CoinGecko experts published a report on the crypto market for the first quarter, noting the growth in sector capitalization.

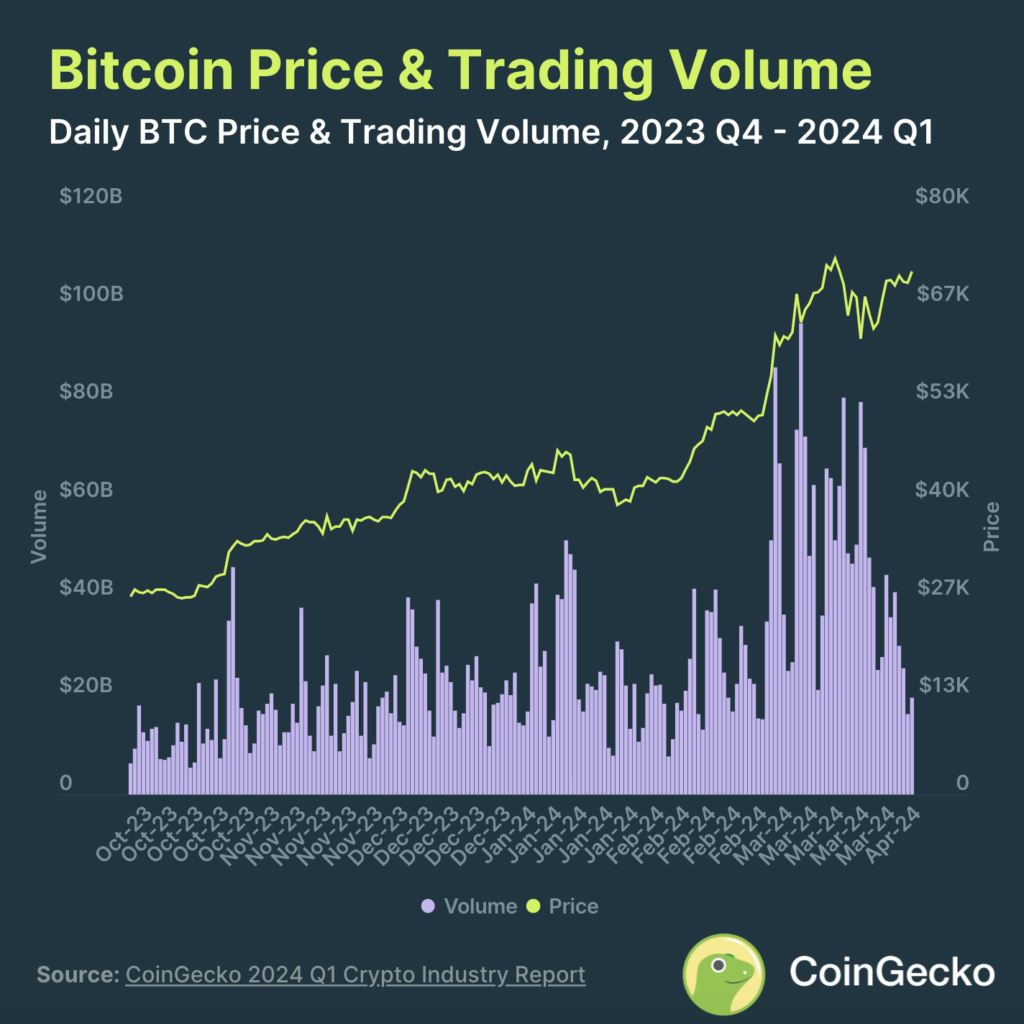

In the first quarter, the crypto market showed growth, according to a CoinGecko report. The segment’s capitalization grew by 64.5%, reaching a peak of $2.9 trillion in March.

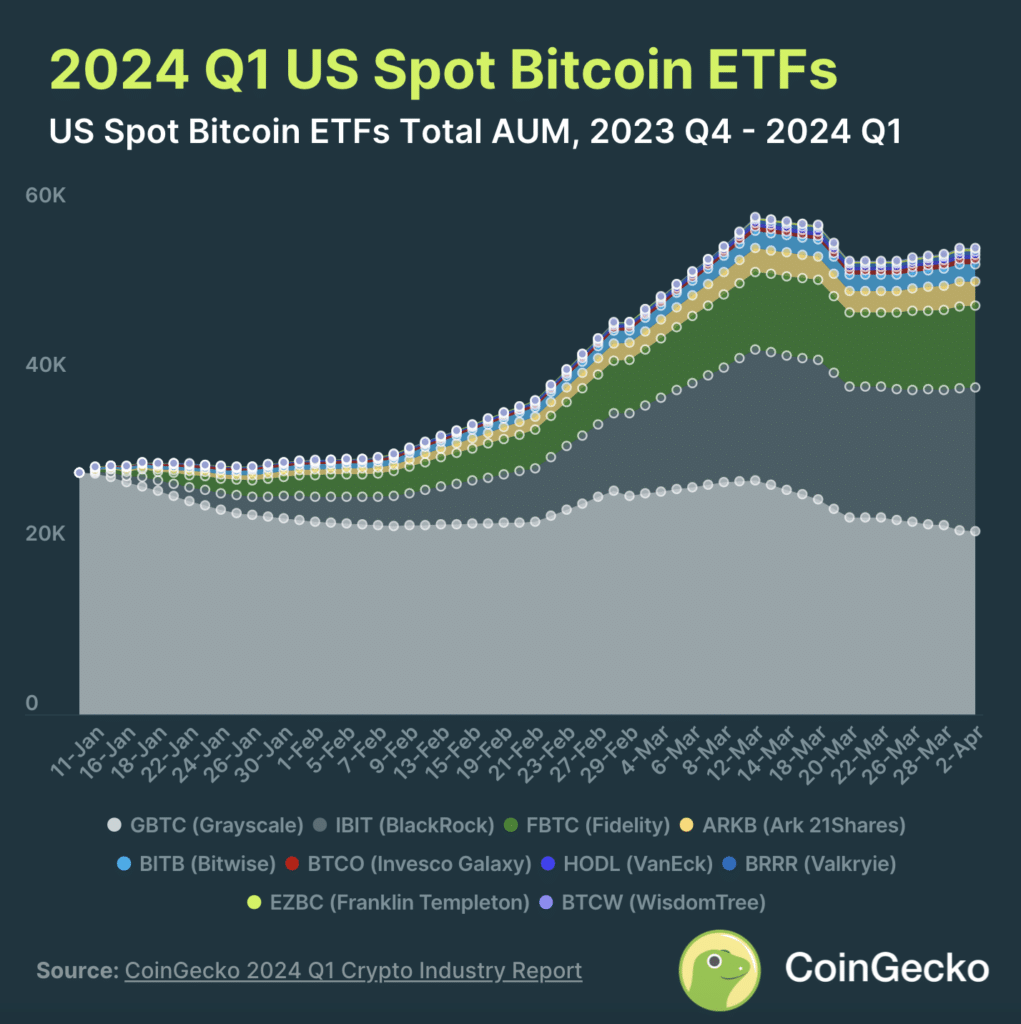

In total, capitalization increased by $1.1 trillion. The report indicates that this is almost double the increase in the fourth quarter of 2024 of $0.61 trillion. During this period, capital inflows into the spot Bitcoin ETFs sector, which were approved on Jan. 10, increased significantly.

The upward trend began in late January and lasted until mid-March when the capitalization rate reached an intermediate maximum.

CoinGecko experts noted that U.S. Spot Bitcoin ETFs assets under management (AUM) grew to $55.1 billion. Grayscale Bitcoin Trust ETF (GBTC) still controls the largest share, but the iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have significantly reduced the gap.

According to analysts, Bitcoin grew 68.8% over the past quarter and reached its all-time high.

Binance Research previously reported that the market capitalization increased by 16.3% in just a month. Although the inflow of capital into spot Bitcoin ETFs slowed at the end of March, this did not stop funds from showing positive dynamics.

Since January, Bitcoin exchange-traded funds have attracted over $12 billion in investments.

This article first appeared at crypto.news