The cryptocurrency market is stabilizing after a major fall on Tuesday, Oct. 22. Consequently, the liquidations show signs of a cooldown.

According to data from CoinGecko, the global crypto market capitalization saw a $57 billion loss yesterday, reaching $2.44 trillion, after hitting a three-month high of $2.498 trillion a day earlier.

The global market cap faced a 2.5% decline in the past 24 hours again, wiping another $7 billion.

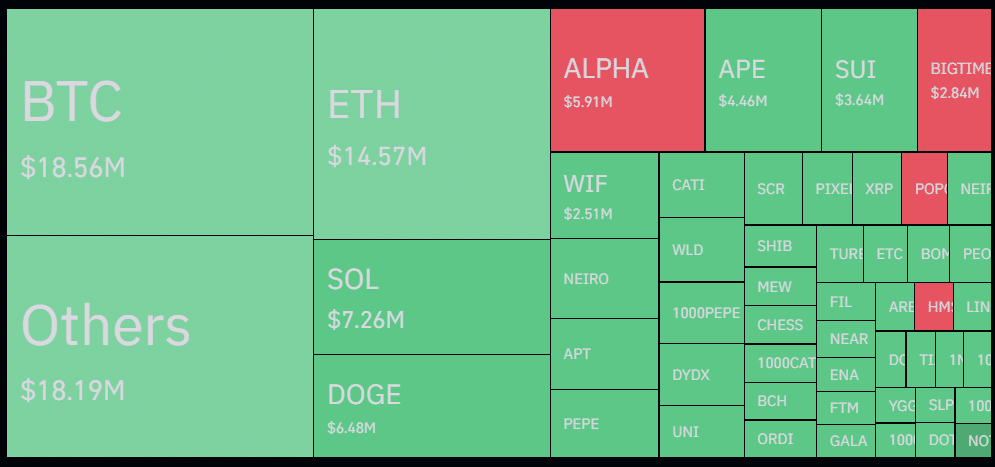

As the Tuesday selloff cools down, the total crypto liquidations plunged by 40% over the past day, reaching $121 million, according to data from Coinglass. Due to the market-wide downturn, 75% of the liquidations, worth $91 million, belong to long positions.

Bitcoin (BTC) is leading with $18.5 million in liquidations—$11 million longs and $7.5 million shorts—as the price fell below the $67,000 mark. BTC is trading at $66,800 at the time of writing, marking a one-week low.

Ethereum (ETH) saw a relatively high long-short ratio as $11.2 million of its total $14.5 million liquidations belong to long trading positions. ETH is still hovering above the $2,600 psychological zone despite the bearish sentiment surrounding it.

The largest single liquidation order, worth almost $690,000 in Solana (SOL)/USDT pair, happened on Binance, the largest crypto exchange by trading volume.

According to a crypto.news report, spot BTC exchange-traded funds in the U.S. recorded their first day of outflows as the market-wide sentiment turned bearish. These investment products as a net outflow of $79.1 million, led by Ark and 21Share’s ARKB fund, with an outflow of $134.7 million.

ETH ETFs, on the other hand, witnessed a net inflow of $11.9 million amid market uncertainty.

This article first appeared at crypto.news