Ethereum’s much-anticipated update is here. Could this be the turning point for lower user fees on the network?

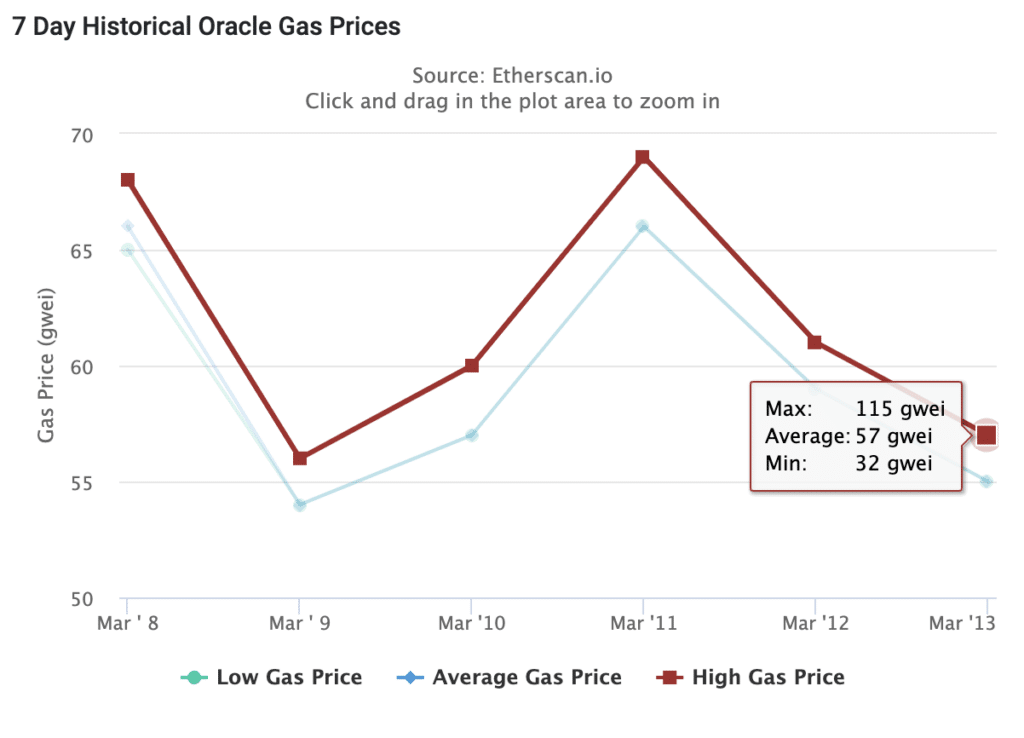

Just before the Dencun update went live, the average gas fee on Ethereum was 66 Gwei — one of the highest levels in the last six months. This meant it cost $5.49 to transfer one Ethereum (ETH) and about $94.56 to exchange tokens on a decentralized exchange (DEX). The commission for one non-fungible token (NFT) sold on the Ethereum network would cost around $159.81.

The long-awaited Dencun update is finally live, but has the problem of high network commissions been solved? The developers plan to achieve this through “proto-danksharding,” the main component of the EIP-4844 proposal within Dencun.

How Dencun will change crypto ecosystem

Grayscale analysts call the full implementation of the Dencun update a prerequisite for Ethereum to become “the most secure” blockchain for decentralized applications (dapps). The rise in popularity of layer-2 blockchains will likely increase competition as they struggle to attract users to their platforms.

The report indicates that network effects and liquidity benefits are particularly favorable for Ethereum in attracting new financial applications and developers.

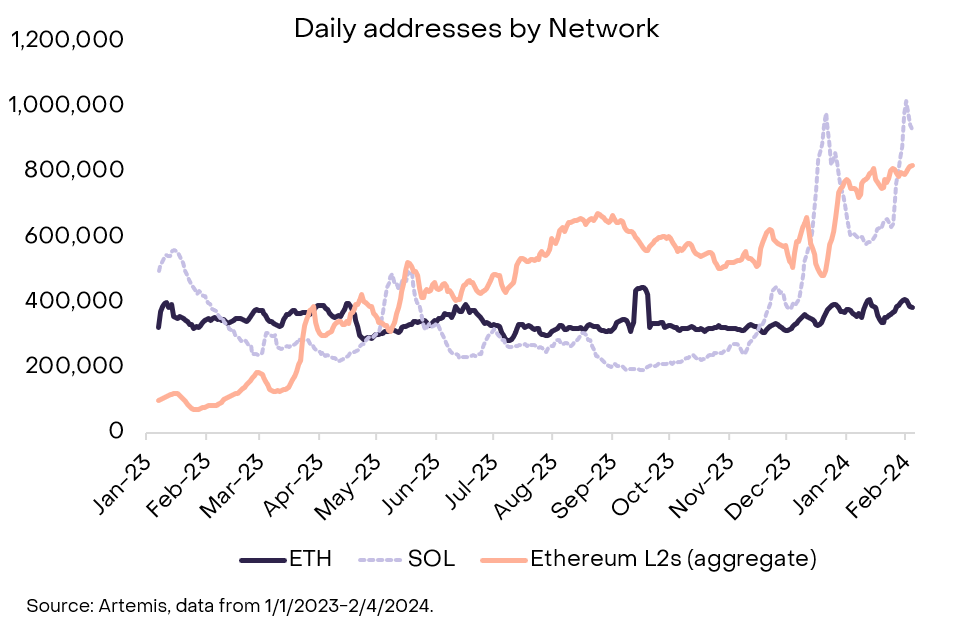

An additional benefit of Ethereum’s growth of layer-2 networks has been attracting new users to its ecosystem. According to Grayscale, Ethereum’s primary net users remained virtually unchanged in 2023, while layer-2 networks such as zkSync, Arbitrum, Optimism, and Base experienced constant growth.

In parallel with the second cryptocurrency, the capitalization of a whole list of projects and altcoins related to layer-2 solutions for the Ethereum blockchain is growing.

What do experts say about gas fees?

In an interview with Consensys, Ansgar Dietrichs, a researcher at the Ethereum Foundation, explained that with the Dencun update, the protocols on the network “have just to be completed with everyone else using the same mechanism.” But now, with the update, they will have their place.

“Now it’s more about no longer having roll-ups to suffer from congestion.”

Ansgar Dietrichs, researcher at Ethereum Foundation

According to a report by Max Wadington, an analyst at Fidelity Investments, the fee reductions promised for layer-2 users will not directly impact users transacting on the Ethereum network.

“In the short term, users who wish to benefit from this fee change must sacrifice some decentralization and security by transacting on l2s instead of Ethereum. This will certainly spur more users to bridge assets elsewhere.”

Max Wadington, Fidelity Investments analyst

Philippe Schommers, head of infrastructure at Gnosis, told crypto.news that the innovation behind the new “blob” transactions introduced by proto-danksharding shows that we are overcoming conceptual challenges toward creating a more easily scalable Ethereum network.

This includes temporary data, which is extremely important to combat the bloat of government resources. Previously, all data used by layer-2 was stored indefinitely on all Ethereum nodes. Now, this new data type will be deleted in about two weeks.

“It’s important to understand that, for now, the changes that Dencun brings will be more behind the scenes than end-user-focused. However, it’s still a building block to more synchronous updates that will benefit users more. The main thing to remember is that if an upgrade is beneficial, then having side chains synchronizing with it will spread those benefits further.”

Philippe Schommers, head of infrastructure at Gnosis

Lower fees: expectation and reality

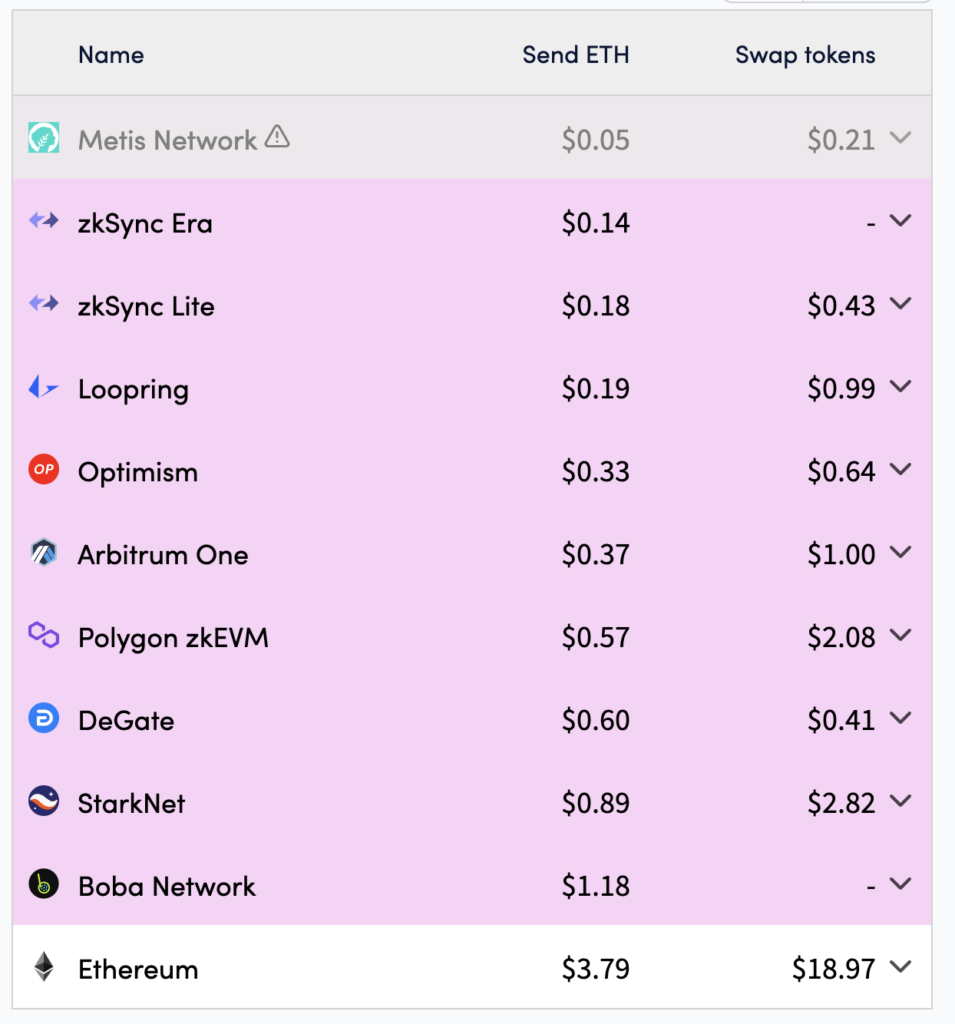

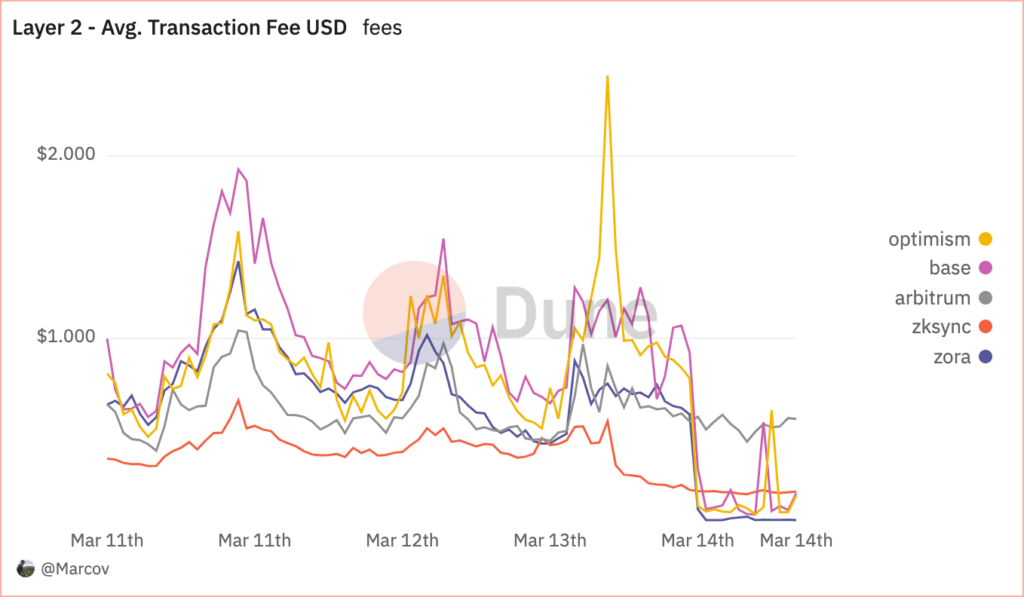

On March 11, IntoTheBlock experts predicted that after updating Dencun, the cost of a DEX swap on various layer-2 solutions, including Arbitrum, Optimism, and Base, would decrease.

Arbitrum is projected to experience a substantial crash in gas costs, which might plummet from its current $2.02 to $0.40.

“There are over 1.8 million daily transactions among top Ethereum l2s, with Arbitrum accounting for over 1 million of the total.”

IntoTheBlock experts

For other popular layer-2 solutions, the situation before Dencun looked like this:

Shortly after the update went live, the Ethereum network experienced significant turbulence, with the average Gwei size ranging from 32 Gwei to 115 Gwei.

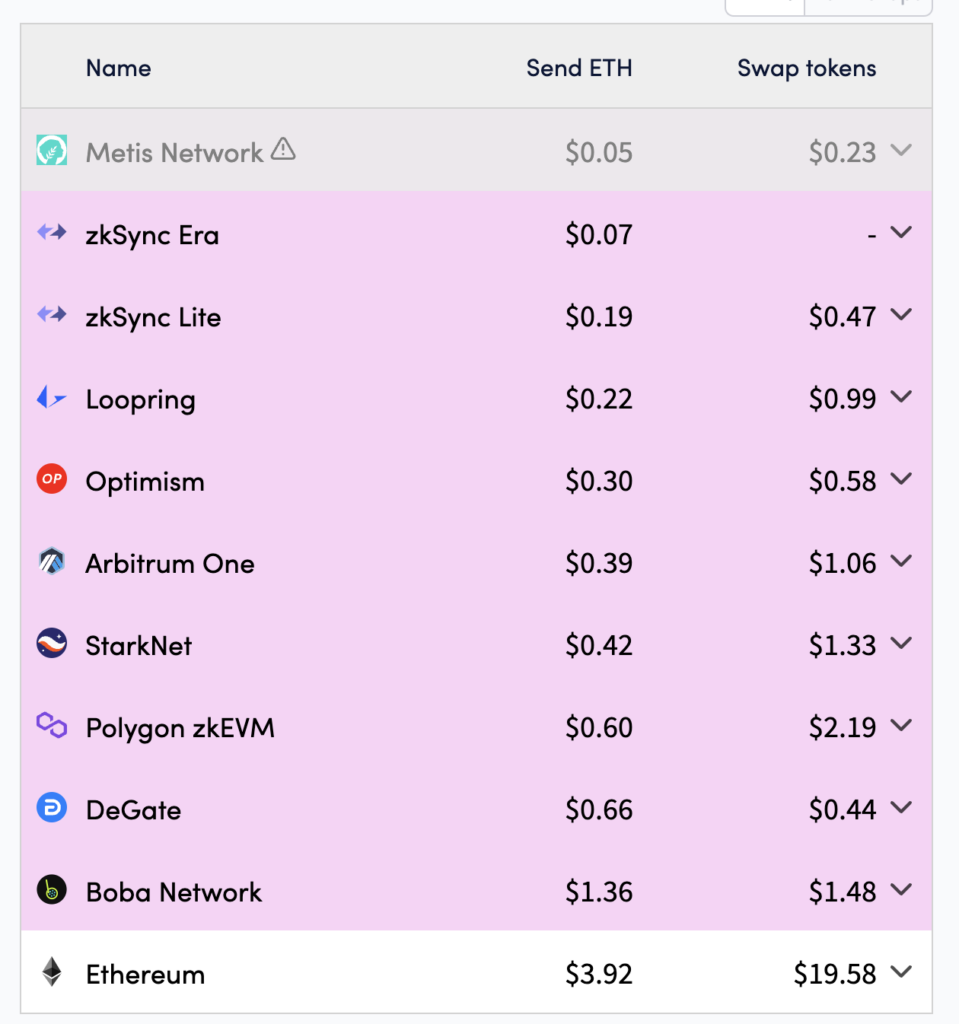

At 15:08 UTC on March 13, just over an hour after the update was launched, Ethereum network fees remained unchanged. However, a small decline was observed in layer-2 chains’ fees. For example, Starknet‘s fee rate dropped by threefold.

X users noted that shortly after the upgrade, they observed changes in gas fees for layer-2 solutions and hoped for a similar decrease in Ethereum fees.

A day following the update, there was a notable improvement. Users saw a desired reduction in Ethereum’s Gwei to 44. Additionally, there was a significant drop in fees for layer-2 networks, with the Optimism network showing a particularly noticeable decrease.

Cautious but optimistic forecast

While the Dencun update promises to improve Ethereum, developers are proceeding with caution. Introducing new consensus mechanisms and making architectural changes might bring unforeseen complexities and challenges.

However, the Dencun update has clearly been a catalyst for Ethereum’s growth, marked by a considerable reduction in fees after the update and an increasing number of users and developers.

This article first appeared at crypto.news