Chainlink price experienced a significant reversal and dropped for three consecutive days, erasing some of the gains made last week.

Chainlink (LINK) token fell to $27, marking a 13% decline from its highest level this year and bringing its market cap to over $17 billion.

The retreat mirrored losses seen across other popular cryptocurrencies. Bitcoin (BTC) dropped to $105,000 from its weekly high of $108,000. Similarly, Ethereum, Ripple, and Solana were down by over 3%.

Still, one whale continued to accumulate LINK tokens, betting on a potential recovery. According to LookOnChain, the whale withdrew 65,000 LINK tokens worth $1.8 million on December 18. This followed a trend that began four days earlier, bringing the whale’s total accumulation to over $17.3 million.

The accumulation came shortly after Donald Trump’s World Liberty Financial acquired LINK tokens worth over $2 million. The upcoming Decentralized Finance platform has selected Chainlink as its oracle provider.

Chainlink is widely regarded as one of the most fundamentally sound projects in the blockchain industry. Its oracle solutions are utilized by major DeFi players like AAVE, Spark, and Compound. The total value secured by Chainlink has grown to over $41 billion, surpassing competitors such as Chronicle, Pyth, and Edge.

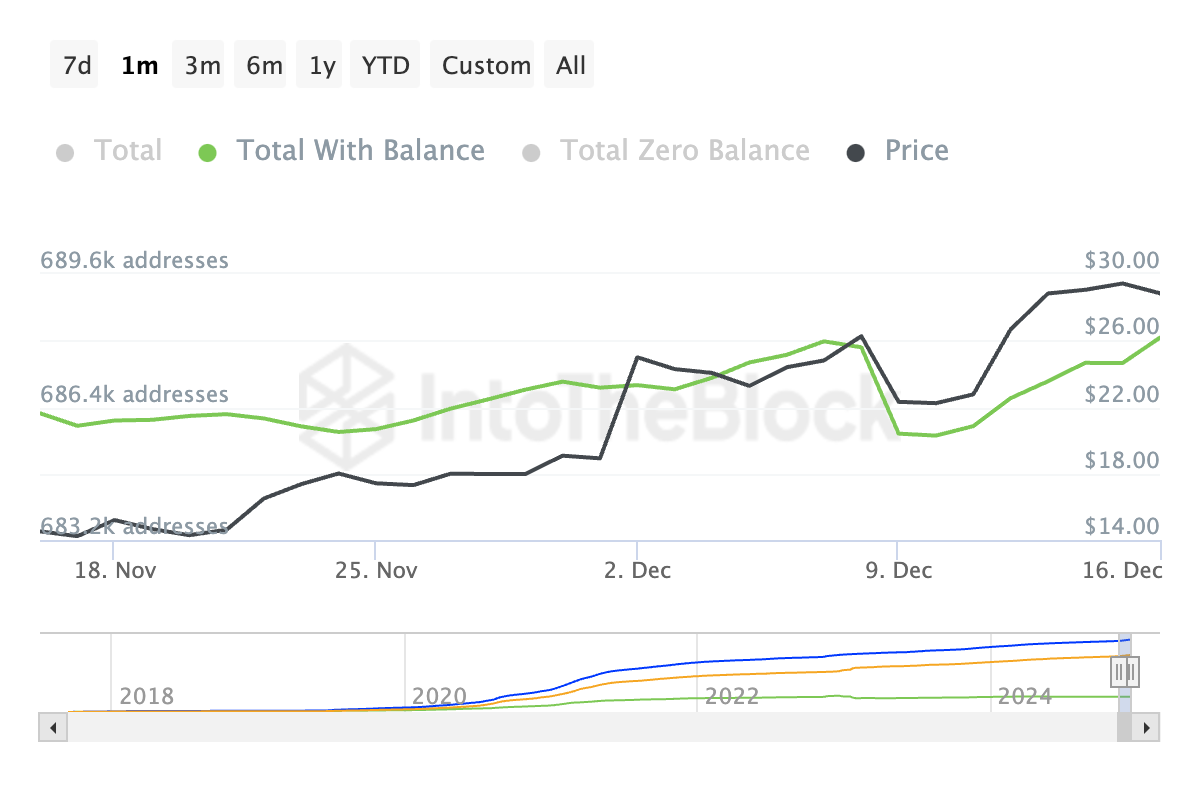

The number of Chainlink holders has also continued rising. According to data from IntoTheBlock, there are now over 688,000 addresses with LINK balances, exceeding the 30-day average of 686,000. This increase indicates sustained demand for the token.

Chainlink is also expected to benefit from its partnership with Swift Network and other large platforms leveraging its technology for tokenization. Furthermore, there are discussions about the potential approval of a Chainlink ETF by the Securities and Exchange Commission.

Chainlink price analysis

The 4-hour chart shows that LINK’s price peaked at $30.95, forming a small triple-top chart pattern—a bearish signal. It has since declined and dropped below the pattern’s neckline at $27.58.

Currently, Chainlink is hovering slightly above the 23.6% Fibonacci Retracement level at $26. It has also fallen below the middle line of the Andrew’s Pitchfork tool and the 50-period moving average.

Therefore, the coin will likely continue rising ahead of the Federal Reserve decision. If this happens, it may drop to the next psychological level at $25 and then bounce back as investors buy the dip.

This article first appeared at crypto.news