Cardano price made a strong bullish breakout on Wednesday, Nov. 20, as the crypto fear and greed index rose and Bitcoin reached a record high.

Cardano (ADA), the popular proof-of-stake cryptocurrency, surged to an intraday high of $0.830, bringing its market capitalization to nearly $30 billion.

This rally was driven by the ongoing risk-on sentiment in the crypto market, reflected in the fear and greed index jumping to 84.

Bitcoin (BTC) also climbed to a record high of $94,200, with analysts optimistic that it could reach $100,000 as soon as this week.

Three key drivers of growth

First, November seasonality is supporting cryptocurrencies, as it is historically the best-performing month for the asset class. According to Coinglass, Bitcoin averages a 45% monthly return during this period.

Second, Cardano’s rally is fueled by optimism surrounding the incoming Trump administration will be bullish for cryptocurrencies. Many are already predicting a spot ADA exchange-traded fund could be approved as early as 2025.

Third, the Federal Reserve’s dovish tone, signaling continued interest rate cuts into 2025, has boosted risk assets.

These factors, combined with Solana (SOL) becoming increasingly expensive, have drawn investors to more affordable tokens like Cardano. Additionally, fear of missing out among both retail and institutional investors has contributed to the rally.

Analysts remain bullish on Cardano. In an X post, crypto analyst Beastlyorion, who has over 71,000 followers, projected ADA could reach $10 in the long term—a potential 1,100% increase from the current level.

Cardano price analysis

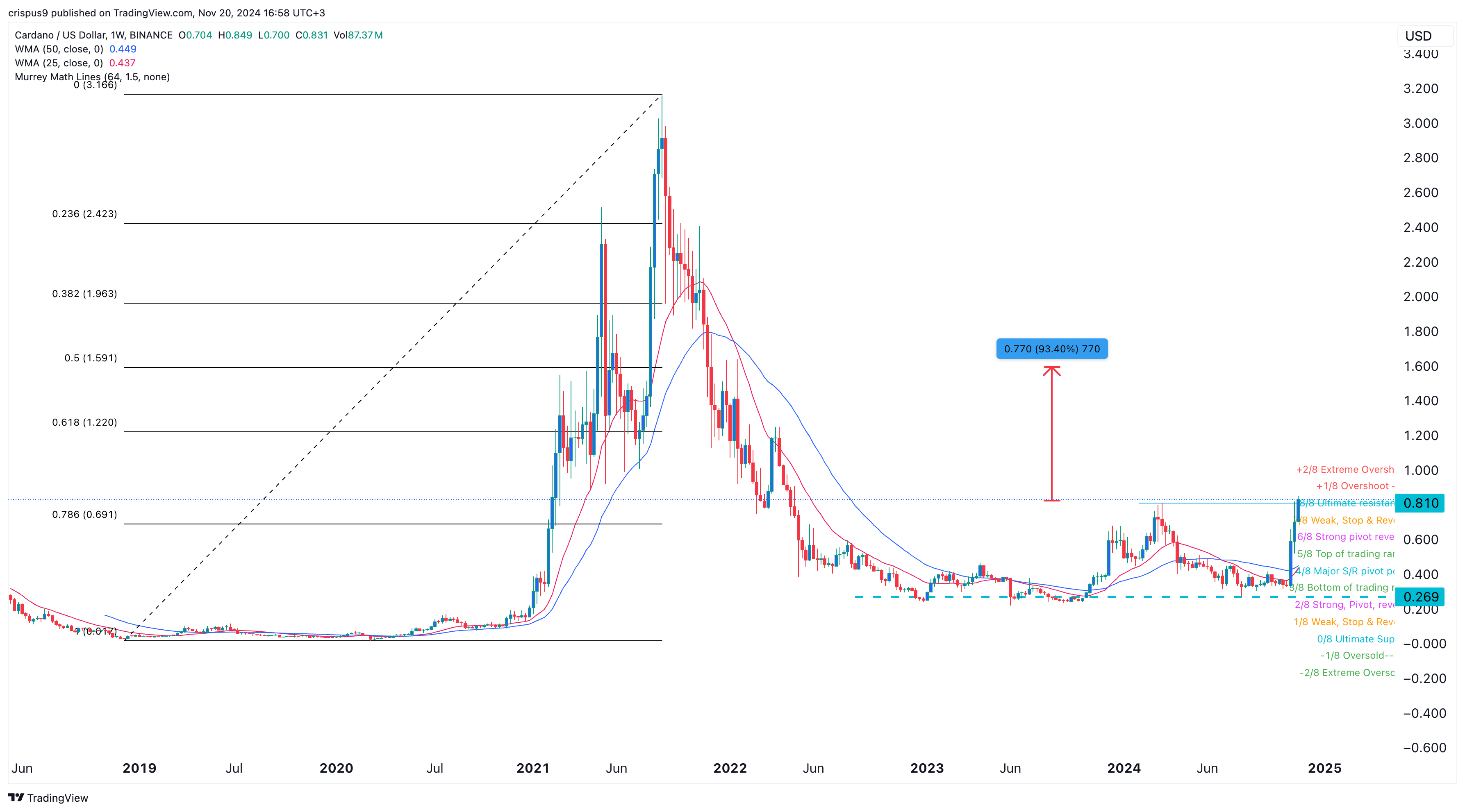

On the weekly chart, Cardano has formed a double-bottom pattern at $0.26 and has now broken above the neckline at $0.81, its highest level since March this year. This breakout aligns with the ultimate resistance level of the Murrey Math Lines.

The cryptocurrency has also moved above the 50-week and 25-week weighted moving averages, with the Relative Strength Index trending upwards.

Given these factors, Cardano’s price is likely to continue rising, with bulls targeting the 50% Fibonacci retracement level at $1.60—approximately 93% higher than the current price.

This article first appeared at crypto.news