Solana left competitor Ethereum to bite the dust with 27% weekly gains and nearly 6% rally on Friday. The native token of the Solana blockchain rallies, on-chain and technical indicators point at further gains in SOL in the coming week.

Table of Contents

Solana vs. Ethereum, Trump crowns a winner

Solana added over 27% to its value in the past seven days per TradingView data. The Ethereum competitor extended its gains on Friday, rallying another 6%. The altcoin is trading 12% below its all-time high of $295.83.

While on-chain data intelligence platforms confirm that President Trump holds Ethereum, the pro-crypto leader launched his meme coin TRUMP on the Solana blockchain. Further, the made in USA narrative favors Solana, alongside other made in USA tokens like XRP, Cardano (ADA) and Avalanche (AVAX).

According to a CNBC report published on January 14, the “Official Trump” coin was announced on the president-elect’s X and Truth Social accounts late Friday night, and started trading on Friday at a price of $4.29 and has rallied over 600% to $33.21, according to TradingView data.

The report lines up the meme coin’s issuance and launch as the latest fundraising effort to come out of team Trump following two NFT collections, Trump Digital Trading Cards on the Polygon

blockchain and Trump Bitcoin Digital Trading Cards on Bitcoin and the DeFi platform World Liberty Financial on Ethereum.

With President Trump picking Solana for his meme token launch, SOL has been crowned a winner against competitor Ethereum.

On-chain analysis supports gains in Solana

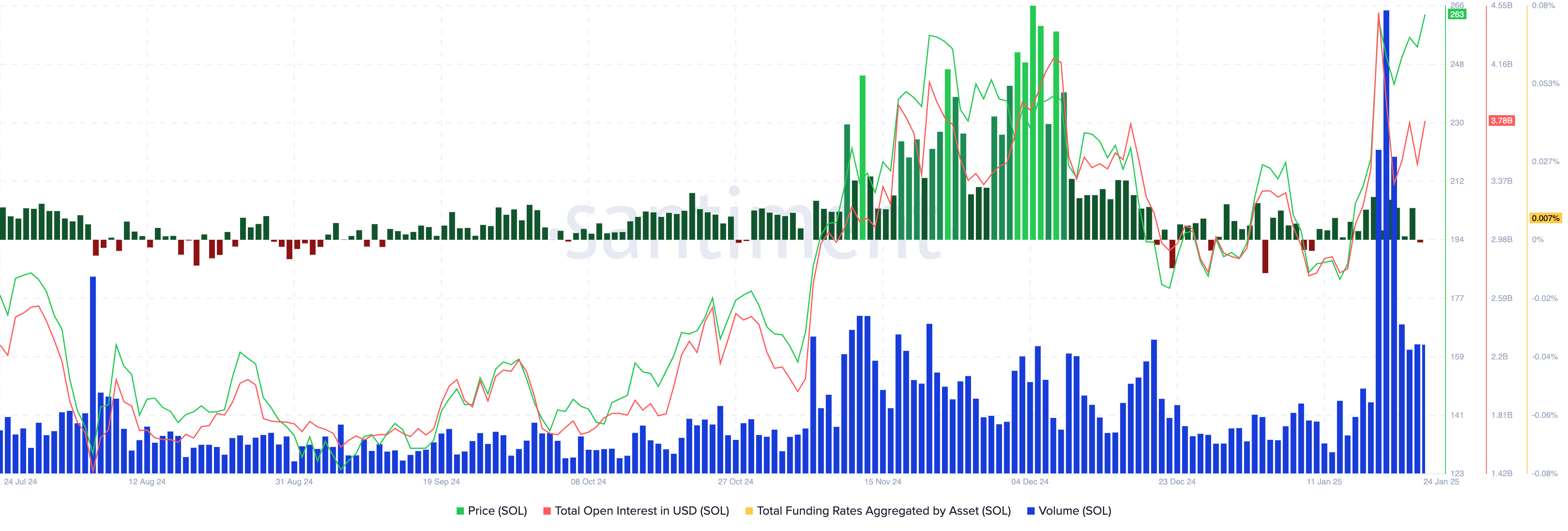

Santiment data show’s that Solana’s trade volume spiked on January 19, since then the metric holds steady above the 2024 average. The open interest in Solana observed spikes this week, alongside positive funding rates most days this week. SOL price sustained its upward momentum, fueled by the bullish thesis.

While Solana’s trade volume and user activity hold steady, it could fuel gains in the altcoin. The on-chain analysis is supported by bullish signs from technical indicators on the SOL/USDT price chart.

Coinglass data shows that OI climbed nearly 3% in the past 24 hours, touching $7.40 billion. Options trade volume gained nearly 44% in the same timeframe.

Traders on most centralized exchanges are bullish on Solana, according to the long/short ratio on Coinglass.

U.S. based Spot Solana ETFs could become a reality in 2025

Greg Magadini, Director of derivatives at Amberdata told Crypto.news in an exclusive interview:

“VanEck applied for a Solana ETF in 2024, I think that narrative will come back, the big hurdle there is the question around is it a security is it a commodity and things like that. If we have a more friendly SEC I could see an easier path for approval.

I could see this kind of friendly landscape start a new era of like corporate meme coins, obviously we have the meme coins that just launched on Solana like TRUMP and MELANIA, but we could also see something like Boeing Airlines just launched a meme coin on Solana and there’s this potential for kind of a new adoption of some sort of meme coins around different corporations launching their own thing, I don’t know what that would look like but I think the door has been opened for that.”

Magadini remains positive on a Solana ETF approval in the U.S. in 2025.

Technical analysis and SOL price forecast

Solana trades 12% under its all-time high of $295.83, at $262.32. On the SOL/USDT daily price charts, technical indicators support gains in Solana price. The Relative strength index reads 67 and is sloping upwards and the green histogram bars on the Moving average convergence divergence indicator show that there is an underlying positive momentum in SOL price trend.

SOL could find support in the Fair value gap between $222.11 and $236.68.

Analysts at Kraken confirm that Solana continues its strong upward momentum and trade above key Exponential moving averages, after setting a new all-time high above $260. Analysts are quoted in Kraken’s OTC report:

“This impulse move originated from a failure to close below the 200-day EMA and trendline, support near $168, with the 50% Fibonacci retracement level at $230 now providing key support. On the back of this sharp rally, the RSI has approached overbought territory near 75, reflecting strong bullish momentum but also signaling potential caution for short-term traders.

A decisive daily close above $260 would confirm renewed bullish momentum and likely pave the way for further upside exploration, with $280 and $300 emerging as the next key targets. However, failure to hold above $230 could see SOL revisit lower support levels, with $204 being the next significant area for bulls to defend.”

Messari analysts break down the launch of TRUMP and MELANIA meme coins on the Solana chain and note that their impact on Solana’s record $85 billion DEX volume supported a bullish sentiment among traders.

Crypto market participants view this as a major milestone for crypto adoption, concerns over insider allocations are rampant, according to tweets on X. It remains to be seen how the meme token launch could shape long-term market trends, the role of future meme coin launches, and how Trump’s engagement with crypto might shape the industry over the next four years.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

This article first appeared at crypto.news