The recent price drop in the Optimism price has helped a strong buy signal resurface with long-term holders at record low levels.

Optimism (OP) plunged by 9.6% in the past 24 hours and is trading at $1.33 at the time of writing. Notably, the asset has been constantly declining from its all-time high of $4.85 on March 6.

OP’s market cap is currently sitting at $1.57 billion, making it the 48th-largest cryptocurrency. On the other hand, the token’s daily trading volume increased by 23%, reaching $145 million.

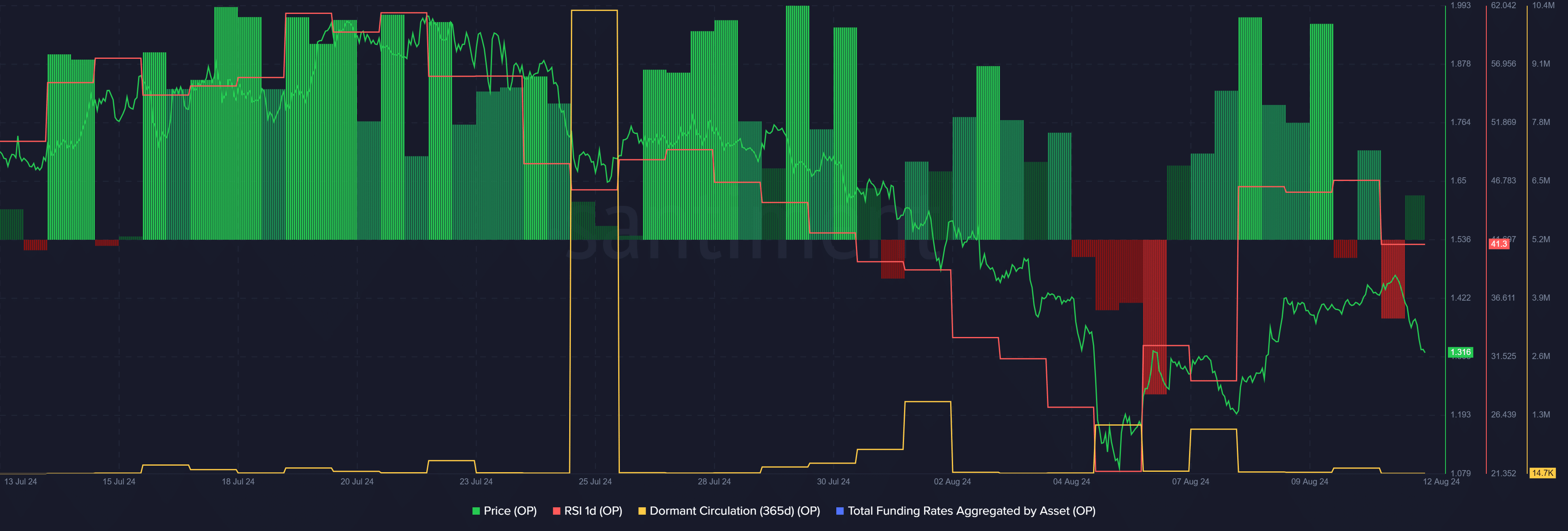

According to data provided by Santiment, the OP Relative Strength Index is hovering at 41 at the reporting time. The indicator shows that Optimism is slightly oversold at this price point.

Data from the market intelligence platform shows that long-term OP holders have remained motionless despite the recent price fall. Per Santiment, the Optimism one-year dormant circulation plunged from 132,510 to 14,701 tokens — marking a one-month low — over the past 24 hours.

According to Santiment, the OP daily active addresses divergence is standing at 114% at the reporting time. The indicator shows a strong buy signal for OP while the heightened trading volume hints at high price volatility.

Moreover, the total funding rate aggregated by Optimism rose from negative 0.003% to 0.002% over the past day. At this point, traders are also bullish on the OP price surge.

However, macroeconomic events could have a strong impact on financial markets, including cryptocurrencies, despite bullish indicators. On Aug. 9, analysts at Coinbase Research believe that macro pressure could potentially put the crypto ecosystem in tension over the next few weeks.

This article first appeared at crypto.news