Crypto-linked investment products experienced the second-largest inflow of 2024 last week, amounting to $708 million, nearly 99% of which came from Bitcoin.

The U.S. market recorded $721 million in inflows, with the fresh ETFs alone gathering $1.7 billion. According to CoinShares research, spot Bitcoin ETFs have consistently attracted an average of $1.9 billion in capital over the past month, culminating in a total of $7.7 billion since their approval.

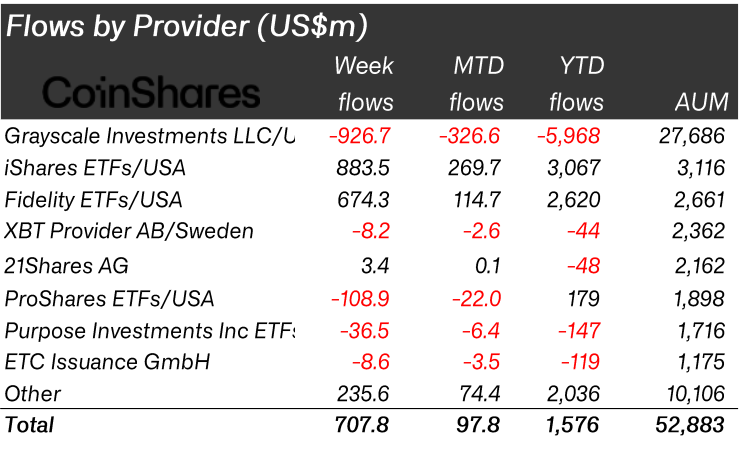

Bitcoin ETFs have maintained an average inflow of $1.9 billion over the last four weeks, reaching a cumulative $7.7 billion since they were first introduced in the second week of January. Despite this surge, there has been a $6 billion withdrawal from established funds, including Grayscale and ProShares.

However, recent data indicates a noticeable slowdown in these outflows.

Bitcoin dominated the inflow charts with $703 million, representing 99% of the total investment flow. In contrast, products betting against Bitcoin experienced a slight withdrawal of $5.3 million, aligning with a positive shift in its price trends.

Among other cryptocurrencies, Solana stood out with $13 million in inflows, surpassing Ethereum and Avalanche, which faced withdrawals of $6.4 million and $1.3 million within the same timeframe.

This article first appeared at crypto.news