Crypto liquidations have surpassed the $1 billion mark less than 24 hours after the market took a red dive.

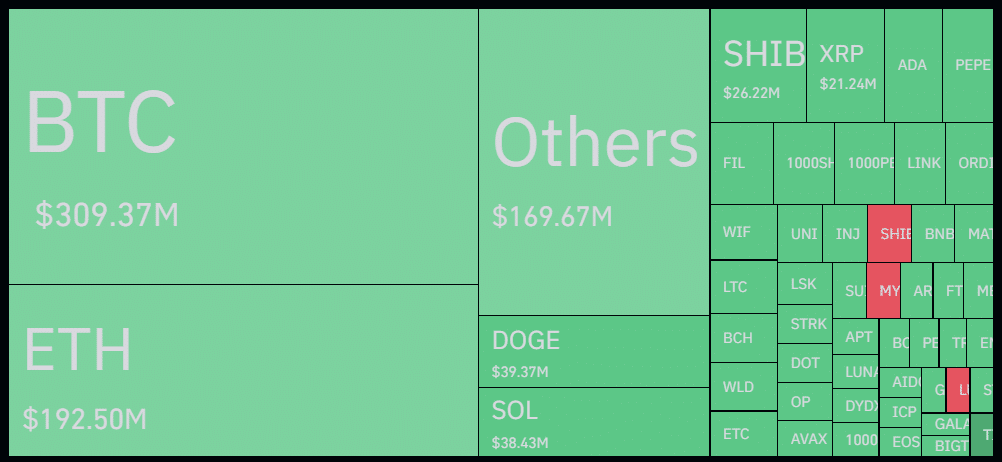

According to data provided by Coinglass, the total cryptocurrency liquidations reached $1.05 billion over the past 24 hours as the global crypto market capitalization declined. Data shows that the majority of the liquidations come from long positions, defying traders’ expectations of a further bull run at this point.

Moreover, $797 million in long and $257 million in short positions have been liquidated across all exchanges over the past day, according to Coinglass.

Bitcoin (BTC) alone witnessed $309 million in liquidations — $211 million in long and $98 million in short positions.

Notably, the flagship digital currency reached a new all-time high of $69,170 on March 5. Following the rally, traders withdrew their trading positions, worth more than $142 million, in just one hour after Bitcoin reached a new peak.

Recently, one trader liquidated $1.04 million in BTC on Bybit as the asset’s price rebounded to $66,500, according to the data aggregator.

Per Coinglass, Binance is leading the chart with $403 million in liquidations followed by OKX and Bybit with $366 million and $106 million in liquidations in the past 24 hours, respectively.

Coinglass data shows that the total open interest declined by 0.65% as the crypto market faces correction — currently hovering around $67 billion.

This article first appeared at crypto.news