The native token of the Nervous Network, CKB, has recorded impressive gains while traders are betting against the asset’s price surge.

CKB is up by 64% in the past 24 hours and is trading at $0.014 at the time of writing. The asset’s market cap surged to $612 million, making it the 108th-largest crypto. CKB’s daily trading volume recorded a 50% rally, surpassing the $500 million mark.

The token has recorded a 320% price surge over the past 30 days. CKB is still down by 69% from its all-time high of $0.044 in March 2021.

On Feb. 13, Nervous Network released an extension protocol for the Bitcoin (BTC) blockchain called RGB++. Shortly after the announcement, CKB recorded a 54% surge.

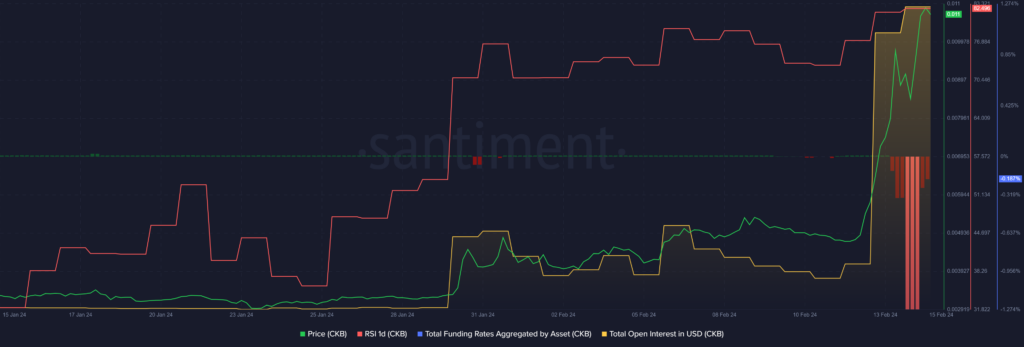

According to data provided by Santiment, CKB’s total open interest (OI) has increased by 430% since the launch of the RGB++ client. The token’s total OI currently stands at roughly $50 million.

However, the CKB total funding rate aggregated from all exchanges has dropped below zero. According to Santiment, CKB’s funding rate is hovering around negative 0.18% at the reporting time.

The indicator shows that short-position holders are currently dominating long traders and betting for a price drop.

Data from the market intelligence platform shows that CKB’s Relative Strength Index (RSI) is sitting at 82.5 at the time of writing. The indicator suggests high price volatility and selling pressure as whales could potentially manipulate the token.

For CKB to remain in the green zone, its RSI would need to cool down to below 60, and an RSI of below 50 could bring further bullish momentum to the asset.

This article first appeared at crypto.news