Last updated:

Key Takeaways:

- Investor sentiment is cooling as key on-chain metrics suggest a milder growth phase.

- Network activity and liquidity trends have eased, hinting at a potential shift in market momentum.

- Historical patterns show such dips often precede extended corrections in Bitcoin’s price cycle.

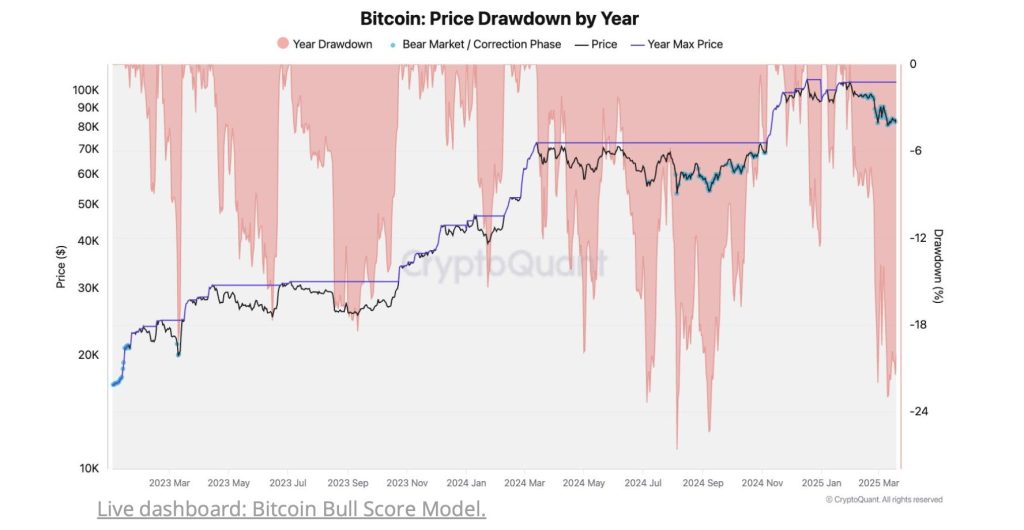

Bitcoin’s price dropped by 23% from its recent peak over the past few weeks, prompting concern among investors as CryptoQuant reported that Bitcoin’s Bull Score Index hit a two-year low.

Market participants are debating whether this signals the start of a bear market or if it reflects a temporary correction within a broader bull cycle.

While Bitcoin has historically experienced sharp pullbacks followed by recoveries, recent data from CryptoQuant indicates that the current market conditions may lack the strength seen in previous bullish phases.

CryptoQuant’s Bull Score Index Reflects Weakening Sentiment

According to a recent report from a CryptoQuant analyst, Bitcoin’s Bull Score Index has fallen to 20—the lowest level since January 2023.

The Bull Score Index measures market conditions based on ten indicators covering network activity, investor profitability, Bitcoin demand, and liquidity.

It ranges from 0 to 100, with higher scores reflecting a strong environment and lower scores pointing to bearish conditions.

Bitcoin has historically maintained rallies when the Bull Score stayed above 60, while readings below 40 often aligned with prolonged bear markets.

The recent drop to 20 signals a weakening investment environment, raising concerns that Bitcoin’s current price correction may be part of a broader downtrend rather than a short-term pullback.

Bitcoin Metrics Turn Bearish Since Mid-February

CryptoQuant’s report further highlights several indicators signaling deteriorating conditions in recent months.

Since mid-February 2025, key metrics have turned bearish.

Indicators such as the CryptoQuant Network Activity Index have remained in negative territory since December 2024, reflecting a sustained decline in on-chain activity.

Previous market cycles show that sustained bullish phases often require growing network activity and consistent demand for Bitcoin.

The report also examines past periods when the Bull Score Index remained below 40 for extended stretches.

Historically, such conditions coincided with bear markets characterized by short-lived price recoveries and ongoing downward pressure.

While some investors expect Bitcoin to recover as it has in prior cycles, CryptoQuant’s analysis recommends caution.

If the Bull Score Index fails to rise above key thresholds, Bitcoin may continue facing downward pressure in the near term.

Frequently Asked Questions (FAQs):

It indicates that investor confidence is easing and fewer transactions are fueling price support, which could lead to a period where gains are harder to sustain, mirroring past correction phases.

Lower network engagement can limit liquidity, meaning there are fewer buyers to push prices upward, which often results in more gradual recoveries or extended sideways movements in the market.

Yes, past cycles have shown that when bullish metrics dip, it typically precedes prolonged corrections, offering a framework to anticipate possible shifts in market dynamics.

This article first appeared at News