Market maker Cumberland may have bought the dip as data showed the firm moving millions in Tether stablecoins to centralized exchanges.

Since Aug. 6, Cumberland has sent over $1 billion in Tether (USDT) to CEX platforms like Binance, Coinbase, and Kraken, according to LookOnChain data.

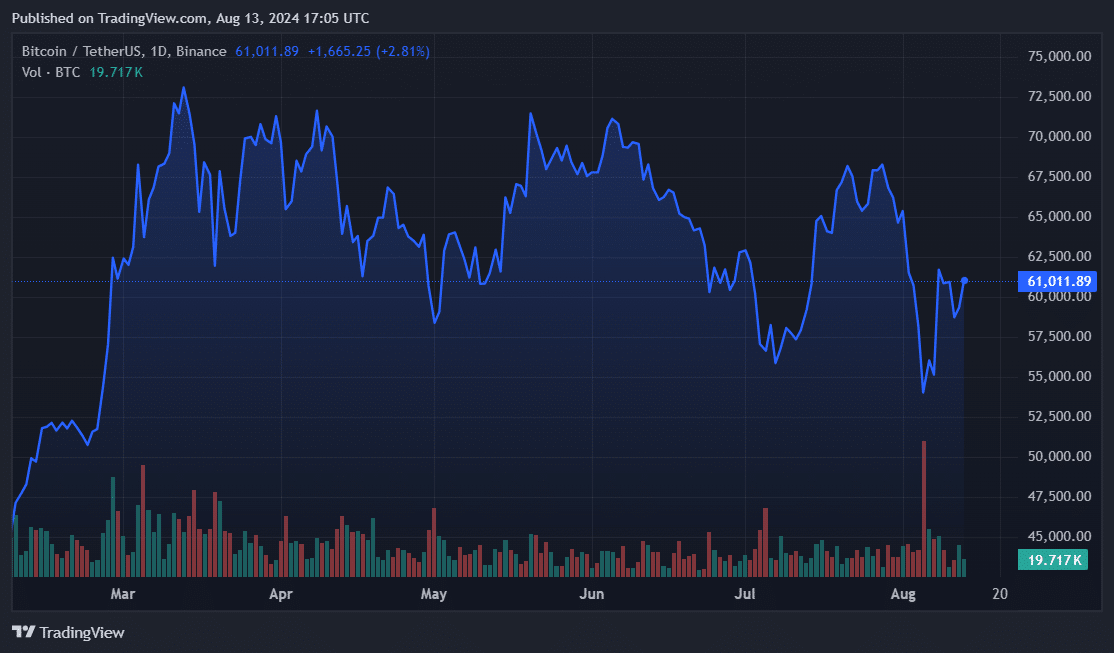

Market makers provide liquidity in financial ecosystems and sometimes adopt an asset accumulation strategy to buffer profits or revenue. Cumberland’s CEX deposit spree began just after the global market slump on Aug. 5, when Bitcoin (BTC) dipped below $50,000, and the total cryptocurrency market plunged to $1.8 trillion.

Crypto prices have recovered some losses since then, with Bitcoin (BTC) crossing $61,000 as of this writing. According to TradingView, the total crypto market has also surged 12% in the past week. This uptick suggests that Cumberland may already be in profit if the market maker used the $1 billion USDT to acquire a basket of cryptocurrencies.

Meanwhile, stablecoin issuer Tether continued its minting streak. The payment firm created $1 billion in new USDT tokens on Ethereum (ETH), bringing its tally for the year to over $32 billion.

The stablecoin complex has surpassed $160 billion in market cap, but firms pay pennies to issue new tokens into circulation. Arkham confirmed that Tether paid less than $1 in on-chain fees for its latest Ethereum inventory restock.

This article first appeared at crypto.news