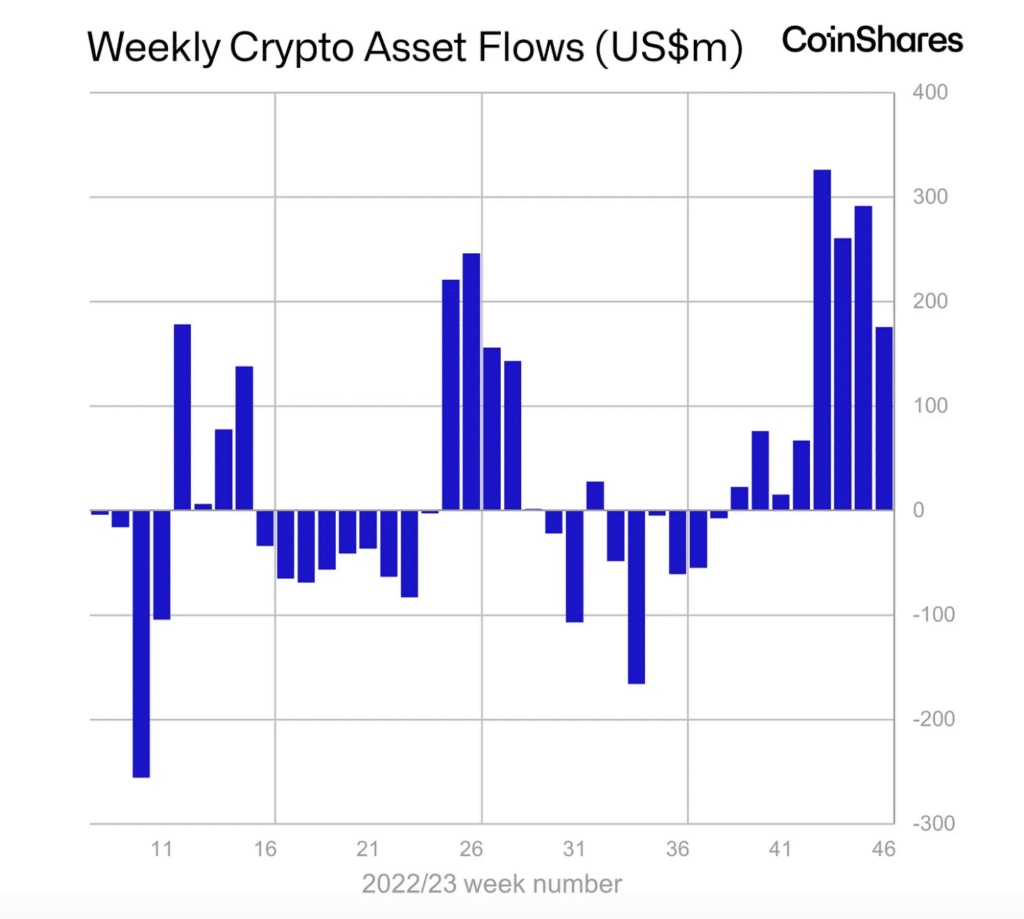

ETP inflows continued last week, reaching $176 million, a much larger share of the cryptocurrency’s total volume.

According to the CoinShares report, the positive dynamics of capital inflows have continued for eight weeks in a row. Meanwhile, ETP’s share of total cryptocurrency volumes is growing, averaging 11% compared to the long-term historical average of 3.4% and well above the 2020-2021 bull market averages.

However, inflows still lag significantly behind 2021 and 2020 figures of $10.7 billion and $6.6 billion, respectively.

Trading volumes grew to an average of $3 billion per week, double this year’s average of $1.5 billion.

Bitcoin (BTC) remains dominant, with inflows of $155 million over the past week. Moreover, over the past eight weeks, the inflow amounted to 3.4% of the total assets under management.

“We believe this continued positive sentiment is related to the imminent approval of a spot-based Bitcoin ETF in the US.”

CoinShares report

The inflows came from a wide range of altcoins, with the most notable being Solana (SOL), Ethereum (ETH), and Avalanche (AVAX), which received $13.6 million, $3.3 million, and $1.8 million, respectively. Uniswap (UNI) and Polygon (MATIC) noted minor outflows of $0.55 million and $0.86 million respectively.

Prior to this, in the period from Nov. 6 to Nov. 10, the inflow of funds into cryptocurrency-based exchange products reached $293 million. Since the beginning of 2023, the volume of infusions has exceeded $1.14 billion. This makes the current influx the third largest in the history of monitoring by CoinShares analysts of the movement of funds on the specified products.

This article first appeared at crypto.news