An average crypto investor experienced a gain of $887.60 in 2023, as reported by CoinLedger, a leading crypto tax software platform.

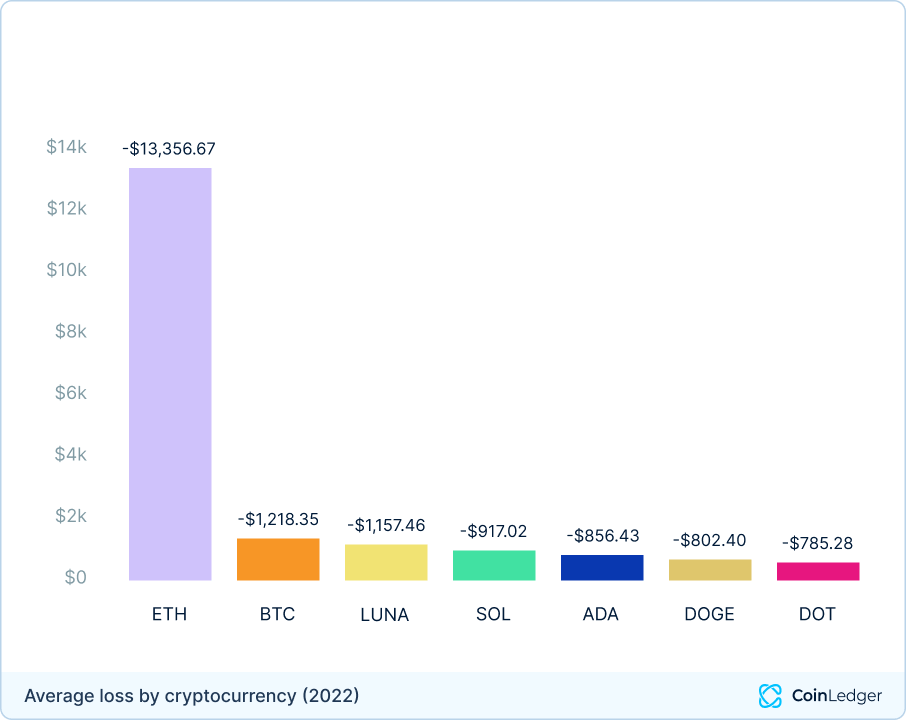

The higher profits contrast sharply from 2022, a year of significant losses exceeding $7,000 per investor, following the collapse of key crypto firms and a pervasive bear market.

“It’s clear that the cryptocurrency market is growing once again. After the collapse of FTX, the cryptocurrency ecosystem saw a freefall in asset prices,” said CoinLedger CEO David Kemmerer in a press release. “This latest rebound highlights the growth of the crypto industry from 2022 to 2023.”

These insights derive from an analysis of data from CoinLedger’s user base, which numbers over 500,000 investors, predominantly from the United States.

The study also revealed that Ethereum (ETH) was the most frequently traded cryptocurrency among CoinLedger users in 2023, followed by Solana, Bitcoin, BNB, and Polygon.

Despite Bitcoin’s global popularity, it ranked third in disposal, suggesting that Bitcoin investors might be more inclined to hold onto their assets than those investing in other cryptocurrencies.

Ethereum also led the pack in the volume of blockchain transactions imported into CoinLedger’s tax software, ahead of Bitcoin, Binance Smart Chain, Polygon, and Avalanche C-Chain. Coinbase emerged as the most popular centralized exchange among CoinLedger’s predominantly American user base.

The report also touched on Binance’s challenging year, including a $4.3 billion settlement with U.S. authorities and a lawsuit from the Securities and Exchange Commission, yet noted that Binance.US still ranked high for CoinLedger imports.

This article first appeared at crypto.news