Ethena price has stabilized in the past three days as the developers continued to attract USDe integrations. ENA was trading at $0.58 on Thursday, 12.5% above its lowest level this month. It remains 48% below its all-time high.

Ethena’s developers have announced several integrations recently as its stablecoin continues to gain market share. Last week, Ethena unveiled a partnership with Bitget, one of the biggest crypto exchanges in the world. The partnership means that the company’s 25 million users will be able to use USDe as margin collateral for coin-m margined perpetuals.

Users will also benefit from zero fee spot trading on the USDe/USDT pair and generate returns in the earn section.

This week, Ethena unveiled a partnership with Symbiotic, a staking platform. The partnership will enable users to generate staking rewards for staking the ENA token in Mellow. Users will also receive 30x ENA multiplier, Symbiotic points, and future potential for LayerZero allocations.

Further, Ethena has integrated with AAVE, one of the biggest players in the Decentralized Finance (DeFi) industry. This deal will enable users to deposit the USDe stablecoin and loop their positions with other stablecoins on Aave. They will also be able to deposit stETH, weETH, ETH, and WBTC on Aave to borrow stablecoins into USDe.

Some of the other USDe integrations are with companies like Bybit, BounceBit, and Blast, one of the top layer-2 networks.

These integrations, and its strong rewards, has helped Ethena USDe become the fourth-biggest stablecoins in the industry with a market cap of $3.6 billion and over 232k holders.

Holders love USDe for its strong yield, which stands at about 8.6%, a figure that is higher than what US government bonds are offering.

Still, there are concerns about whether this yield is sustainable, especially in periods of high volatility. Some analysts have compared its strong yields to that of Terra Luna, which collapsed in 2022. The two biggest risks are the funding rates reversal and counterparty risks.

Ethena price has stabilized

Ethena’s ENA token has not done well even with the ongoing USDe growth and integrations as it has lost almost half of its value from its all-time high. This performance is likely because of the growing risks about its stablecoin. It is also in line with the performance of most altcoins, which have entered a bear market in the past few weeks.

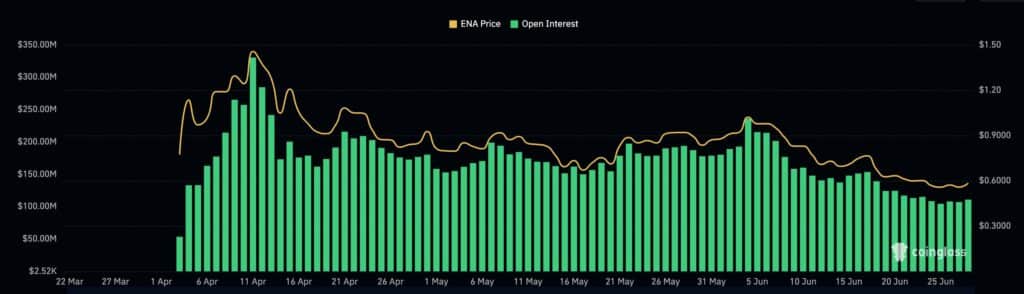

Ethena futures open interest

Ethena’s daily traded volume and its open interest in the futures market have also continued dropping after peaking in April.

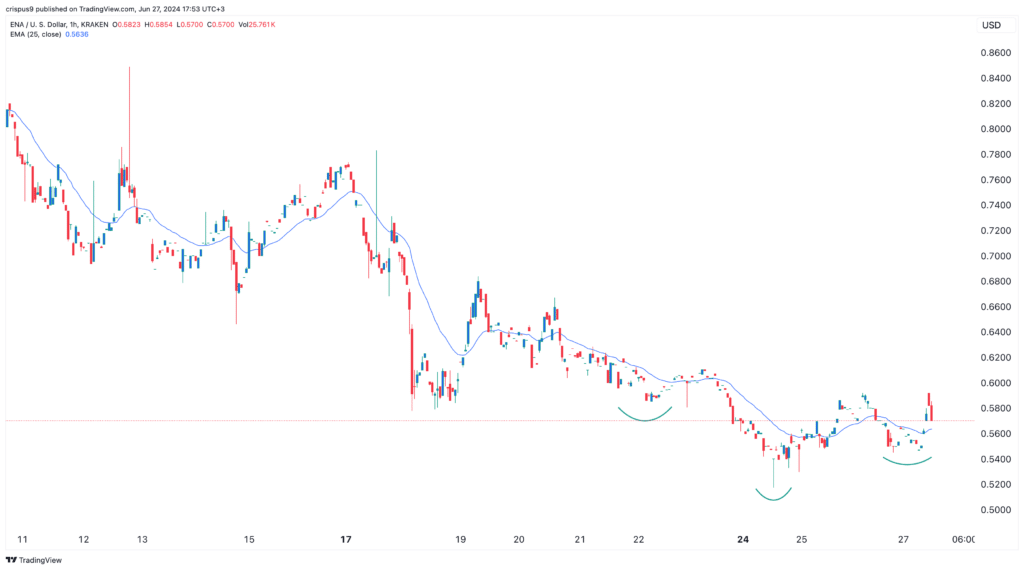

Ethena price hourly chart

Therefore, bulls will hope that the small inverse head and shoulders (H&S) pattern that has formed on the hourly chart will work out. In technical analysis, this is one of the most accurate reversal patterns.

This article first appeared at crypto.news