Last updated:

US-based crypto trading company Cumberland has received an in-principle approval from the Monetary Authority of Singapore (MAS) for the Major Payment Institution (MPI) License.

The license would allow its Asian subsidiary, Cumberland SG, to offer regulated digital asset services and expand its Asian foothold.

“We look forward to expanding our presence in this important region, bringing our disciplined approach to compliance, proven market expertise and commitment to the digital asset ecosystem to counterparties in Singapore and beyond,” the firm wrote on X.

The firm added that the in-principal nod for an MPI is a “strong signal” of confidence from Singapore’s regulator. However, “it does not constitute a license at this stage,” Cumberland clarified.

Singapore’s Stringent Requirements Under MPI Framework

Jason Tay, Head of Commercial at StraitsX, told Cryptonews that Singapore has been lauded for its progressive and forward-thinking stance towards digital assets.

“Whether it’s the MPI license or the forthcoming stablecoin license, all firms seeking to operate as legitimate and recognised entities must undergo the same rigorous licensing process,” he noted.

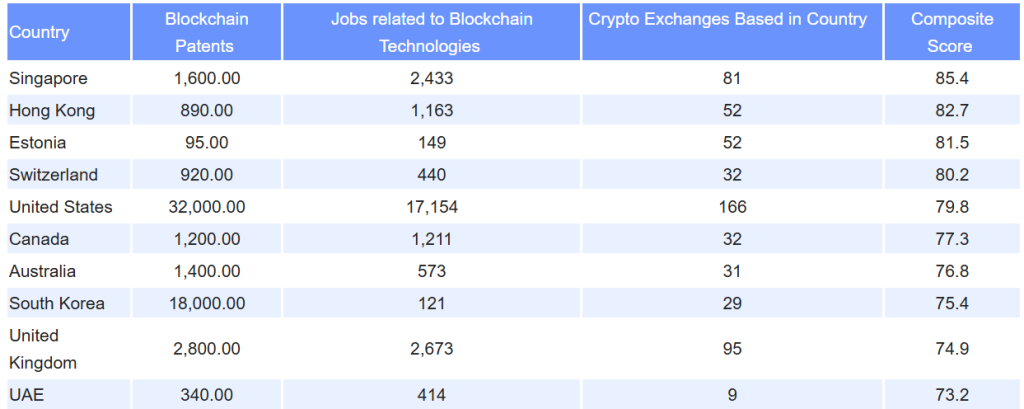

According to a December study by ApeX Protocol, the city-state has emerged as a global leader based on blockchain patents, crypto exchanges and jobs.

Per the regulator’s requirements, crypto firms are subject to capital adequacy and anti-money laundering compliance before operating under the MPI.

US SEC Drops Cumberland’s Case

The US regulator has been recently dropping all crypto firm-related cases that were under light during Gensler’s regime. In October 2024, the US SEC charged crypto market maker Cumberland DRW for acting as an unregistered dealer.

The agency said that Cumberland has acted as an unregistered firm since March 2018, involving in the buy-sell of cryptos.

However, the SEC agreed to end its legal dispute with the firm early this month, though its finalization is still pending approval.

This article first appeared at News