Gold has been under pressure while Bitcoin has thrived since the US presidential election as the industry expects a strong shift to crypto assets.

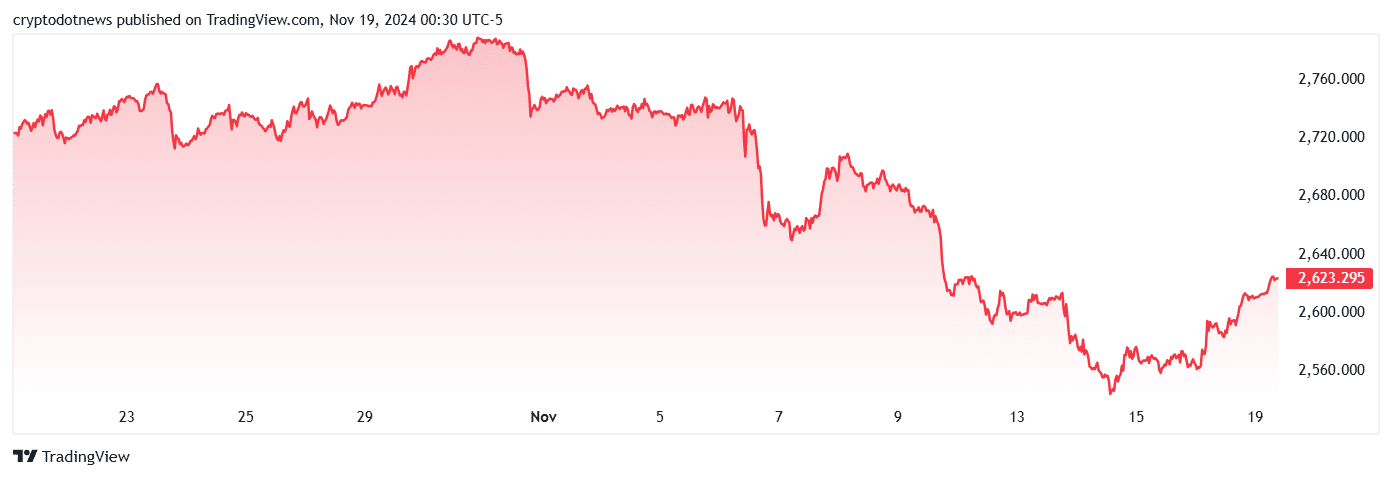

The leading investment asset, also used as the primary inflation hedge, plunged to a one-month low of $2,543 on Nov. 14, less than a day after the US Consumer Price Index report surfaced — the U.S. inflation rate came at the expected 2.6% in October.

Despite its recent surge to $2,623, gold is still down by 2.6% over the last 30 days.

On the other hand, Bitcoin (BTC), the digital gold, rallied to an all-time high of over $93,400 just hours after the U.S. CPI data was released.

In addition to Bitcoin, limiting rate cuts could also make the U.S. Treasury yields look more appealing than gold.

Maruf Yusupov, the co-founder of the gold-backed stablecoin Deenar, expects a strong shift in the appeal of gold with Donald Trump’s strong focus on taxes, tariffs, and crypto.

“Despite its century-old relevance, the focus on Bitcoin might stem the dominance of gold as a hedge against inflation moving forward. This implies that investors might shift funds from gold to Bitcoin, fueling a rapid rally for the latter.”

Yusupov told crypto.news.

The Federal Reserve’s hawkish stance — raising interest rates — could “put economic metrics back on track,” the co-founder of Deenar added. However, this would also negatively impact the “attractiveness of gold.”

“Investors who want to diversify their capital may choose Bitcoin instead, as it is known for its relatively higher yield.”

Yusupov says.

Yusupov believes that strengthening the U.S. dollar could threaten gold in the long term as the “need to embrace gold or other hedges becomes unnecessary overall.”

Republican US Senator Cynthia Lummis proposed on Nov. 17 to sell some of the Fed’s gold to accumulate Bitcoin as a national reserve. As of Q2 2024, the U.S. had 8,133 tons of gold reserves, according to Gold.org data.

This article first appeared at crypto.news