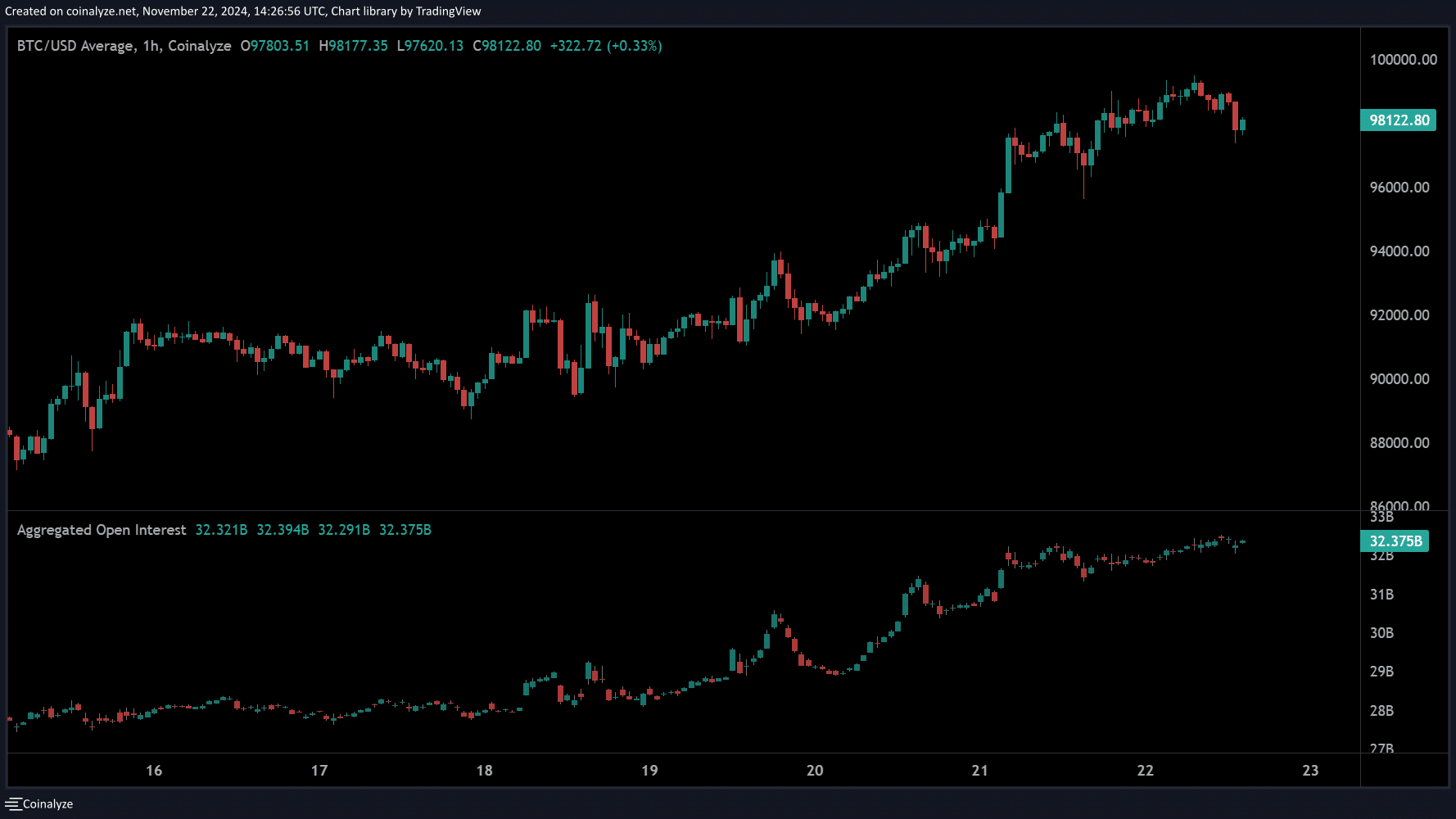

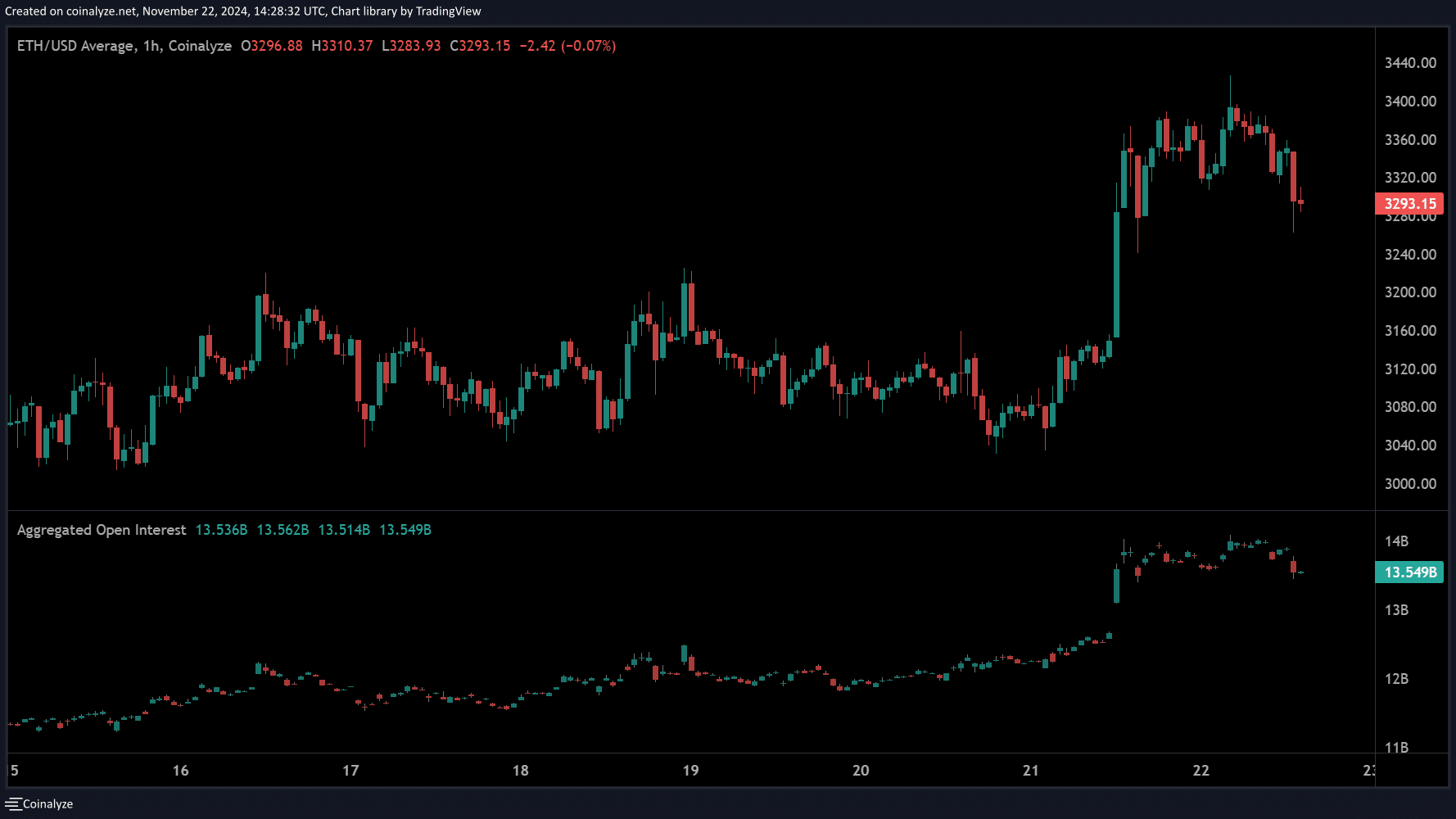

Open interest for Bitcoin and Ethereum in futures markets each hit a new all-time-high in the past 24 hours of trading, following Bitcoin’s flirtation with $100,000.

On Nov. 22, Bitcoin(BTC) OI has reached a peak of $57 billion in the past 24 hours. Meanwhile, Ethereum(ETH) OI went up 12% to an all-time high of $20.8 billion within the same time period. Both cryptocurrencies have accumulated their highest accumulated Open Interest following slumps at the beginning of the month.

Open interest is a metric in the crypto industry that is used to shows the amount of outstanding futures contracts employed in exchanges. A higher interest level indicates that a crypto asset is more liquid and in significant demand.

This surge came a few hours after Bitcoin reached a new all-time high of $99,486, getting even closer to the $100,000 mark. Ethereum also saw a rise of 7%

Based on data from Coinglass, BTC Open Interest is currently at $64.08 billion, with most of it coming from CME. CME holds more than 33% of the total Bitcoin futures OI with 216,820 BTC, valued at $21.23 billion.

This is followed by Binance, the largest crypto exchange by trading volume, holding 19.2% of the total BTC OI, with an open interest of over 124,740 BTC worth around $12.22 billion.

Bybit occupies third place with 13.39% of BTC OI, reaching 87,020 BTC or $8.53 billion, while Bitget and OKX stand in the top five, each holding 9.87% and 8.4% respectively.

On Ethereum’s side, ETH OI sits at a total of $20.08 billion. Unlike Bitcoin, Binance accounts for the majority of ETH Open Interest, holding 31.19% of the total with 1.9 million ETH, valued at $20.09 billion

Bybit comes in second with 18.18% of ETH OI, holding 1.11 million ETH worth around $3.65 billion. In third place is CME, with 663,180 ETH, valued at $2.19 billion. CME holds around 10.88% of the market’s total ETH OI.

OKX and HTX make it into the top five, with each exchange holding 9.38% and 7.82% respectively.

This article first appeared at crypto.news