Ethereum (ETH)‘s price went up today along with most other cryptoassets after what has been a month of sluggish performance against bitcoin (BTC), and a prolonged period of falling interest in decentralized finance (DeFi) and non-fungible tokens (NFTs).

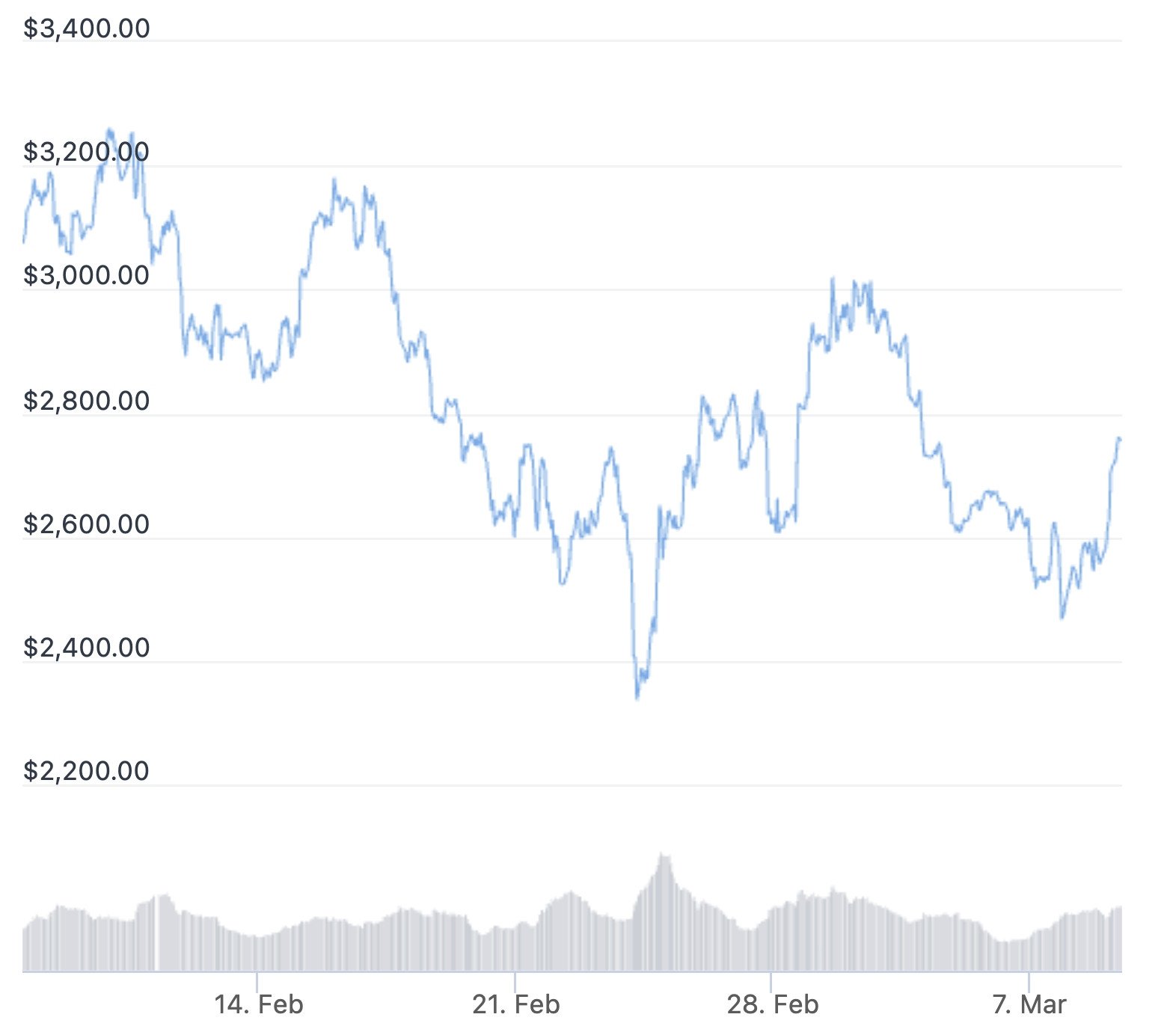

As of Wednesday at 12:55 UTC, ETH traded at USD 2,750, up 6.9% for the past 24 hours and down 7.6% for the past 7 days.

And although today’s rally was certainly welcomed by ETH holders, the coin was far from being the best performer in the market, with BTC gaining 8.7%, and the top-performer terra (LUNA) jumping more than 21% over the same 24 hours.

Price of ETH past 30 days:

The latest gains for ETH come after what has been a long period of underperformance compared with BTC, with the ETH/BTC trading pair now down by about 26% from a high of BTC 0.088 per ETH in December last year. As of press time, ETH 1 traded for BTC 0.065 on crypto exchange Binance.

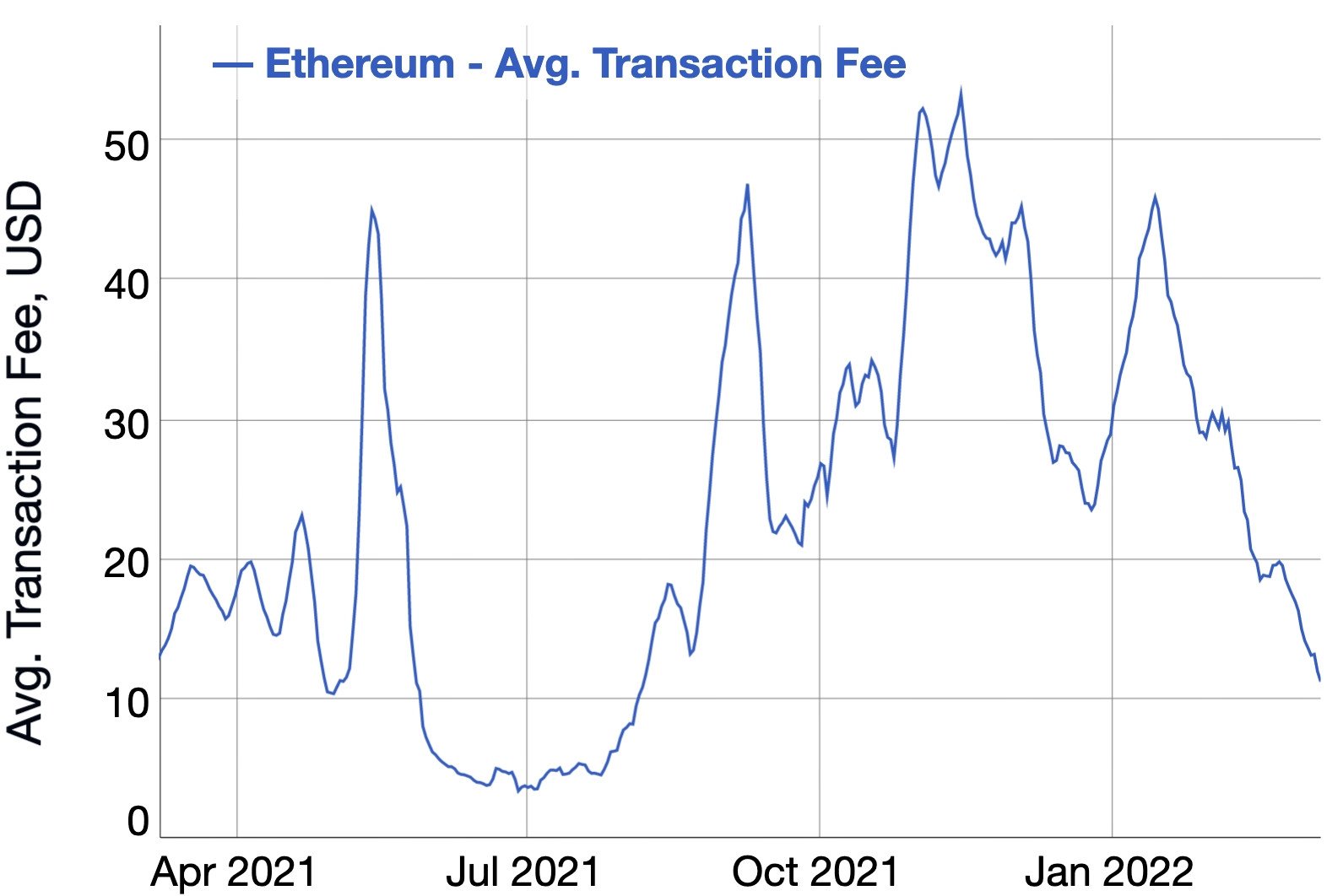

The price rally for ETH also comes as the fee for sending transactions over the Ethereum network reached its lowest since August 2021.

As of Tuesday this week, the average transaction fee on Ethereum stood at USD 10.28. That compares to a high for this year of USD 52.46 from January and the all-time high from May 2021 of USD 69.92, data from BitInfoCharts showed.

Commenting on the drop in transaction fees, crypto tracking site CryptoCompare noted in its monthly report for February that the fees still remain “well above fees in other networks,” while pointing to BTC, cardano (ADA), and XRP, which it said had average fees at the time of USD 1.84, 0.48, and 0.11, respectively.

Ethereum transaction fees (7-day moving average):

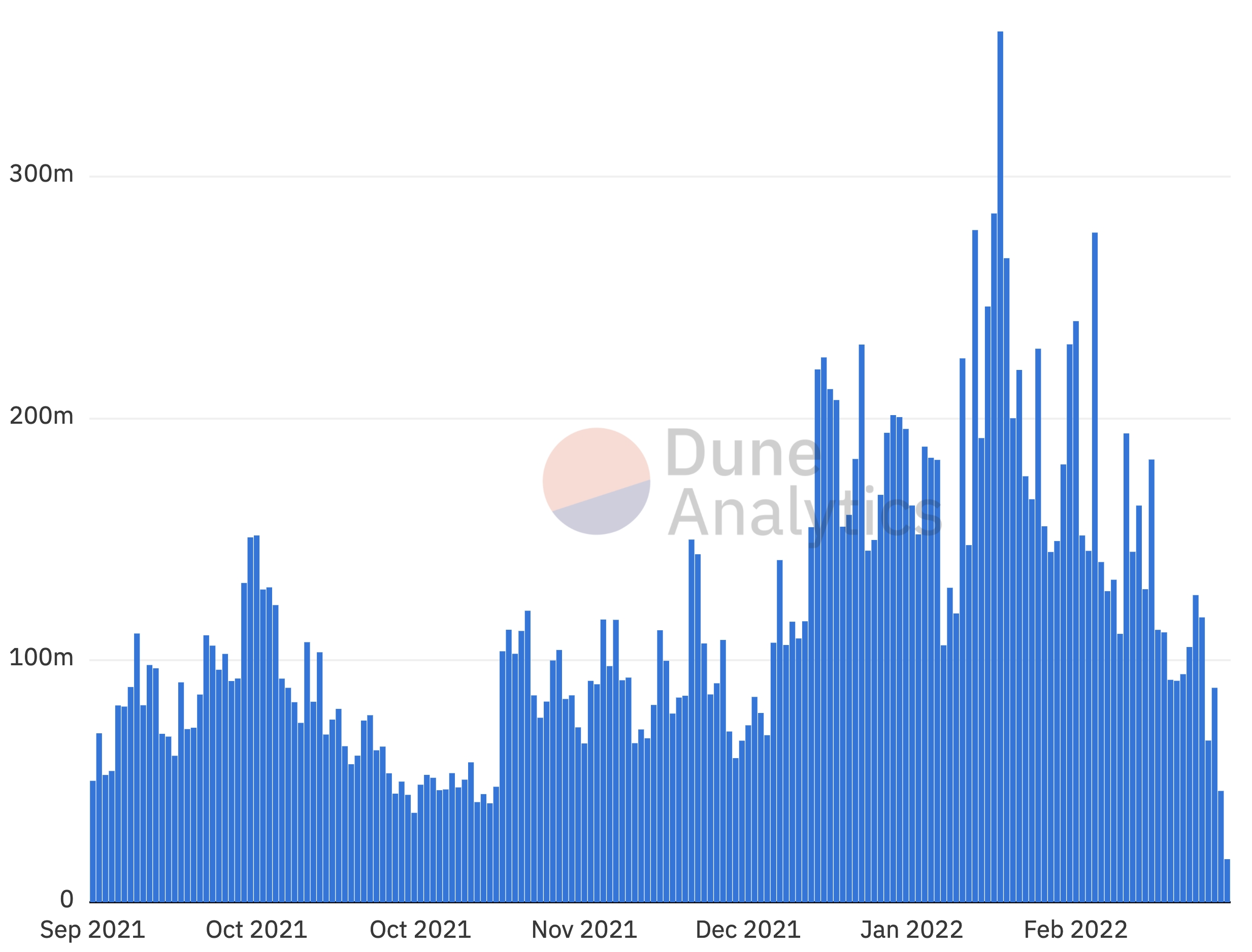

While one explanation for the decline in transaction fees is that the ETH has become cheaper in US dollar terms, another factor is a decline in trading of NFTs on Ethereum.

According to data from Dune Analytics, daily trading volume on the dominant NFT marketplace OpenSea is down significantly from its peak on February 1 this year, when USD 360m worth of NFTs were traded. As of Tuesday this week, that figure stood at just USD 46m, after falling consistently since the February high.

OpenSea daily volume in USD:

The drop in NFT activity comes in addition to lower interest in another sector that is critical for Ethereum: decentralized finance.

According to data from DeFi Pulse, the total value locked (TVL) in DeFi protocols on Ethereum has declined significantly since the end of last year, when TVL in Ethereum-based DeFi protocols reached an all-time high of USD 110.72bn. As of today, that figure has come down to USD 76.18bn.

Notably, the decline is also clear when looking at it in ETH terms. From an all-time high of ETH 11m on April 20 last year, the TVL is now down to ETH 8.18m, the data showed.

Goldman to refer clients to ETH fund

Meanwhile, news also emerged yesterday that the investment banking giant Goldman Sachs will give clients interested in ETH exposure the chance to invest in the Galaxy Institutional Ethereum Fund.

The fund, managed by Mike Novogratz’s firm Galaxy Digital, invests directly in ETH and is open only to accredited investors, according to the fund’s fact sheet.

Per a filing with the US Securities and Exchange Commission (SEC), Goldman Sachs will receive an “introduction fee” for all clients it refers to Galaxy’s fund. It remains unclear how much capital has already been referred to the fund through Goldman Sachs.

____

Learn more:

– Crypto Market Tries to Recover With Ukraine Negotiations in Focus; Gold & Commodities Rise

– Devs Publish Bitcoin, Ethereum Donation Guidelines for Russians Who Support Ukraine

– Opera Integrates DeversiFi to Improve P2P Ethereum Transactions

– Polygon Implements Ethereum Improvement Proposal 1559; MATIC Dives Today

– How to Use Layer-2 Solutions to Save on Ethereum Fees: Optimism

– How to Use Layer-2 Solutions to Save on Ethereum Fees: Arbitrum

This article first appeared at Cryptonews