The current crypto bloodbath is pushing investors to seek protection by buying options.

According to Bybit X Block Scholes crypto derivatives analytics report, the current crypto market downturn has pushed investors to buy options as a way of hedging against further losses.

When Trump announced the U.S. would create a crypto strategic reserve, which would consist of Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA), prices of all these assets pumped. However, their rallies were short-lived as Trump’s promises of new tariffs on imported goods put off investors from risker assets due to the resulting macroeconomic uncertainty.

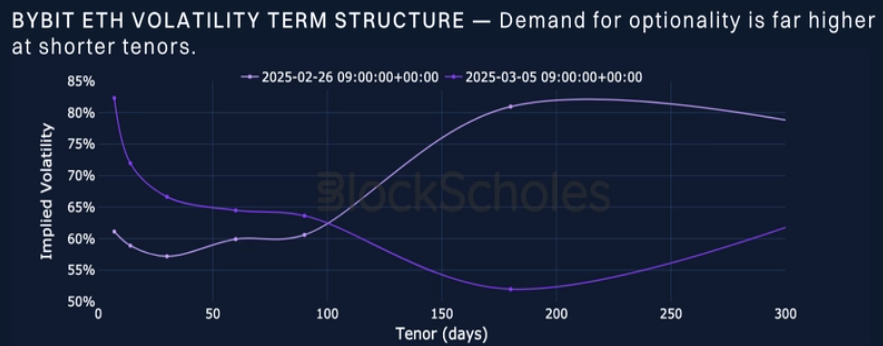

The sudden price swings caused by these two developments—first, the reserve news pushing crypto prices up, and then the tariff news driving them down—have increased market volatility.

As a result, realized volatility (how much the price actually moved) is now higher than implied volatility (what options traders expect the price to move). This shift prompted traders, worried about further declines, to start buying short-term options to hedge against potential losses.

The fact that traders are turning to put options suggests that they expect significant downside in the short term. This aligns with many analysts’ predictions. For example, Arthur Hayes said in his recent post on X that he expects Bitcoin to retest the $78,000 level, and possibly fall even lower to $75,000.

This article first appeared at crypto.news