1 billion mark, while expenses rose to nearly $666 million.

The number of daily active users of the network increased to over 404,000, and the daily number of transactions to 1.18 million. In the first quarter of 2024, more than 107 million transactions were carried out on the network, and another 263.8 million unique addresses were added. The daily commission was 508.77 Ethereum (ETH).

Coin98 Analytics also noted that in the first three months of 2024, more than 4.8 million NFTs were created on Ethereum, and the USDT stablecoin remained the largest Ethereum-based stablecoin by market capitalization.

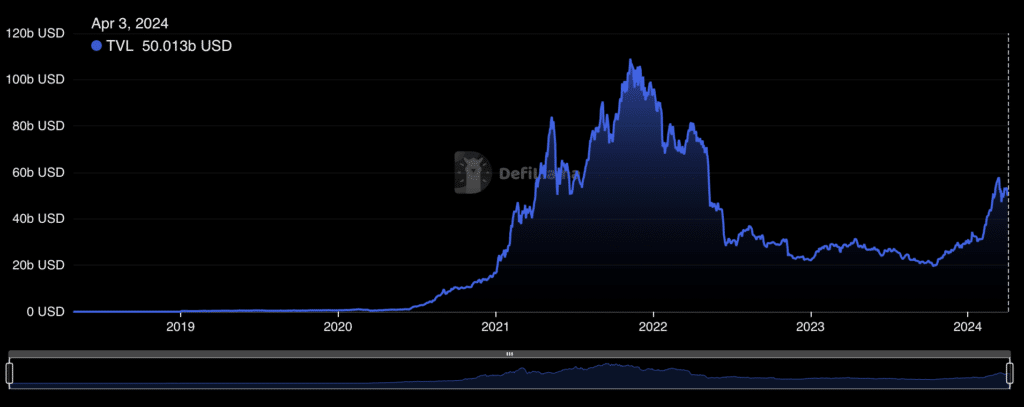

According to DefiLlama, the total value locked (TVL) on the Ethereum network has risen to $55.89 billion but has fallen to $50 billion at the time of this writing.

The company’s profits increased following rising fees on the Ethereum network. The costs of conducting transactions on Ethereum have increased significantly compared to a significant rise in ERC-20 tokens, especially meme coins.

Rising transaction costs highlight the critical need for scalable solutions to meet growing demand without alienating users. The March Dencun update resolved some issues related to the commission, such as the size of commissions for Ethereum level 2 solutions, which has decreased several times.

This article first appeared at crypto.news