Despite widespread misconceptions, cash remains the dominant tool for illicit finance, while blockchain offers greater transparency and traceability, a new study reveals.

Cash remains the preferred tool for criminals engaging in illicit finance, despite the popular perception that cryptocurrencies dominate unlawful transactions, a new study by Crypto ISAC reveals. While blockchain transactions create an immutable record, making crypto more traceable, cash transactions leave no digital footprint, complicating efforts to track illicit activities.

“The scale of money laundering and terrorist financing through conventional banking channels, as reported by regulatory bodies and law enforcement agencies, dwarfs the volume of similar activities observed in the cryptocurrency space.”

Crypto ISAC

Though cryptocurrencies have been tied to crime in high-profile cases, including exchange collapses and thefts, these account for a small portion of total crypto volume. Crypto ISAC notes that while it is impossible to track the exact amount of illicit activity in the traditional finance space, the estimated amount of money laundered globally in one year is 2-5% of global GDP, or $800 billion-$2 trillion.

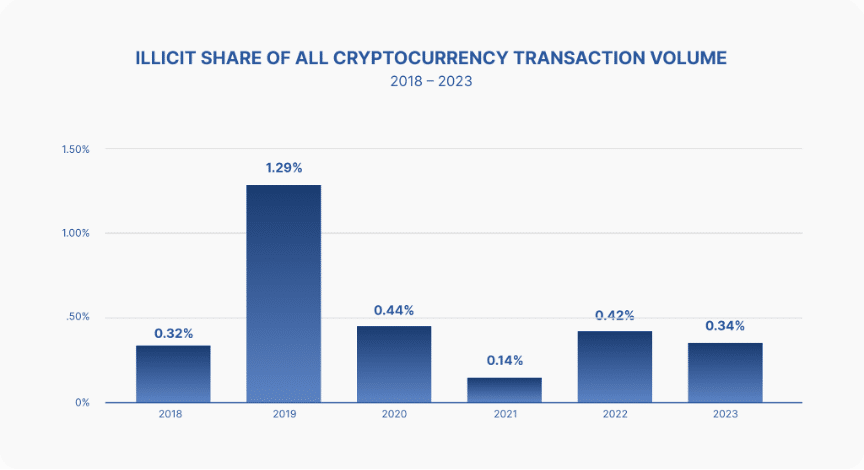

Meanwhile, blockchain analysis firm Chainalysis reported that in 2023, just 0.34% of on-chain transaction volume was linked to illicit activity.

Crypto ISAC noted that law enforcement agencies have increasingly used blockchain’s transparency to track illegal activity, positioning regulated crypto platforms as allies in combating crime. At the same time, when criminals use traditional finance systems, there are no public sources through which law enforcement can easily trace funds, which makes it harder for law enforcement agencies to track down criminals.

“This creates a higher burden of proof and requires the U.S. Attorney to empanel and jury to hear and issue the subpoena. Only then can law enforcement begin to piece together the forensic trail of the funds at issue.”

Crypto ISAC

The U.S. Treasury earlier also echoed these findings, stating that cash continues to be the go-to method for money laundering because of its anonymity, stability, and ubiquity. According to the Treasury’s February reports, bulk cash smuggling, often involving U.S. dollar banknotes transported across borders and deposited into foreign accounts, remains a common method for laundering illicit proceeds.

This article first appeared at crypto.news