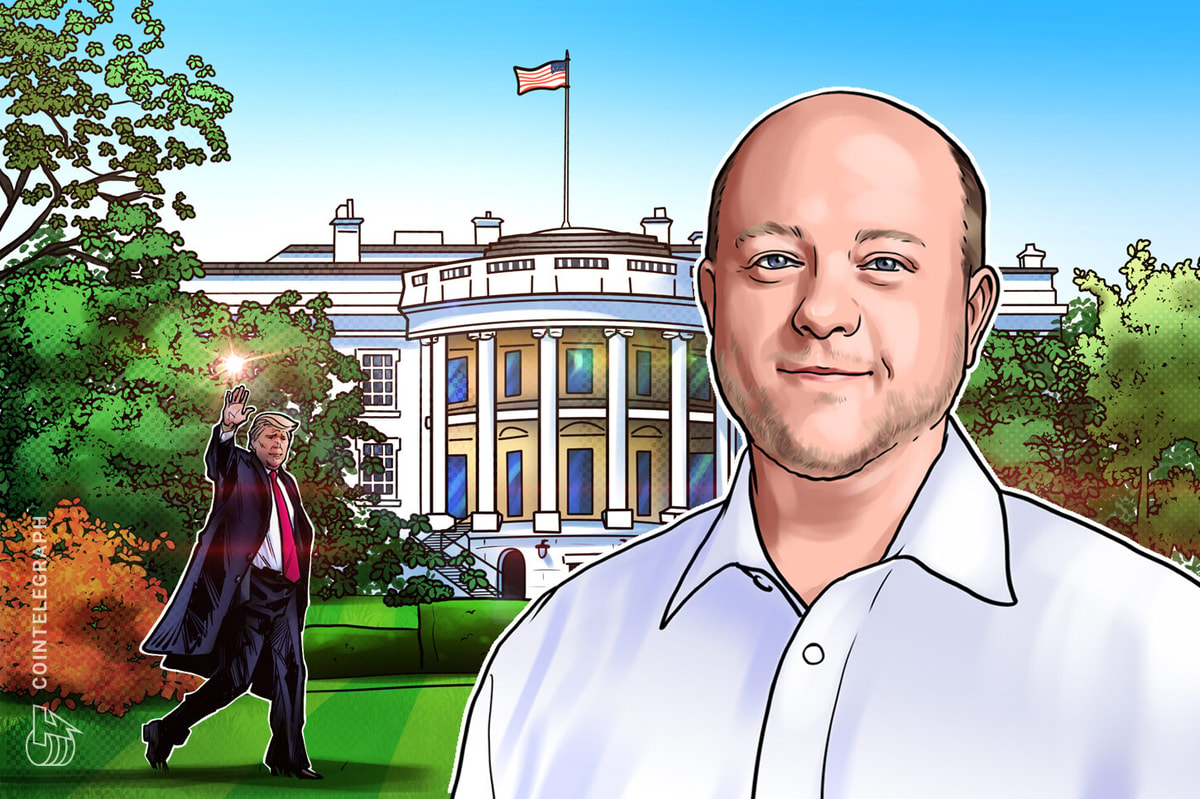

Jeremy Allaire expects President Trump to issue several crypto-friendly executive orders.

News

Circle CEO Jeremy Allaire believes US President Donald Trump could soon sign an executive order making it easier for banks to own digital assets.

In an interview with the Reuters Global Markets Forum at the World Economic Forum’s annual meeting in Davos, Switzerland, Allaire said he expects President Trump’s pro-crypto orders to be issued “imminently,” but he didn’t specify when.

Allaire is especially concerned about the Securities and Exchange Commission’s Staff Accounting Bulletin (SAB) 121, a controversial framework that effectively prevents financial institutions from holding crypto on their balance sheets.

Although Congress voted to overturn SAB 121, the resolution was later vetoed by President Joe Biden. At the time, Biden said, “My administration will not support measures that jeopardize the well-being of consumers and investors.”

As Reuters reported, Allaire and other crypto executives believe SAB 121 isn’t intended to protect investors but instead to stymie the adoption of the new technology.

SAB 121 “effectively made it punitive for banks and financial institutions and corporations even to hold crypto assets on their balance sheet,” Allaire said, adding:

“That’s something I think to watch closely in terms of [executive orders].”

Allaire’s Circle, the stablecoin issuer behind USD Coin (USDC), donated $1 million to Trump’s inauguration committee. The donation was made in USDC, Allaire said on Jan. 9.

Source: Jeremy Allaire

Related: Trump inauguration live: Latest crypto market updates, analysis, reactions

Trump’s inauguration speech silent on crypto

For all the euphoria surrounding Trump’s crypto plans, the president made no mention of digital assets during his inauguration address on Jan. 20.

The 40-minute speech focused largely on immigration and tariffs, with Trump introducing his proposal for an “External Revenue Service,” a plan to collect tariffs from foreign sources.

Crypto markets experienced heavy volatility throughout the day, with Bitcoin (BTC) hitting an all-time high above $109,000 before Trump’s inauguration. The cryptocurrency has since corrected lower and was trading down 2% at $103,300 at the time of writing.

As Cointelegraph reported, crypto exchange-traded products (ETPs) attracted $2.2 billion in inflows last week, largely in anticipation of Trump taking office. Roughly $1.9 billion of that total flowed into Bitcoin ETPs.

So far this year, Bitcoin funds have attracted $2.7 billion in net inflows, according to CoinShares data.

Magazine: BTC’s ‘reasonable’ $180K target, NFTs plunge in 2024, and more: Hodler’s Digest Jan. 12 – 18

This article first appeared at Cointelegraph.com News