The crypto market has reacted little to the U.S. Federal Reserve’s decision to leave interest rates unchanged, even as it hinted at a final hike before year’s end.

On Sept. 20, the U.S. Federal Reserve (Fed) Chair Jerome Powell held a Federal Open Market Committee (FOMC) press conference, announcing that current interest rates, ranging between 5.25% and 5.5%, would remain unchanged.

“In light of how far we have come in tightening policy, the committee decided at today’s meeting to maintain the target range for the federal funds rate at 5 ¼ to 5 ½ percent and to continue the process of significantly reducing our securities holdings.”

Jerome Powell, Federal Reserve Chair

However, the Fed hinted at one final hike ranging between 5.5% and 5.75% before the end of 2023 to close the current cycle that would have seen 12 interest rate hikes since March 2022.

Powell reiterated the Fed’s goal to bring inflation back down to 2%, adding that its decision would be guided by “ongoing assessments” of data.

Crypto market reacts

Following the FOMC’s announcement, the traditional financial market retreated marginally, with the S&P 500 dropping by 0.94% and the Nasdaq Composite losing roughly 1.5%.

The crypto market also reacted slightly to the FOMC, shaving off a tiny fraction of its market cap. Most cryptocurrencies, among the top 50 with the highest capitalization, dropped their prices from 0.1% to 5%.

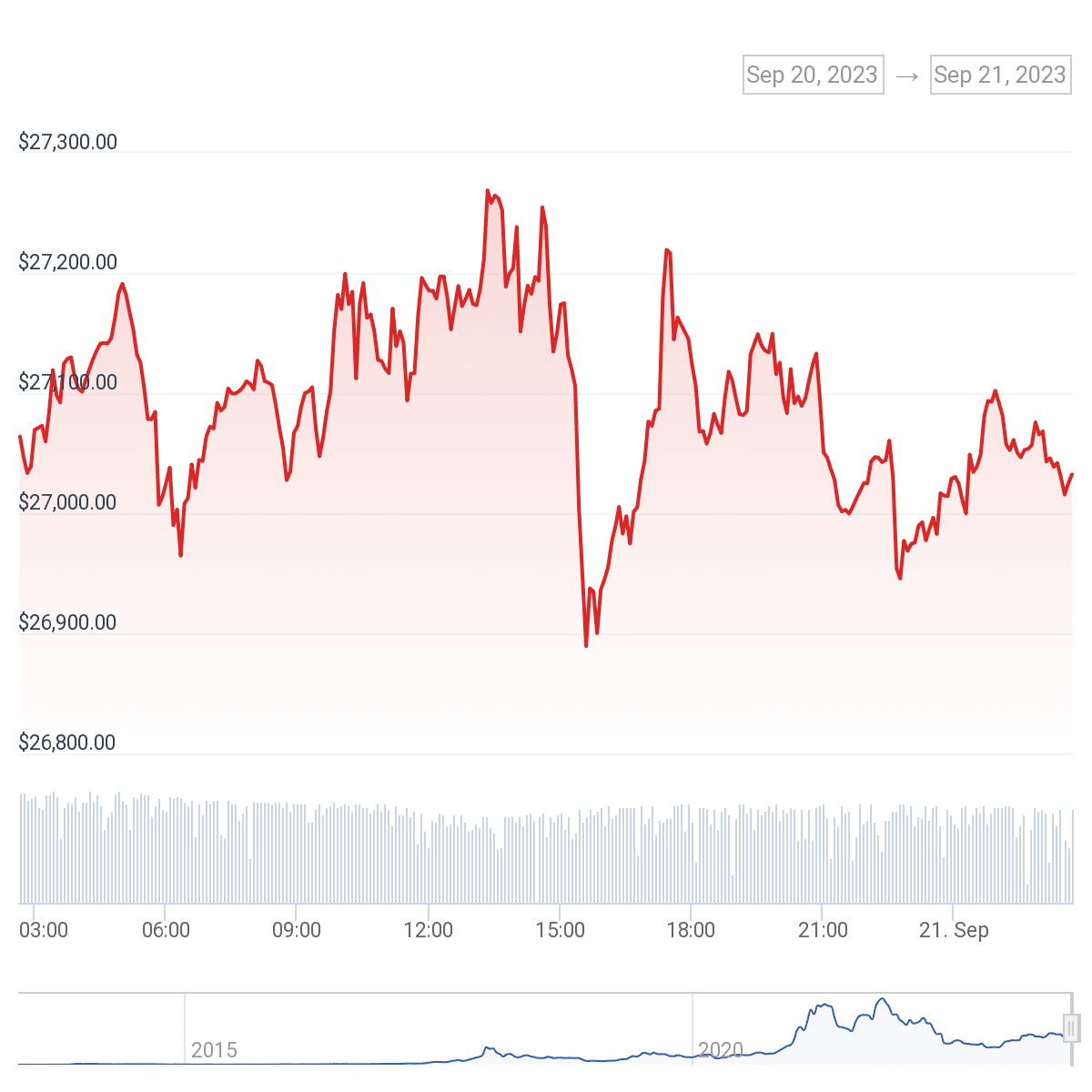

Bitcoin (BTC), the leading cryptocurrency by market cap, remained largely unaffected, recording an almost negligible drop of 0.8% in the last 24 hours. However, at one point, the coin’s price dipped below $26,900 before recouping most of that loss in the following hours, according to data from CoinGecko.

At the time of going to press, Bitcoin was changing hands for $26,700 and had a trading volume of $12.9 billion.

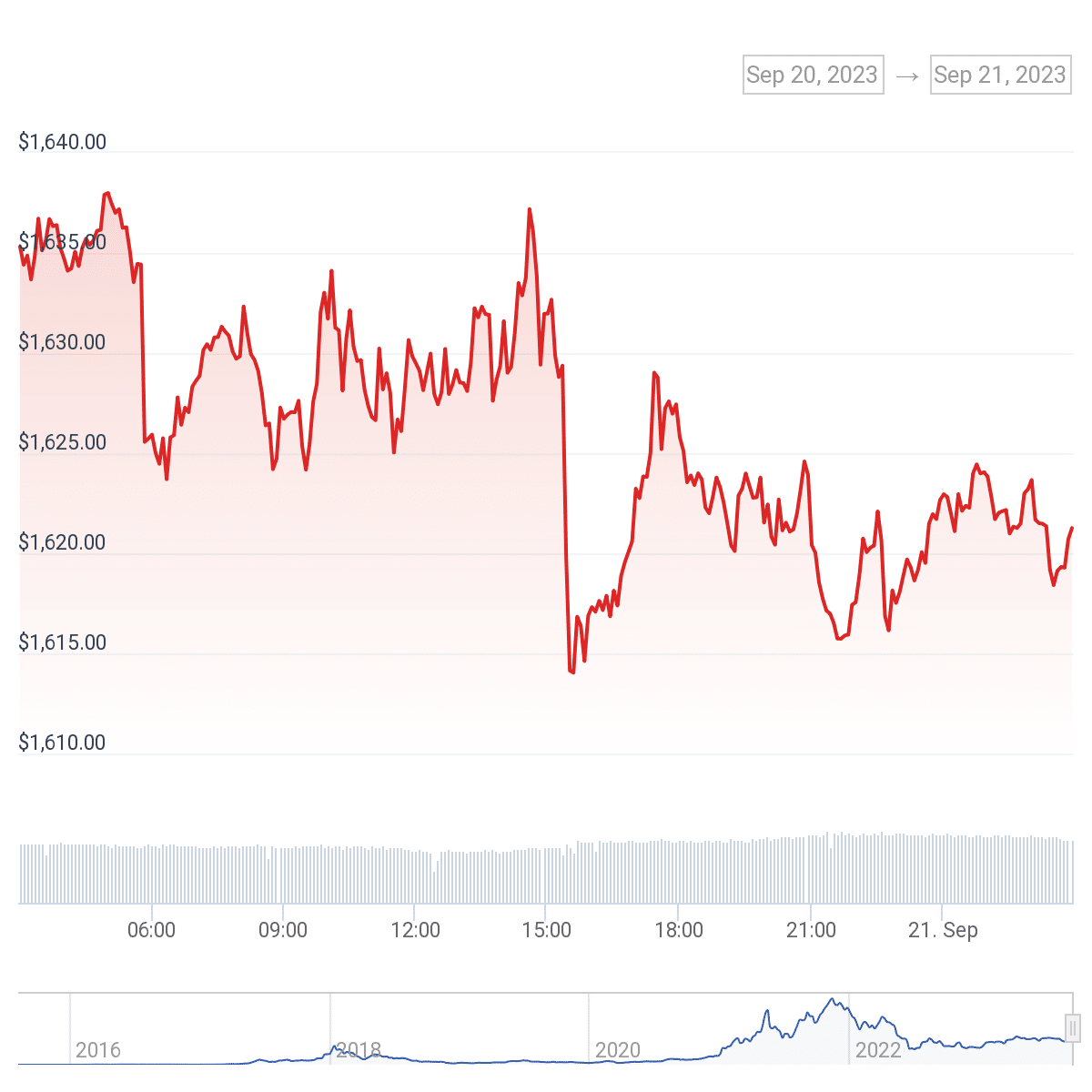

Ethereum (ETH) reacted in nearly the same manner as Bitcoin, registering a 24-hour dip of 1%. In the aftermath of Chair Powell’s press conference, ETH dropped suddenly from $1,629 to $1,614, an almost 1% loss in value as BTC had experienced.

Other popular altcoins, including Ripple (XRP) and Solana (SOL), also saw little movement. The two leading stablecoins, Tether (USDT) and USD Coin (USDC) were also largely unaffected by the FOMC pronouncement.

While most negative price changes were below 2%, Kaspa (KAS) suffered the biggest loss among the top coins, shaving 4.6% off its value in the hours following the FOMC press conference. Despite the dip, the coin still registered a 5.1% gain in the last seven days and 23.8% over two weeks.

Dogecoin (DOGE) did buck the trend, though, however slightly, making a 0.4% gain on its price in the last 24 hours. It marked a continuation over the previous seven days, where the meme coin has clawed back 2.1% of its value after mostly being in the red in the past 30 days.

This article first appeared at crypto.news