Analysts from CryptoQuant revealed two scenarios that could unfold before the approval of spot Bitcoin (BTC) ETFs.

CryptoQuant experts analyzed the support and resistance levels of the first cryptocurrency based on the average price of BTC holders and presented two scenarios: bullish and bearish.

According to the first bullish scenario, before the U.S. Securities and Exchange Commission (SEC) makes a final decision, the price of BTC could reach a local peak of $48,500. In this case, the share of short-term holders (from one day to a week) will exceed 8%, which indicates a market overheating. In addition, this indicator increases the likelihood of a correction. This level may become the main resistance level for Bitcoin. $48,500 is the average price for long-term holders.

In a bearish scenario, the price of BTC could drop by 2-30%. Historical data evidence this: after active growth, the value usually falls. If this happens again, the key support levels will be $30,000 and $34,000. The first indicator is the average price of long-term holders, and the second being short-term holders.

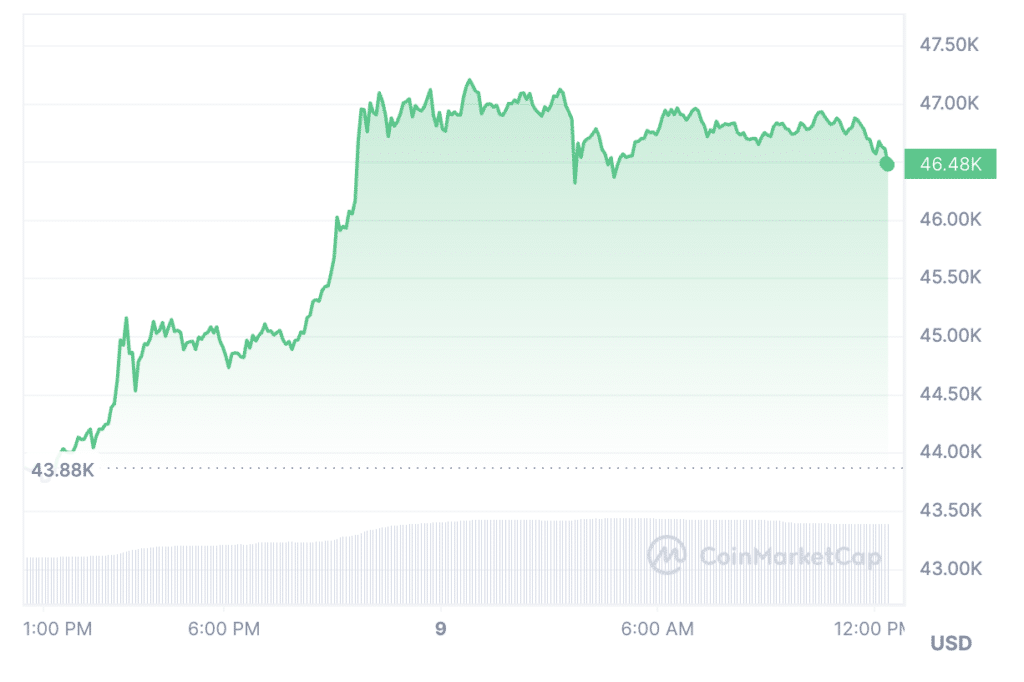

On Jan. 8, the price of BTC once again updated its annual maximum at $47,218. The last time the figure reached this level was in April 2022. According to CoinMarketCap, Bitcoin is currently trading at $46,477 at the time of writing. Over the past 24 hours, the asset’s value has strengthened by 7%.

The fate of spot Bitcoin ETFs remains uncertain. The crypto market is awaiting a decision on applications from the SEC this week.

This article first appeared at crypto.news